Bull versus Bear markets: How to invest when the market is down

Table of contents

- What is a bull or bear market?

- How long do bull and bear markets last?

- How should I invest in a bear market?

Key takeaways

- A bear market is when stocks decline by more than 20% from a recent low; a bull market is when stocks rise more than 20%.

- Historically, bull markets have lasted longer and been more frequent than down-trending bear markets.

- Most experts advise investors not to sell their stock in panic, as a theoretical loss becomes a real loss, and lead you to miss out on gains should the stock recover.

Related articles

- Concerned about a recession?

- Seven strategies to help manage volatility and risk

- Five types of investment risk

- The importance of setting financial goals

- Capitalizing on volatility

Amid headlines about interest rates, inflation, and possible economic recession, there is often discussion about stocks heading into “bear market” territory. More than just a market downturn, a bear market is when stocks in an index (for example, the S&P 500 Index or S&P/TSX Composite Index) decline more than 20% from a recent peak. Stock markets can decline for a variety of reasons (geopolitical events, a pandemic shock, etc.), but often, sustained declines can be the result of interest rate movements and inflation.

When we’re in a “bull” market (when stocks increase more than 20% from a recent low), investors tend to be pleased because stocks are going up. But headlines about bear markets are often more worrying for investors, leaving them uncertain about their investments, and about their next move.

So, what do bull and bear markets mean for investors?

What is a bull or bear market?

A “bull market” is commonly defined as when the market rises 20% over a sustained period after a recent low. If a market is trending upward, it’s a bull market. A bull market tends to happen when an economy is strong or strengthening; it’s an indicator of economic expansion.

Conversely, a “bear market” is when the market declines 20% over a sustained period after a recent high. If a market is trending downward, it’s a bear market. A market tends to enter bear market territory prior to an economic retraction.

Though “bulls” and “bears” are most commonly used in reference to stock markets, the terms also apply to other markets, such as bonds and commodities.

Historically, we’ve tended to have more bull markets than bear markets. To illustrate, U.S. stocks entered into a bear market in mid-June 2022, but other than a few short months at the beginning of the pandemic, the U.S. market was a bull market since March 2009, following the 2008 Financial Crisis.

How long do bull and bear markets last?

Despite how difficult it can be to watch your investments lose value, there’s one thing about bear markets that you need to keep in mind: Bull markets have historically been longer and stronger than bear markets. Put another way, while watching stocks decline during bear markets can be scary, they generally don’t last very long.

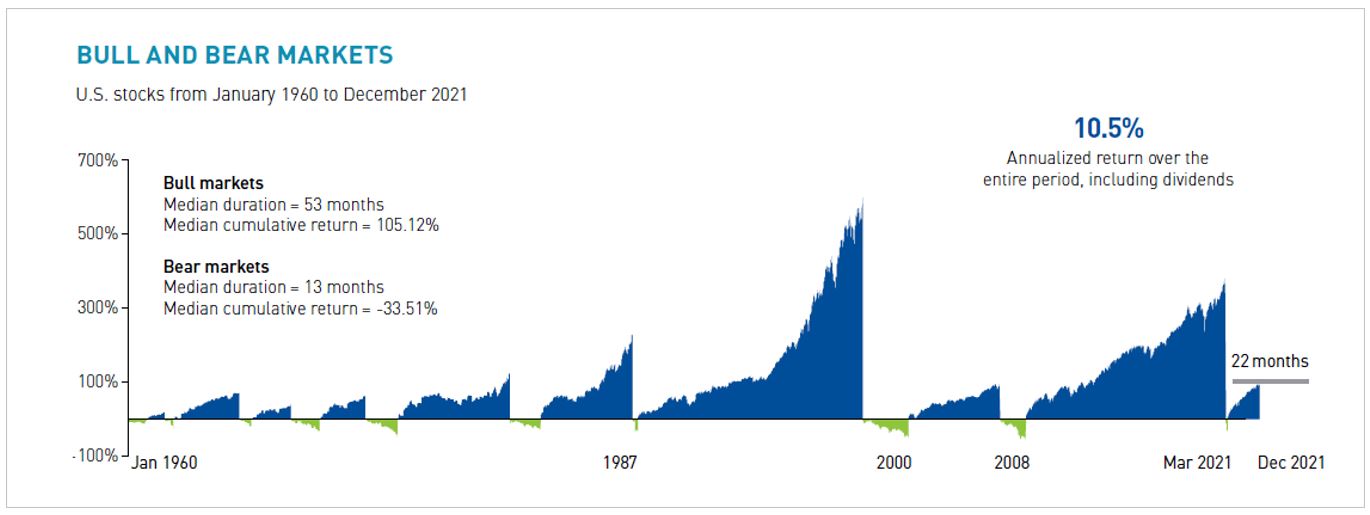

Check out the chart below compiled by Qtrade’s sister company, NEI Investments. It shows all the bull (in dark blue) and bear (in green) markets since 1960. The key takeaway is that rising bull markets have lasted longer and been more frequent than down-trending bear markets.

Source: NEI Investments

More importantly, the chart also shows that the gains produced from bull markets (median cumulative return of 101.5%) more than offsets the losses from the bear markets (median cumulative return of -30.31%). That’s great news for investors.

How should I invest in a bear market?

Don’t panic. Yes, the market is down and your investments may have taken a worrying nosedive. But don’t give into fear. An emotional reaction could lead you to make rash decisions regarding your investments. If you sell your stock in a panic, your theoretical loss becomes a real loss. And if you’re no longer invested in that stock, you could miss out on gains should that stock make a recovery down the road.

Stay invested.

If you need to access your money, of course, you may need to sell your investment, but most experts recommend that you hold onto your stock to ride out the lows until the market recovers at least somewhat. Though it’s difficult to do nothing when your stocks plummet, it might be best to simply sit tight and wait it out.

As we saw in the NEI Investments chart above, bear markets don’t tend to last as long as bull markets. If you sell your investment when it’s down in value, you crystalize/realize the loss. What looks like a loss of value in your portfolio isn’t an actual loss until you actually sell the stock. And then, you run the risk of missing out on the gains you could have made when the market rallies (or rises).

Tax-loss selling.

There are some circumstances where it might be an advantage to sell your stock when its value declines significantly: on your tax return.

Tax-loss selling (or tax-loss harvesting) is when you sell an investment that has declined in value below its original purchase price. This triggers a “capital loss”, which can be used to offset capital gains you’ve made on another investment, saving you money at tax time. Talk to your accountant to see if this scenario might be right for you.

Revisit your investing strategy and risk tolerance.

Ultimately, if your investment goals haven’t changed, neither should your investing strategy. That’s easy to say when markets are up (during a bull market), but when markets are down (a bear market), it could be a good time to take another look at your overall investing strategy. If you’re finding it stressful to think about your investments, your risk tolerance may not be as high as you had originally estimated. A bear market can tell you how you really feel about risk. And give you an opportunity to adjust for the future.

When you first created your investing plan, maybe you were much younger, and had a longer time until retirement. Perhaps your investment risk is now too high because you have less time to recover from market dips. Have your financial goals changed? Do you need to shift your strategy to achieve your goals?

It might be a good time to buy.

If the end goal is to buy low and sell high, keep in mind that a bear market is when stock prices are typically at their lowest. If you have the money to do it, you could consider putting more money into the market. It may take a while for the stock to recover, but if history is any indication, stocks have usually been able to regain their old highs within a few years.

Online brokerage services are offered through Qtrade Direct Investing, a division of Aviso Financial Inc. Qtrade and Qtrade Direct Investing are trade names or trademarks of Aviso Wealth Inc. and/or its affiliates.

Aviso Wealth Inc. ('Aviso') is a wholly owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited. The following entities are subsidiaries of Aviso: Aviso Financial Inc. (including divisions Aviso Wealth, Qtrade Direct Investing, Qtrade Guided Portfolios, Aviso Correspondent Partners), and Northwest & Ethical Investments L.P.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes, and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. Information, figures, and charts are summarized for illustrative purposes only and are subject to change without notice. All investments are subject to risk, including the possible loss of principal.