Weekly Market Pulse - Week ending April 19, 2024

Market developments

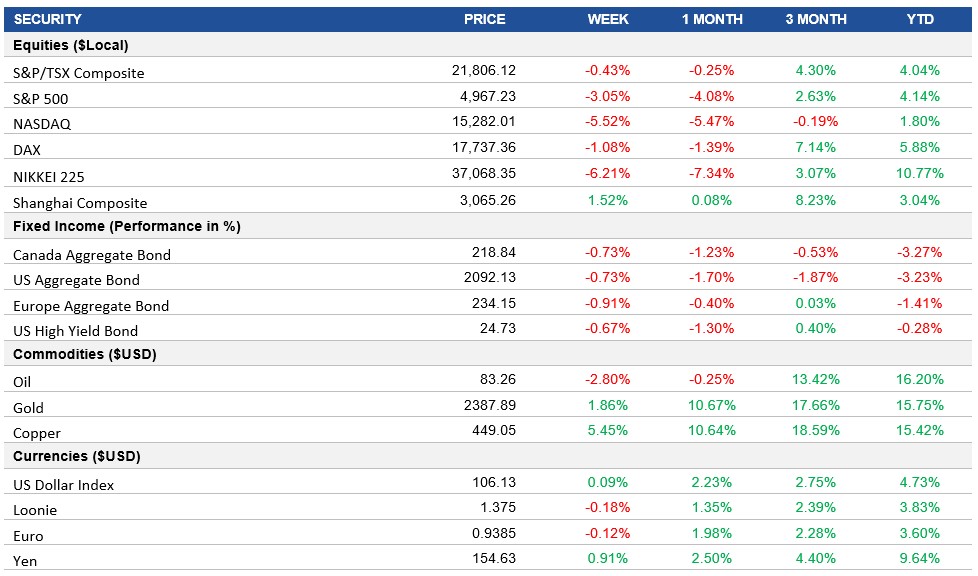

Equities: Equities fell at the end of a week that saw the S&P 500 closing below 5,000, following a rally that sent the benchmark to all-time highs. The selloff has been driven by a drumbeat of hawkish “Fedspeak” and a flare-up in inflation worries, which have weighed heavily on investor sentiment and trimmed bets on a central bank pivot. The stock market's retreat from all-time highs is giving investors parked in cash an opening to buy in, and some experts expect the rally to resume and broaden based on strong earnings growth and continuing economic momentum. For the week, the S&P 500 Index and Nasdaq closed -3% and -5.5% respectively.

Fixed Income: The Federal Reserve has been forced to reconsider the timing of its first interest-rate cut in 2024 due to a string of disappointing inflation data. Chair Jerome Powell has indicated that it will likely take longer than expected to gain the confidence needed to lower rates, dashing hopes for more than two cuts in 2024. Some experts even worry there may be no cuts at all, as the Fed is concerned about the strength of the economy and labour market, which could mean further rate hikes are needed to tame inflation. Economists now expect only two rate cuts this year, down from the three forecasted earlier, as the Fed grapples with the persistence of demand in the economy.

Commodities: Oil prices initially spiked after reports of an Israeli attack on Iran, but later eased as Iran downplayed the impact of the strikes. Brent crude futures climbed over $3 per barrel, reaching above $90, as the attack reignited concerns about potential disruptions to Middle Eastern oil supplies. Crude ended the volatile week down -2.8%.

Performance (price return)

Source: Bloomberg, as of April 19, 2024

Macro developments

Canada – Inflation Rose to 2.9% in March

In March 2024, Canada's annual inflation rate rose to 2.9%, mainly due to higher gasoline prices. Increased mortgage interest costs contributed to faster growth in average rents, while food inflation slowed down. Core inflation rates, watched by the Bank of Canada, slowed more than expected.

U.S. – U.S. Retail Sales Surge

Retail sales in the U.S. surged by 0.7% in March 2024, surpassing expectations, indicating strong consumer spending. Non-store retailers, gasoline stations, and miscellaneous store retailers saw significant increases, while sales declined for certain categories like clothing and electronics.

International – U.K. Unemployment Rate Increased to 4.2%, U.K. Inflation Falls to 3.2% in March, U.K. Retail Sales Come in Flat, China’s Economy Grew by 5.3% and Japan’s CPI Slows to 2.7%.

The U.K.'s unemployment rate increased to 4.2%, with a rise in both unemployed individuals and economic inactivity. Inflation in the U.K. fell to 3.2% in March 2024, primarily driven by a slowdown in food and housing prices. Retail sales volumes remained flat in March, with mixed performance across different sectors.

China's economy grew by 5.3% year-on-year in Q1 2024, supported by government measures and spending related to the Lunar New Year. Despite the growth, industrial output and retail sales rose less than expected, indicating the need for further policy easing. The jobless rate remained near its recent high, underscoring ongoing challenges in the labour market.

Japan's annual inflation rate decreased slightly to 2.7% in March 2024, with slowdowns observed in various sectors. Prices for transportation, clothing, and household items showed deceleration, while fuel prices dropped at a slower pace. Core inflation rate fell to 2.6%, slightly below forecasts, with a slight increase in consumer prices in March compared to previous months.

Quick look ahead

As of April 19, 2024