Weekly Market Pulse - Week ending August 18, 2023

Market developments

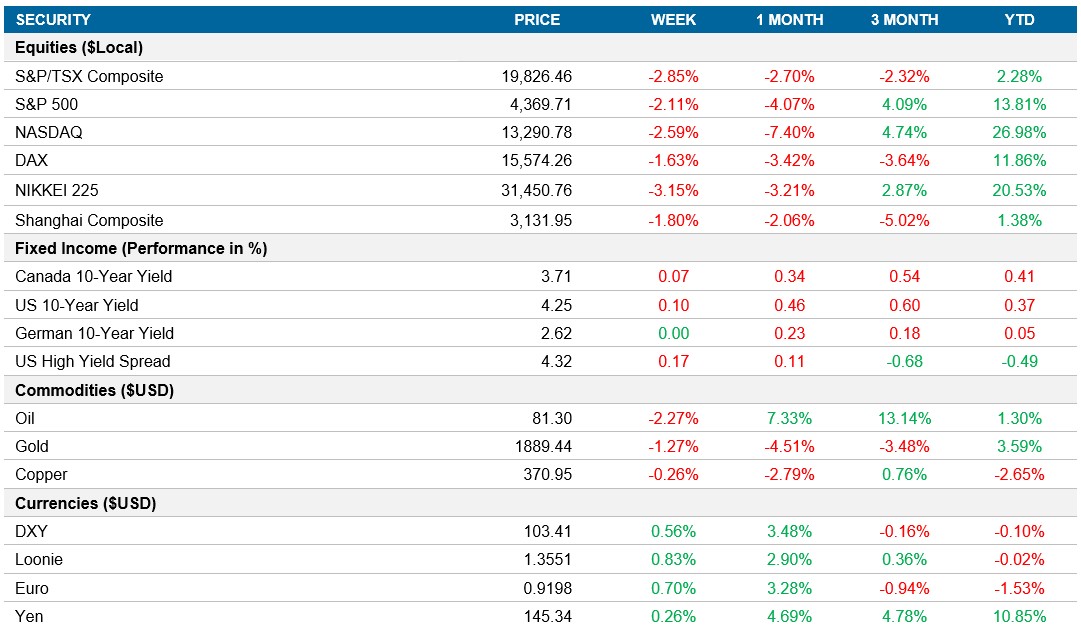

Equities: Equity markets faced a significant decline as fears of higher rates weakened sentiment, driving key indices toward their largest weekly loss since March. The S&P 500 and MSCI World Index continued to slide, with both U.S. and global benchmarks on track for one of the worst weekly performances since the Silicon Valley Bank incident. The Nasdaq experienced a 2.6% drop, surpassing the decline seen in S&P 500 (-2.1%), as risk assets faced a widespread selloff.

Fixed income: The Federal Reserve indicating further rate hikes to address inflation boosted Treasury yields this week. Global bonds did rebound on Friday as losses were seen as potentially overdone, with yields on US 10-year Treasuries easing slightly from recent highs and settling at 4.25%. Anticipation looms over the upcoming Jackson Hole gathering, where policymakers may shed light on their stance amid receding recession fears but persistent inflation concerns.

Commodities: Oil recorded its first weekly loss since June, slipping below $81 a barrel as low trading volumes made the market vulnerable to macroeconomic worries. Despite signs of a tight crude market, including lower US stockpiles, concerns over poor economic data and a housing slowdown in China overshadowed the positive indicators. West Texas Intermediate's aggregate open interest dropped to its lowest level since January.

Performance (price return)

As of August 18, 2023

Macro developments

Canada – Inflation rose to 3.3% in July

In July, Canada's annual inflation rate reached 3.3%, surpassing market expectations of 3%. Energy prices declined less than before due to higher gasoline prices, while electricity costs rose. The mortgage interest cost index saw a significant 30.6% year-over-year increase, a major contributor to overall inflation. Groceries and traveler accommodation prices slowed, while airfares and natural gas costs continued to decrease. The Consumer Price Index (CPI) rose 0.6% in July, driven by higher travel tour prices during peak travel season.

U.S. – U.S. Retail Sales Up 0.7% in July

U.S. retail sales grew by 0.7%, marking the fourth consecutive monthly rise and surpassing the 0.4% forecast. Despite high costs, consumer spending remained strong, potentially influenced by Amazon's Prime Day. Non-store retailers led the growth with a 1.9% increase, while some sectors like furniture and electronics experienced declines. Excluding certain categories, retail sales increased by 1%.

International –UK Consumer Price Inflation Drops to 6.8% in July, Eurozone Economy Grows Modestly in Q2 2023, Japanese Economy Surges 1.5% in Q2 2023

Consumer price inflation in the UK fell to 6.8% in July 2023 from 7.9% in June, driven by lower fuel prices. The core rate, excluding volatile items, remained at 6.9%. Transport, food, furniture, recreation, and miscellaneous goods contributed to the decline. Monthly consumer prices decreased by 0.4%.

The Eurozone economy saw a 0.3% growth in Q2 2023, following a flat first quarter, aligning with initial estimates. The recovery in demand was supported by easing inflationary pressures, although higher interest rates and declining confidence still impacted the overall economy. France and Spain demonstrated steady growth (0.5% and 0.4% respectively), while Germany's economy stagnated, and Italy unexpectedly contracted by 0.3%. The annual growth rate of 0.6% was the slowest since the recession of 2020-21.

Japan's economy experienced a robust 1.5% growth in Q2 2023, exceeding predictions and marking its fastest pace since Q4 2020. The expansion was propelled by rebounding exports and declining imports, boosting net trade. While government spending and capital expenditure remained subdued, private consumption dipped due to cost pressures. Despite this growth, the economy's 2023 expansion slowed to 1.1%, reflecting global challenges.

Quick look ahead

As of August 18, 2023