Weekly Market Pulse - Week ending January 19, 2024

Market developments

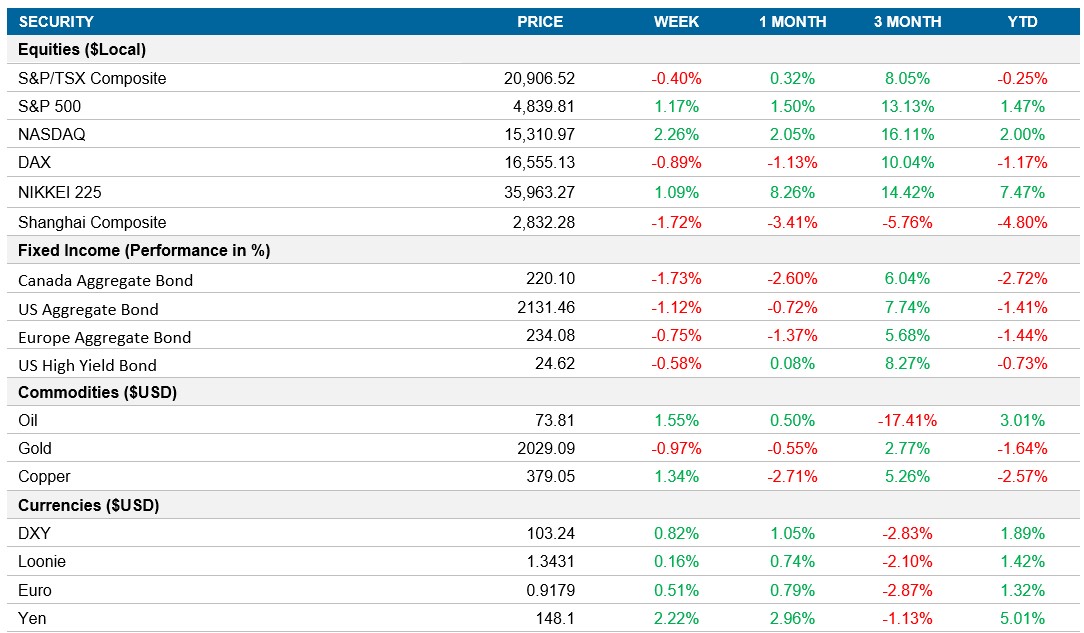

Equities: Stocks closed the week positively, hitting record highs amid speculation of rate cuts by the Federal Reserve. Technology stocks, led by companies like Nvidia and Microsoft, contributed to the S&P 500's surge, defying concerns about concentration in certain shares. The S&P 500 erased weekly losses, rising 1%, with the Nasdaq 100 gaining even more. Despite concerns of narrow leadership, optimism prevails due to strong economic data, lower inflation expectations, and a possible easing of Fed rate hikes.

Fixed income: A decrease in Treasury volatility boosted risk-taking by investors. Positive sentiment is fueled by a "Fed-friendly" report, supporting the case for potential rate cuts based on high consumer confidence and lower inflation expectation. Federal Reserve officials emphasize a data-driven approach for potential rate cuts amid declining inflation. Traders adjusted expectations, pricing in around 1.4 percentage points of reductions for the year, which is down from a week ago and led to bond indices ending the week lower.

Commodities: Oil futures declined at the end of the week as traders evaluated factors like increasing supplies, demand outlook, U.S. production challenges, and tensions in the Middle East. The weak performance is attributed to geopolitical events not affecting actual supply and a perceived economic downturn, including a concerning housing sales report. Despite early gains, oil finished the week with a loss.

Performance (price return)

Source: Bloomberg, as of January 19, 2024

Macro developments

Canada – Canada’s Inflation Rate Comes in Higher Than Expected

Canada's annual inflation rate rose to 3.4% in December, aligning with market expectations. The increase was driven by a rebound in gasoline costs and elevated mortgage rates affecting shelter and rent prices. Despite a 0.3% monthly decline in consumer prices, policymakers signal potential for another rate hike to address unsustainable price growth. In the same month, preliminary estimates suggest a strong 0.8% surge in retail sales, the sharpest increase in 11 months.

U.S. – Retail Sales Exceed Expectation

In the United States, retail sales soared 0.6% in December, exceeding expectations and marking the biggest increase in three months. The rise was led by strong sales in various sectors, including autos, non-store retailers, clothing, and general merchandise stores. Core retail sales, excluding specific categories, rose at a robust 0.8%, the most since July. Unadjusted retail sales for the full year of 2023 increased by 3.2%.

International – U.K. Inflation Rose 4%, U.K. Retail Sales Fall, Japan’s Inflation Rate Falls to Lowest Level Since 2022 and China’s Economy Expands by 5.2%

The annual inflation rate in the U.K. unexpectedly rose to 4% in December, the first increase in ten months. Contributing factors included higher prices for alcohol, tobacco, and recreation and culture items.

U.K. retail sales tumbled by 3.2% in December, marking the largest monthly decline since January 2021. Non-food store sales, including department stores and household goods stores, saw significant drops, contributing to a 2.4% year-on-year decrease in trade for the full year of 2023.

Japan's annual inflation rate fell to 2.6% in December, the lowest since July 2022. Moderation in food, healthcare, and communication costs contributed to the decline, while fuel and light prices continued to fall. The core inflation rate reached 2.3%, the lowest in 18 months. Despite this, consumer prices edged up 0.1% in December, following a flat reading in November.

China's economy expanded by 5.2% year-on-year in Q4 2023, exceeding the official target of around 5.0%. December's industrial production showed the strongest growth in almost two years, but retail sales increased the least in three months. The surveyed jobless rate edged up to a four-month high. For the full year of 2023, China's GDP growth was 5.2%, reflecting various support measures and a low base comparison. The 2023 growth rate is the slowest since 1990. Beijing is expected to announce the GDP growth target for 2024 in March.

Quick look ahead

As of January 19, 2024