Weekly Market Pulse - Week ending June 30, 2023

Market developments

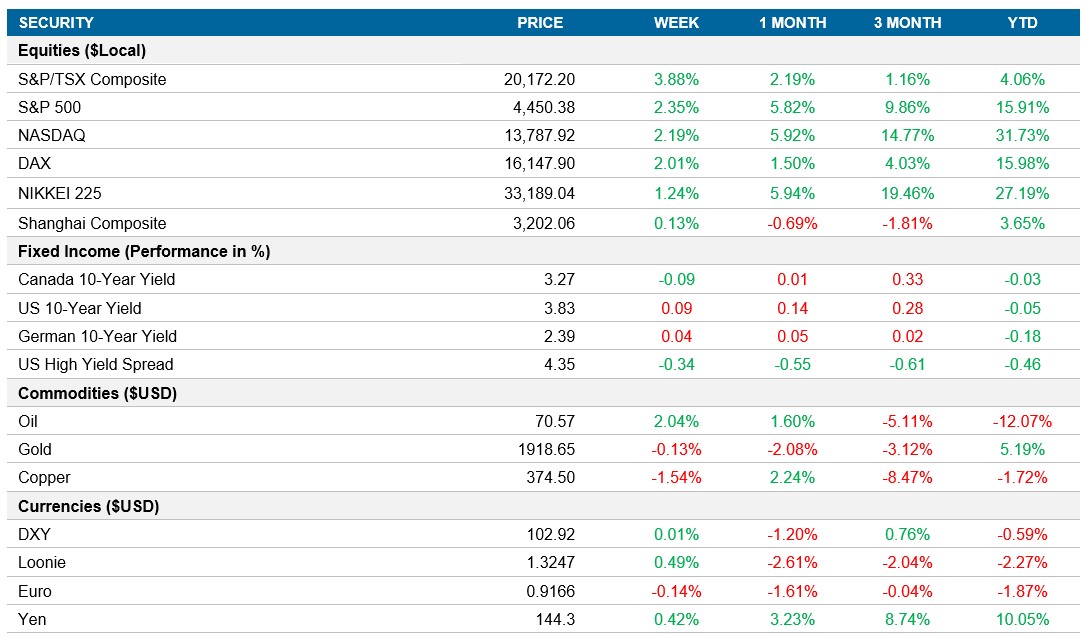

Equities: Tech Mega Caps, including Apple, fueled a strong rally, propelling the Nasdaq 100 to a historic first-half performance. Investors embraced positive inflation data, favoring economic growth. Tech stocks, driven by artificial intelligence, outperformed. The Nasdaq 100 surged by nearly $5 trillion this year, defying bubble concerns with a 40% gain. The "Big Seven" tech companies, such as Apple, Microsoft, Alphabet, Amazon, Meta Platforms, Nvidia, and Tesla, are expected to drive earnings growth, with AI as a key driver. The S&P 500 and the Nasdaq closed the week up 2.35% and 2.2% respectively.

Fixed income: U.S 10-year yields rose to over 3.8% this week. In May, key indicators of U.S. inflation showed a slowdown, with consumer spending remaining stagnant and the personal consumption expenditures price index, favoured by the Fed, increased by 0.1%. Compared to the previous year, the index recorded a decrease to 3.8%, marking the smallest annual increase in over two years. Given the economic data, the futures market is now pricing in a peak Fed Funds rate of 5.4% with a very low probability of rate cuts this year.

Commodities: Although positive for the week, Oil recorded nearly a 7% decline in Q2 due to ample supplies and concerns over global demand. Robust crude exports from Russia and Iran, coupled with worries about a potential global economic slowdown, weighed on prices. The outlook for the second half remains uncertain, with mixed expectations of a tightening market and potential impact from further interest rate increases.

Performance (price return)

As of June 30, 2023

Macro developments

Canada – Canada's Inflation Rate Drops to 3.4% in May, Canadian Economy Surges by 0.8% in Q1 2023, Exceeding Expectations

In May 2023, Canada's annual inflation rate fell to 3.4%, the lowest since June 2021, largely due to the impact of Russia's invasion of Ukraine on energy prices. Transportation and durable goods prices decreased, while mortgage interest costs rose sharply. Core inflation slowed more than expected, and the monthly Consumer Price Index increased by 0.4%.

The Canadian economy grew by 0.8% in the first quarter of 2023, surpassing market estimates of 0.4% expansion. Exports of goods and services accelerated, while imports rose at a slower pace. Household consumption rebounded, but housing and business investments declined due to higher interest rates. The annualized GDP growth stood at 3.1%, providing leeway for potential tightening measures if inflation remains high.

U.S. – PCE Price Index Rises 3.8% YoY in May 2023

In May 2023, the U.S. personal consumption expenditure price index increased by 3.8% YoY, the lowest since April 2021. Goods prices rose by 1.1%, services prices by 5.3%, and food costs by 5.8%. Energy prices, however, decreased by 13.4%. Excluding food and energy, the core PCE price index rose by 4.6% YoY. On a monthly basis, PCE prices increased by 0.1%, and the core index by 0.3%. The Fed projected PCE inflation of 3.2% and core PCE inflation of 3.9% for the year.

International – Eurozone Consumer Price Inflation Eases to 5.5% in June, China's Composite PMI Output Index Declines to 52.3 in June

Eurozone's consumer price inflation rate dropped to 5.5% in June 2023 from 6.1% in the previous month, slightly below market expectations. The core inflation rate remained high at 5.4%, indicating potential future rate hikes. Energy prices decreased, while food, alcohol, tobacco, and non-energy industrial goods saw slower price increases. Services inflation rose to 5.4%. Monthly consumer prices advanced by 0.3% in June.

China's Composite PMI Output Index declined to 52.3 in June 2023, the lowest since December 2022. Factory activity contracted for the third month, while the service sector experienced slow growth. Economic challenges persist, with weak domestic and global demand, along with record-high youth unemployment. Premier Li Qiang mentioned plans to boost demand without elaborating on specifics.

Quick look ahead

As of June 30, 2023