Monthly Market Insights - Data and opinions as of November 30, 2020

Dow hits 30,000

On the back of U.S. election results and positive developments on the vaccine front, stocks rallied to new all-time highs in November. While the S&P 500 surpassed its pre-COVID-19 level back in August, it took the Dow Jones Industrial Average until mid-month to achieve the same thing. While 30,000 is more of a psychological milestone than anything, the recent outperformance of this cyclical-heavy index is a light at the end of the tunnel. Despite a continued rise in virus cases prompting more lockdowns, investors seem to be looking past the near-term risks. Anticipated fiscal expansion from a Biden presidency as well as a vaccine next year are positive drivers for markets and the economy.

The NEI perspective

Vaccine news drive markets to new highs. It is no longer a matter of “if,” but “when” a vaccine will be available, as multiple drug companies announced positive early trial results. However, with approval processes, distribution efforts, and the general public’s muted enthusiasm, it may take some time to achieve herd immunity to COVID-19.

Lockdowns continue. Global virus cases continue to rise, prompting more lockdowns. While euro area PMIs show contracting business activity, U.S. business activity indicators further accelerated due to vaccine optimism and less restrictive lockdowns.

Fiscal policy will drive the recovery. While it is unlikely we’ll see a U.S. stimulus package this year, the nomination of former Fed Chair Janet Yellen as Treasury Secretary bodes well for a coordinated monetary and fiscal response over the longer-term.

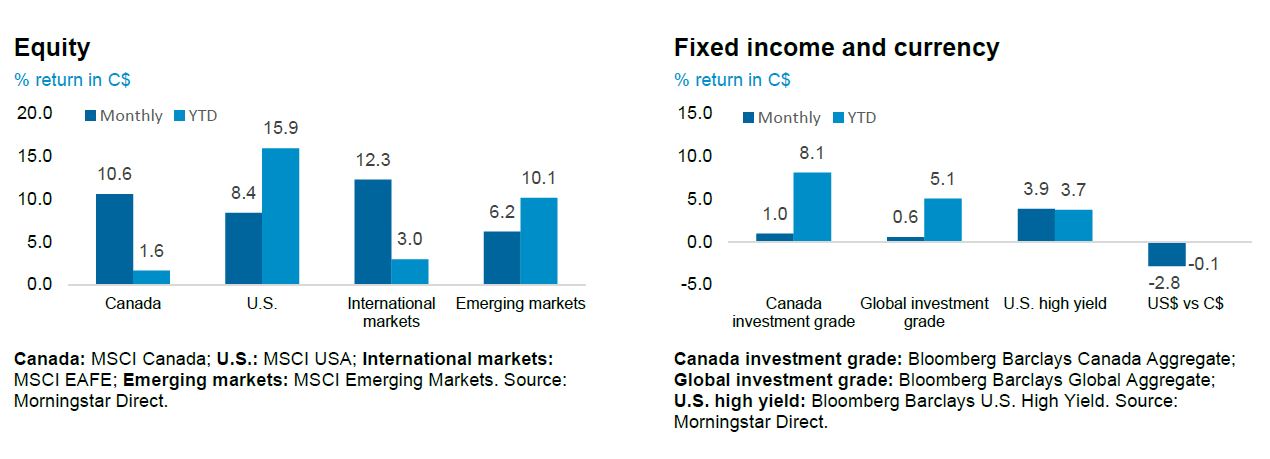

As of November 2020

Virus, vaccines, and value

When news broke on November 9 of Pfizer’s vaccine breakthrough, the Dow opened 1600 points above the previous day’s close (+5.7%), hitting an all-time intra-day high. With the strong momentum throughout the month as more encouraging vaccine news rolled in, investors got a glimpse of market rotation dynamics in action. A faster return to normal provides a stronger boost for some sectors relative to others. You can see in the chart below how the traditional value sectors of energy, financials, and industrials rebounded strongly in November. Meanwhile, sectors such as information technology, which has performed spectacularly this year, lagged.

Encouraging vaccine developments accelerate the cyclical value rotation

.JPG)

Source: Bloomberg. Data as of November 30, 2020.

Despite the vaccine breakthroughs, challenges lie ahead. Vaccine(s) still need to be approved, and manufacturing and distribution on a global scale will take time. According to the World Health Organization, as much as 80% of the global population would likely need to receive a vaccine in order to achieve “herd immunity.” While some developed countries may get access to the vaccine as early as Q1 next year, other countries may end up waiting. Through collaboration with the Access to Medicine Index, Aviso Wealth’s Asset Management division, NEI Investments, continues to engage pharmaceutical companies, including Pfizer and others, to ensure fair and equitable access and pricing to critically important medicines.

The widespread availability of a coronavirus vaccine would be a major game changer. It would help accelerate global economic recovery and a return to normal. It would also provide a strong tailwind for cyclical sectors, which are still considerably lagging the broad market.