Weekly Market Pulse - Week ending April 12, 2024

Market developments

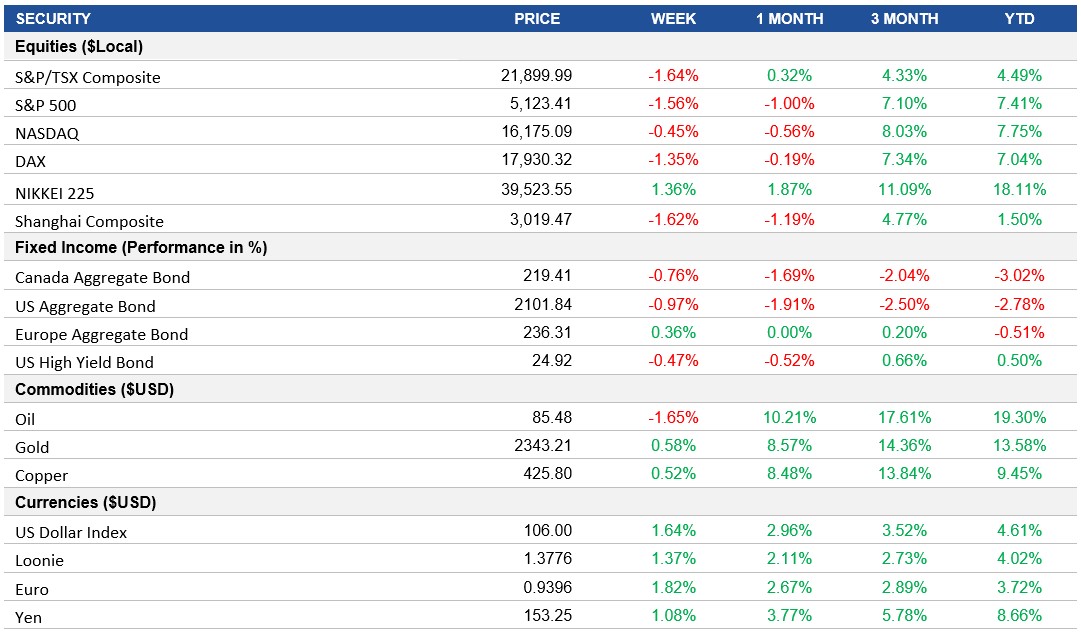

Equities: Heightened geopolitical risks, particularly between Israel and Iran, caused stocks to decline while safe-haven assets like bonds and the dollar surged. Equities fell sharply, with the S&P 500 with one of its worst days since January and down ~1.5% for the week. Earnings season kicked off and major banks' results reflected the impact of persistent inflation on their earnings. While some banks missed estimates due to increasing funding costs, others benefited from corporations tapping markets for financing and consumers leaning on credit cards.

Fixed Income: Amid expectations of interest rate cuts, there were contrasting views on the Fed's likely actions. Some expected rate cuts, while others warned of potential rate hikes if U.S. inflation rises further. The higher-than-expected inflation data caused treasury yields to climb, driving North American bond prices lower for the week.

Commodities: Escalating tensions spurred bullish activity in the oil options market, with elevated buying of call options as implied volatility climbed. Gold prices rose this week as investors viewed it as a better hedge against geopolitical risk than government bonds, amid concerns about U.S. inflation.

Performance (price return)

Source: Bloomberg, as of April 12, 2024

Macro developments

Canada – Bank of Canada Maintains Key Rate Amid Inflation Concerns

The Bank of Canada kept its key rate steady at 5%, citing persistent inflation risks despite easing price pressures across various sectors. Governor Macklem highlighted cautious optimism regarding moderating inflation but expressed the need for more data before considering looser monetary policy. Inflation is expected to hover near 3% until 2025, with GDP growth forecasts indicating resilience in the face of global economic uncertainty.

U.S. – U.S. Annual Inflation Hits Highest Level Since September, U.S. Core Producer Prices Rise, Exceeding Market Expectations

Annual inflation in the U.S. rose to 3.5% in March, driven by increased energy costs and sharp rises in transportation and apparel prices. While some sectors saw stability, others experienced declines, contributing to a monthly CPI increase of 0.4%. Core inflation remained steady at 3.8%, signaling ongoing price pressures.

Core producer prices in the U.S. increased by 0.2% in March, aligning with market forecasts and reflecting a yearly rise of 2.4%. This acceleration from February surpassed expectations, indicating continued upward pressure on prices excluding food and energy.

International – European Central Bank Maintains High Interest Rates, China's Inflation Slows, Reflecting Lunar New Year Effects

The European Central Bank kept interest rates unchanged at record highs for the fifth consecutive meeting, signaling a commitment to controlling inflation. While acknowledging a decline in inflation, officials cautioned against strong domestic price pressures, emphasizing a data-dependent approach to future policy decisions.

China's consumer prices edged up by 0.1% year-on-year in March, below market expectations, with a notable slowdown attributed to the fading effects of the Lunar New Year. Non-food inflation eased, while food prices experienced a steeper decline, contributing to the first monthly CPI decrease in three years.

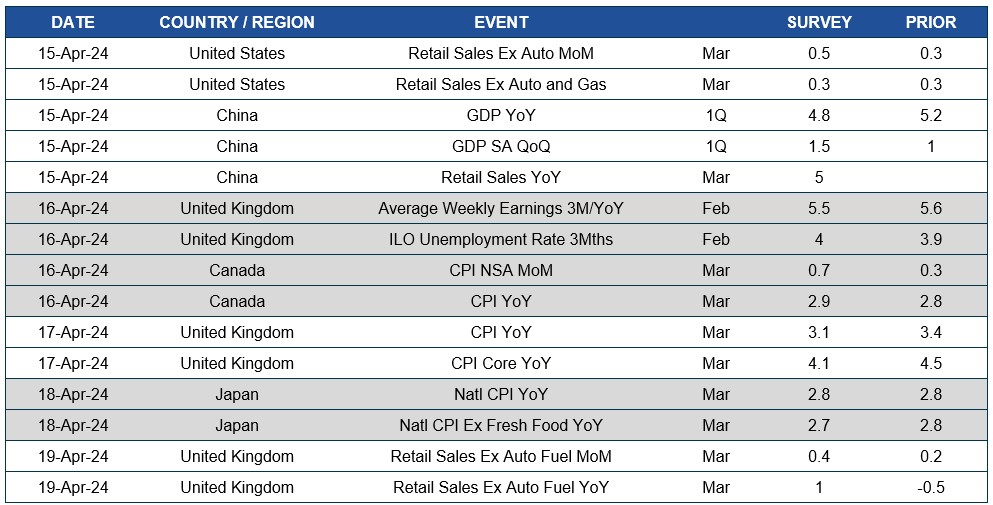

Quick look ahead

As of April 12, 2024