Weekly Market Pulse - Week ending February 2, 2024

Market developments

Equities: The stock market extended gains, reaching all-time highs with the S&P 500 above 4,950 and the Nasdaq up 1.5%. Positive outlooks from Meta Platforms Inc. and Amazon.com Inc. contributed to the rally. Economic optimism overshadowed concerns about the Federal Reserve delaying their first rate cut to the second quarter. The rush into technology stocks is being compared to the dot-com era, with investors assuming strong economic performance despite tighter monetary policy. Bank of America Corp.'s Michael Hartnett notes that 75% of investors expect a “soft landing”, while 20% anticipate a “no-landing” scenario.

Fixed income: The strong economic data suggests the Federal Reserve may defer rate cuts until at least the second quarter. Market participants have adjusted expectations, reducing the odds of a March rate cut. The Fed's cautious approach aligns with Chair Powell's recent comments, emphasizing the need for sustained confidence in inflation moving toward 2%. The strong economic data, along with central bank comments drove whipsawed yields this week, but yields ultimately ended the week lower, lifting bond indices higher.

Commodities: Oil prices settled at their lowest level in three weeks on Friday, contributing to their largest weekly decline since October. Demand concerns and uncertainty around a potential ceasefire in the middle east has led to the continued uncertainty.

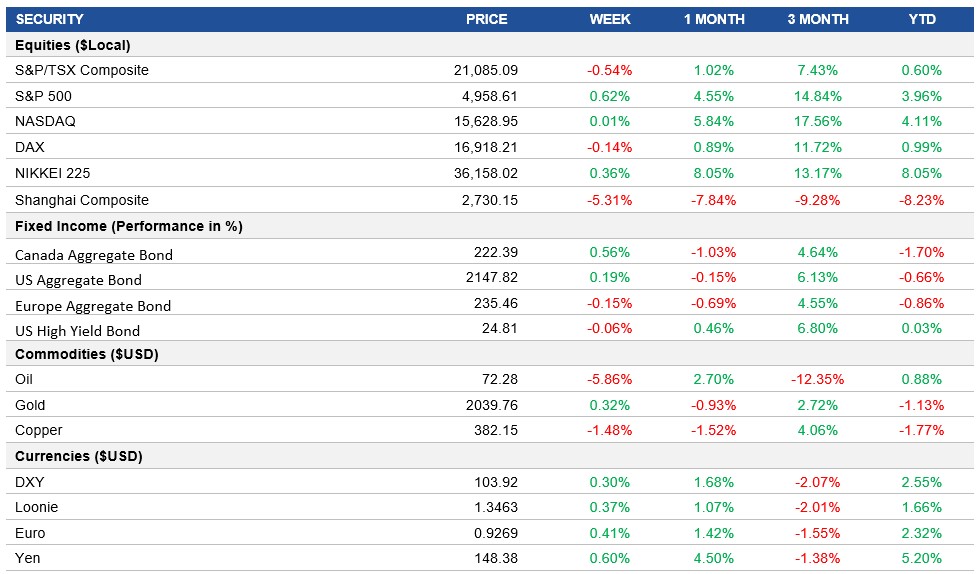

Performance (price return)

Source: Bloomberg, as of February 2, 2024

Macro developments

Canada – Canada's Economy Shows Mixed Growth in December 2023,

Canada's economy is expected to have grown by 0.3% in December 2023, driven by increases in manufacturing, real estate, and mining. However, declines in transportation, construction, and educational services partially offset this growth. The S&P Global Canada Manufacturing PMI improved in January, marking the slowest contraction since October, with production and new orders seeing less severe declines.

U.S. – Federal Reserve Maintains Rates Amid Inflation Concerns, Positive Signs in the U.S. Manufacturing Sector, Steady U.S. Unemployment Rate in January

The Federal Reserve kept the Fed funds rate unchanged at 5.25%-5.5% in January 2024 for the fourth consecutive meeting, emphasizing the need for greater confidence that inflation is moving sustainably toward 2% before considering rate reductions. Chair Powell suggested a possible rate cut later in the year but dismissed the likelihood of a March cut. The Fed's focus remains on achieving employment and inflation goals.

The S&P Global U.S. Manufacturing PMI for January 2024 was revised higher to 50.7, reflecting a bigger improvement than initially expected. New orders returned to expansion, and output contraction slowed. Input prices rose, leading to the fastest output charge inflation since April 2023. Employment rose for the first time since September, indicating continued growth expectations.

The U.S. unemployment rate held steady at 3.7% in January 2024, unchanged from the previous month and slightly below market consensus. The activity rate remained flat at 62.5%, while the number of unemployed individuals decreased, and the count of employed individuals dropped slightly.

International – Eurozone Economy Stalls in Q4 2023, Eurozone Manufacturing PMI Shows Improvement, China's Manufacturing PMI Unexpectedly Shows Growth

The Eurozone economy unexpectedly stalled in the last quarter of 2023, with Germany contracting by 0.3%. Positive contributions came from Spain and Italy, but challenges remain for 2024, including high borrowing costs, subdued demand, and a soft manufacturing sector, particularly in Germany.

The HCOB Eurozone Manufacturing PMI rose to 46.6 in January 2024, the highest in ten months, indicating further contractions but at the slowest rates in nine months. New orders and output indices increased, backlogs of work dropped sharply, and employment reductions continued at the softest rate in four months. Business confidence reached its highest level since April.

The Caixin China General Manufacturing PMI unexpectedly remained at 50.8 in January 2024, indicating a third straight month of growth in factory activity. Stable output growth, increased foreign sales, and improved supply chains contributed to this positive trend. Despite a slight fall in selling prices, sentiment reached a 9-month high, linked to forecasts of stronger global demand and planned investments.

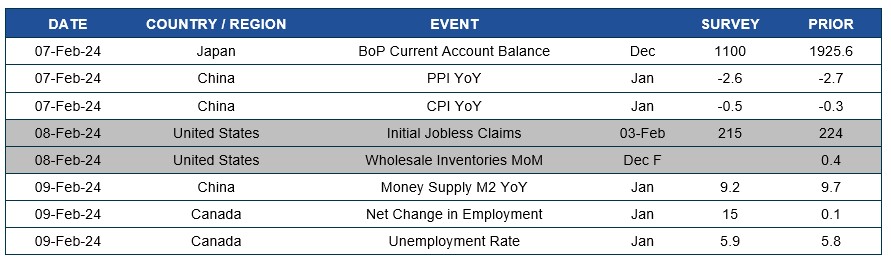

Quick look ahead

As of February 2, 2024