Weekly Market Pulse - Week ending July 29, 2022

Market developments

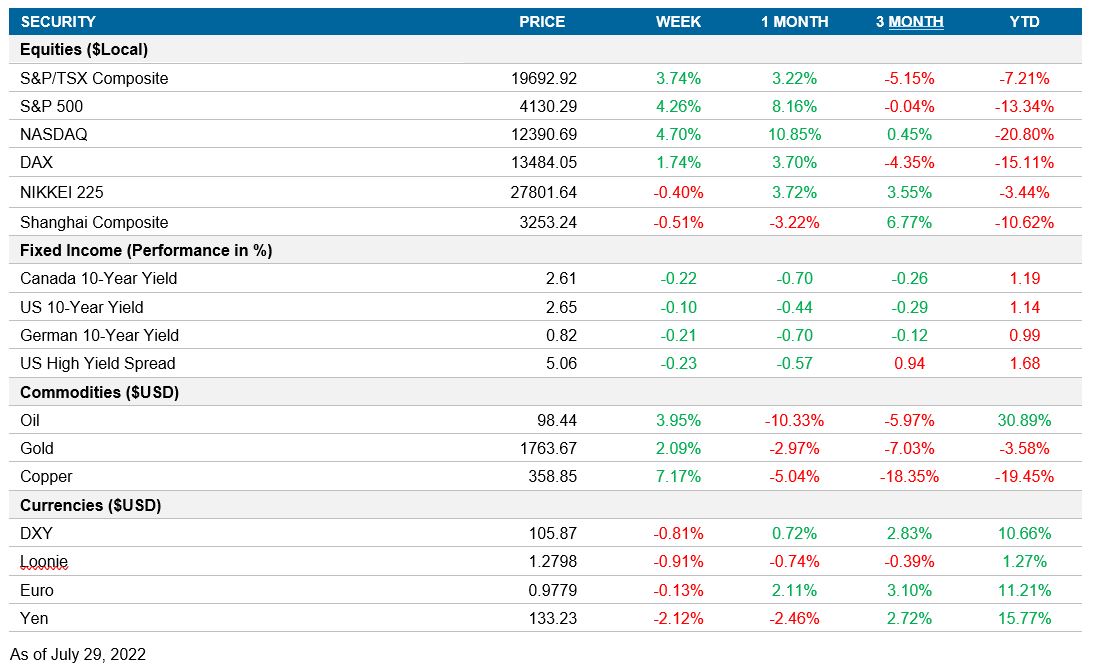

Equities: Equity markets remained positive, with the rally in U.S. equities continuing since hitting a low in mid-June. A substantial proportion of the S&P 500 continues to beat analysts' earnings expectations. Investors are also expecting the Federal Reserve to possibly soften monetary policy after their latest 75-bp hike and U.S. GDP contracted in the second quarter.

Fixed income: Yields remained volatile after the Fed raised rates by 75-bp and the latest U.S. GDP data was released. Yields moved lower, signaling an increased probability of recession.

Commodities: Oil prices rallied as supplies continue to tighten despite increased energy demand as we move further into the summer months. Copper prices continue to sustain increases because of similar supply chain issues. Demand for gold increased with the market expecting smaller rate hikes for the foreseeable future.

Performance (price return)

As of July 29, 2022

Macro developments

Canada – No notable releases

No notable releases for the week.

U.S. – Conference Board consumer confidence declines; Durable goods orders increases; Fed hikes by 75-bp; GDP falls

The Conference Board released their consumer confidence findings for July. Consumer confidence has fallen for the third month in a row, reaching a 16-month low of 95.7. Surprisingly, this fall was driven by the present situation index rather than the expectations index. The present situation index fell from 147.2 to 141.3 but the expectations index fell from 65.8 to 65.3. Worries about inflation continue weighing on the American consumer and survey participants believe the job market is weakening—an interesting precursor to employment data next week.

Durable goods orders data for the month of June surprised on the upside. New orders grew by 1.9%, up from 0.8% month-over-month. This was driven by a large 80.6% month-over-month increase in new defense aircraft orders. This was partially offset by a 2.1% decrease in commercial aircraft orders, 1.1% decrease in primary metal orders and 2.7% decrease in defense capital goods orders. Like the headline figure, core new orders saw an expansion of 0.3% month-over-month.

The Federal Reserve unanimously raised rates by 75-bp to 2.5% during their July 27 meeting. In their monetary policy note, the Fed had a softer tone, as they mentioned that the economy is starting to weaken, and they removed their statement regarding Chinese supply chain pressures. However, the Fed also noted that employment data remained strong, and they mentioned food prices as one of the main drivers of inflation. The rest of the guidance remained unchanged, meaning rate hikes will likely continue for the near future.

The U.S. advance GDP estimates for the second quarter had a weak release. Consensus estimates forecasted growth of 0.5% quarter-over-quarter, but the actual figure had a surprise on the downside with a reading of –0.9%. The drivers of the decline were gross private domestic investment (-13.5% QoQ) and government spending (-1.9% QoQ). Services remained resilient and service consumption increased by 4.1% quarter-over-quarter. This contractionary GDP release indicates that the U.S. entered a technical recession during the second quarter.

International – Germany’s ifo index falls; Germany’s CPI stronger than expected; Japan’s industrial production rallies; Japan’s retail sales weaken; Germany’s GDP stagnates; Eurozone CPI rises; Eurozone GDP rises

Germany’s ifo business climate index continued its downwards trajectory in July. The index came in at 88.6, which was a second consecutive surprise to the downside. Germany’s economy has proven to be resilient, with the current situation index having a reading of 97.7. However, the business expectations index continued to fall sharply to 80.3, down from 85.5. German business owners are expecting conditions to become much worse, citing rising energy costs and worries about gas shortages. This negative outlook was shared across all industries, including the key manufacturing component.

Germany’s preliminary CPI release for July came in higher than expectations. CPI figures were 7.5% year-over-year—down 0.1% from June, and 0.9% month-over-month—up 0.8% from June. Energy prices continued to fall and showed a 35.7% year-over-year increase. Destatis currently does not know the exact effects of Germany’s consumer fuel discount but priced it into the report regardless. Food prices are proving to be a growing concern, as they rose to 14.8% year-over-year.

Germany’s advance GDP estimates for the second quarter released under consensus estimates. The German economy has stagnated and remained flat with growth of 0.0% quarter-over-quarter. The year-over-year figure had a reading of 1.5%. Personal and government consumption were the primary drivers of economic growth during the second quarter. Tightening energy and food supply chains had a negative effect on the German economy, causing imports to increase. The year-over-year increase is attributed to the COVID-19 pandemic since Germany was undergoing a third wave during Q2 2021.

After facing four consecutive decreases from tightening supply chains, Japanese industrial production posted an increase with a surprise on the upside for the month of June. Production had a reading of 8.9% month-over-month, up from a contraction of 7.5% in June. This significant increase in production was caused by supply chains easing after Chinese lockdown measures eased in June.

Japanese retail sales weakened during the month of June. Retail sales grew by 1.5% year-over-year, down from 3.7% year-over-year. Demand for goods has diminished during the month of June and fuel sales growth is slowing due to lower commodity prices. Motor vehicle sales remained strong with growth of 9.2% year-over-year.

Eurozone flash inflation for July released with a surprise on the upside. CPI had a reading of 8.9% year-over-year and 0.1% month-over-month. Like Germany, the eurozone faced energy prices that were diminishing but remained high nonetheless at 39.7% year-over-year. Food prices have also been rising, with food, alcohol and tobacco posting an increase of 9.8% year-over-year. Inflation in Spain and France continued rising, with figures of 10.8% and 6.8% year-over-year respectively.

Eurozone’s flash GDP estimates for the second quarter released above expectations. GDP estimates were 0.7% quarter-over-quarter and 4.0% year-over-year. Spain (1.1% QoQ), Italy (1.0% QoQ) and France (0.5% QoQ) reported quarterly increases in their GDP. Growth is starting to stall in many eurozone countries such as Germany and Portugal, as ECB rate hikes dampen demand for goods, services, and investment.

Quick look ahead

Canada – Employment (August 5)

StatCan will release July’s employment data. Canada’s strong employment readings are starting to prove a barrier to the inflation target and the BoC will be closely watching this release to determine if there is more room for tightening. Unemployment is expected to increase to 5.0%, up from 4.9% in June.

U.S. – Employment (August 5)

The Bureau of Labor Statistics will publish July’s employment data. America is facing the same narrative as Canada, where high wages are acting as a tailwind on inflation. Economists are expecting unemployment to remain at 3.6%.

International – Germany’s retail sales (August 1); Eurozone retail sales (August 3); BoE rate decision (August 4); Germany’s industrial production (August 5)

Destatis will release Germany’s retail sales data for June. Retail sales are expected to expand by 0.2%, down from 0.6% month-over-month.

Eurostat will publicize its June retail sales release. The eurozone’s retail sales are predicted to grow by 0.1%, down from 0.2% month-over-month.

The Bank of England will make its interest rate announcement on August 4. Economists are expecting a rate hike of 25-bp to 1.5%.

Destatis will release Germany’s industrial production data for June. Consensus estimates are expecting production to contract by 0.4% month-over-month. However, it is important to note that June had a strong PMI release where positive factors of production rallied, and production has a decent chance of expanding.