Weekly Market Pulse - Week ending September 1, 2023

Market developments

Equities: U.S. stocks saw a significant weekly rise as monthly jobs data suggested the Federal Reserve might halt its tightening measures. The S&P 500, Nasdaq, and TSX all increased by over 2.5% ahead of the long weekend. Despite improved hiring in August, wage growth slowed, and the unemployment rate unexpectedly rose to 3.8%. This may influence the Fed's decision on interest rates. Some individual stocks like Lululemon, Dell Technologies and Eos Energy rose due to positive announcements. However, some caution remains in the market, with concerns about a potential economic "hard landing."

Fixed income: In response to recent developments, Treasury two-year yields fell by 20 basis points to 4.87%, signaling reduced expectations of further rate hikes this year. Swap contracts now suggest less than a 50% chance of another rate increase and even speculate on a rate cut in May instead of June. U.S. 10-year real yields saw virtually no change this week as it hovers around 1.92%. The focus in the U.S. session includes personal income and spending data, which includes the PCE deflator, the Fed's preferred inflation measure.

Commodities: Oil prices reached their highest point this year, with U.S. benchmark crude up over 7.5% for the week, driven by supply concerns and positive Chinese manufacturing data. August marked the third straight monthly gain for Brent and WTI, rebounding from earlier worries about China's economy and U.S. interest rates. Saudi Arabia is expected to continue cutting oil production, potentially tightening inventories.

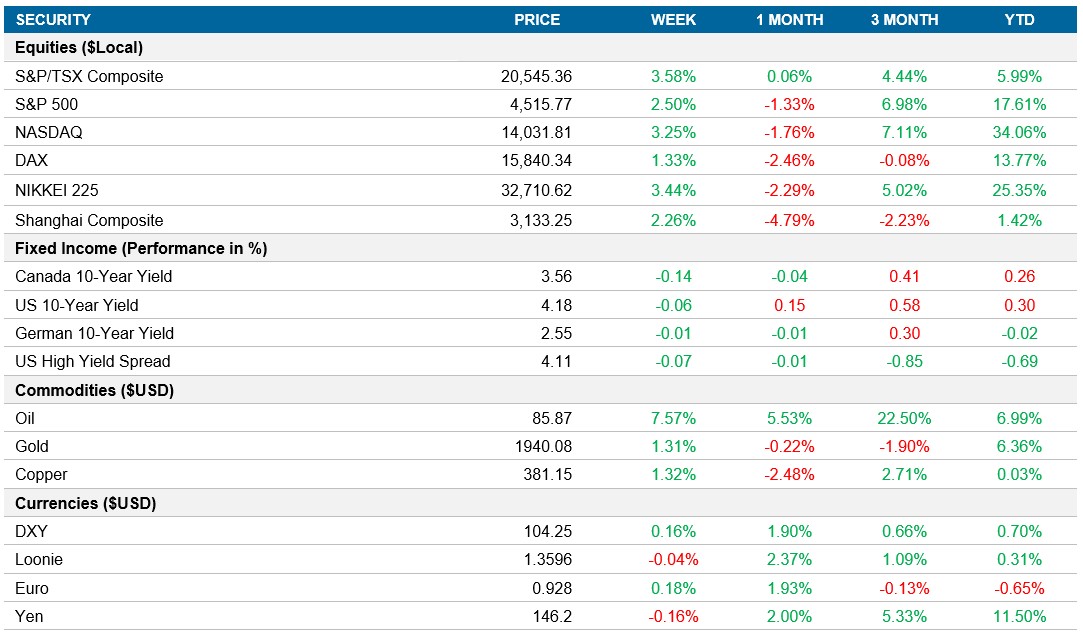

Performance (price return)

As of September 1, 2023

Macro developments

Canada – Canadian GDP Stalls in Q2

Canadian GDP in Q2 2023 stagnated, missing the expected 0.3% growth, and declining from the previous 0.6% growth. This was due to higher interest rates affecting the economy, causing a drop in inventory investment and housing. Imports also increased more than exports, leading to negative net foreign demand. Annualized GDP contracted by 0.2%, far below the expected 1.2% growth.

U.S. – U.S. Economy's Grows 2.1% in Q2, U.S. Adds 187K Jobs in August, U.S. Unemployment Rate Rises, PCE Price Index Increases 0.2% MoM

The U.S. economy grew at an annualized rate of 2.1% in Q2 2023, lower than preliminary estimates. Consumer spending and exports slowed, but non-residential fixed investment increased. Residential investment continued to decline.

In August, the U.S. added 187,000 jobs, lower than previous months, signaling a gradual labour market easing due to Federal Reserve's interest rate hikes. Job gains were in healthcare, hospitality, social assistance, and construction, while transportation lost jobs.

The U.S. unemployment rate rose to 3.8% in August, attributed to an increase in the number of unemployed individuals. The U-6 unemployment rate, including underemployed and discouraged workers, increased to 7.1%, which is the highest level since May 2022, but labour force participation improved.

In July, the PCE price index in the U.S. increased by 0.2% month-over-month, matching June's pace, and meeting market expectations. Service prices accelerated, rising by 0.4%, while goods prices declined by 0.3%, with durable goods falling by 0.7%. On a year-on-year basis, PCE prices grew by 3.3%, up from 3.0% in June. Excluding food and energy, the PCE price index also increased by 0.2% month-over-month and by 4.2% from the previous year.

International – Eurozone Inflation Steady at 5.3%, China's PMI Inched Up to 51.3, Japan's Retail Sales Growth rose by 6.8%

The annual inflation rate in the Eurozone remained at 5.3% in August, surpassing the ECB's target. Energy prices decreased at a slower rate, but inflation slowed for food, alcohol, tobacco, non-energy goods, and services.

China's Composite PMI Output Index inched up in August, with factory activity contracting less, but market demand remained a concern. China's recovery was described as "tortuous," and counter-cyclical adjustments were emphasized.

Retail sales in Japan rose by 6.8% YoY in July, indicating continued recovery from the pandemic. Various retail sectors, including automobiles, food, and cosmetics, experienced growth, with a monthly increase of 2.1% in July.

Quick look ahead

As of September 1, 2023