Weekly Market Pulse - Week ending December 1, 2023

Market developments

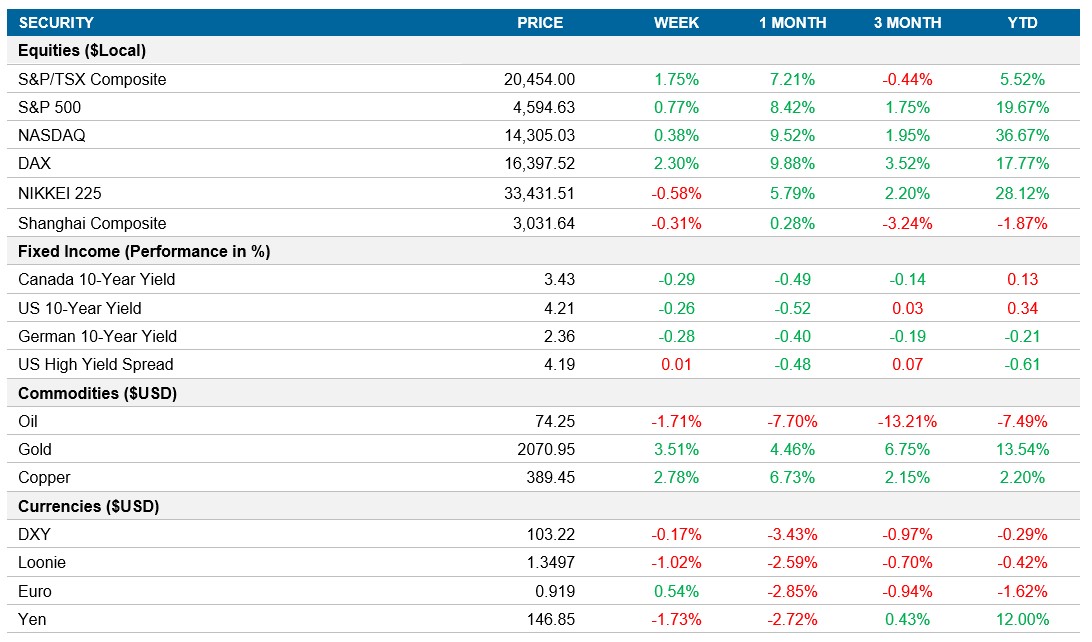

Equities: The S&P 500 experienced a slight increase on Friday, rebounding from earlier losses and closing the week up 0.75% following Federal Reserve Chair Jerome Powell's statement that policy is "well into restrictive territory." This week saw the end of one of the strongest November’s in the last 20 years as the S&P 500, Nasdaq and TSX ended the month up 8.9%, 10.7% and 7.2% respectively. These indices are now pushing up against short term levels of resistance which could potentially lead to a reversal of momentum in the near term.

Fixed income: Wall Street responded positively to Powell's efforts to discourage bets on interest-rate cuts, with bond yields falling on speculation that the Federal Reserve will maintain its current stance this month and potentially ease policy in 2024. Despite Powell's readiness to tighten further if necessary, the market continues to anticipate future rate cuts, with odds rising for a quarter-point cut in March and a reduction fully priced in by May. The market appears unconvinced by Powell's attempt to keep a more cautious tone. North American 10yr yields fell this week as the Canadian 10yr and U.S. 10yr yields ended the week 27bps and 24bps lower respectively.

Commodities: Oil futures experienced another down week, as traders remained skeptical about the commitment of OPEC+ producers to implement additional production cuts. Following the eagerly awaited OPEC+ meeting, which resulted in an agreement to cut approximately 2.2 million barrels per day in the first quarter of the next year, oil traders remained doubtful.

Performance (price return)

As of December 1, 2023

Macro developments

Canada – Canadian GDP Contraction and Rising Unemployment in Canada

In Q3 2023, Canada's GDP contracted by 0.3%, its first decline since Q2 2021. The decline is attributed to higher interest rates affecting the economy, with exports falling by 1.3%, especially in refined petroleum energy. Additionally, slower inventory accumulation, a withdrawal in manufacturing inventories, and stagnant household expenditures contributed to the contraction, surprising markets that expected expansion.

Canada's unemployment rate increased to 5.8% in November 2023, the highest since January 2022. The rise is accompanied by a notable increase in the number of unemployed individuals, impacting the younger demographic significantly, with a 2.0 percentage point surge in the youth unemployment rate between April and November.

U.S. – U.S. Economy Expands by 5.2% in Q3 and U.S. PCE Cools

The U.S. economy expanded by an annualized 5.2% in Q3 2023, surpassing initial estimates and forecasts. Positive revisions include higher non-residential and residential investments, increased government spending, and strong export performance. Consumer spending slightly slowed due to a decrease in services spending, while inflation, measured by the PCE inflation rate, cooled to 3%, reflecting a moderation in inflationary pressures.

In October, the U.S. saw a cooling in PCE inflation to 3% and a flat monthly personal consumption expenditure, the weakest since July 2022. Core PCE inflation, excluding food and energy, also slowed to 3.5%. These figures indicate a continued moderation in inflationary pressures, aligning with the Federal Reserve's preferred inflation metric.

International – Eurozone Inflation Drops to 2.4%, Unemployment remains unchanged and China’s PMI Shows Signs of Recovery

In November 2023, the Euro Area's inflation rate dropped to 2.4%, the lowest since July 2021. Core inflation also decreased to 3.6%, with notable declines in energy costs and rates for services, food, alcohol, and tobacco. The region's seasonally-adjusted unemployment rate remained at 6.5%, with varying rates among Euro Area economies, notably Spain, Italy, France, and Germany.

China's manufacturing sector showed signs of recovery in November 2023, with the Caixin China General Manufacturing PMI rising to 50.7. This exceeded market forecasts and indicated growth in output and buying levels. Efforts from Beijing to stimulate the economy played a role, and cost pressures remained subdued. The sentiment improved to a 4-month peak, emphasizing the ongoing macroeconomic recovery and the need for long-term growth strategies.

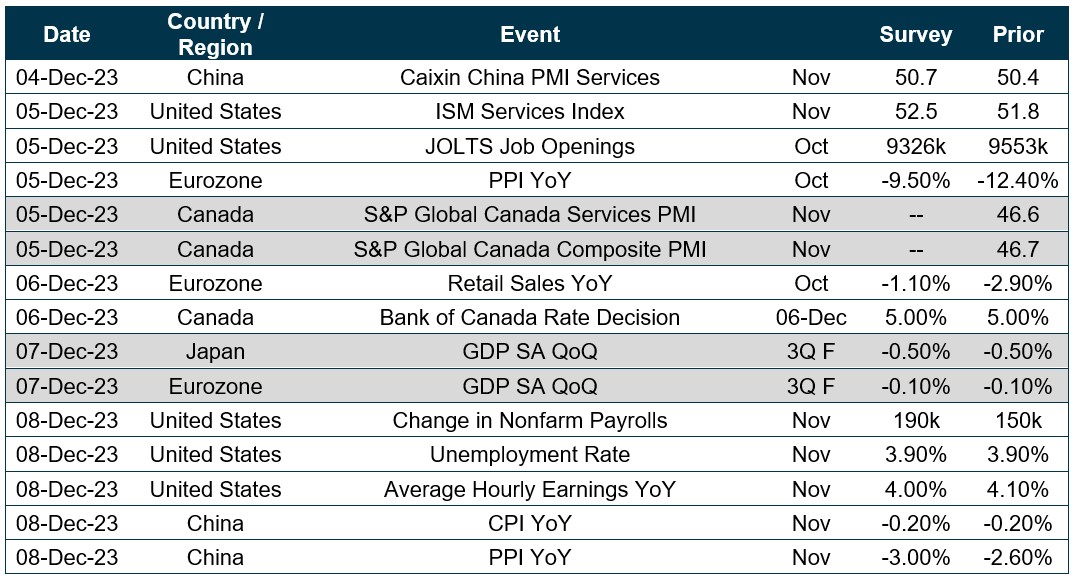

Quick look ahead

As of December 1, 2023