Weekly Market Pulse - Week ending December 15, 2023

Market developments

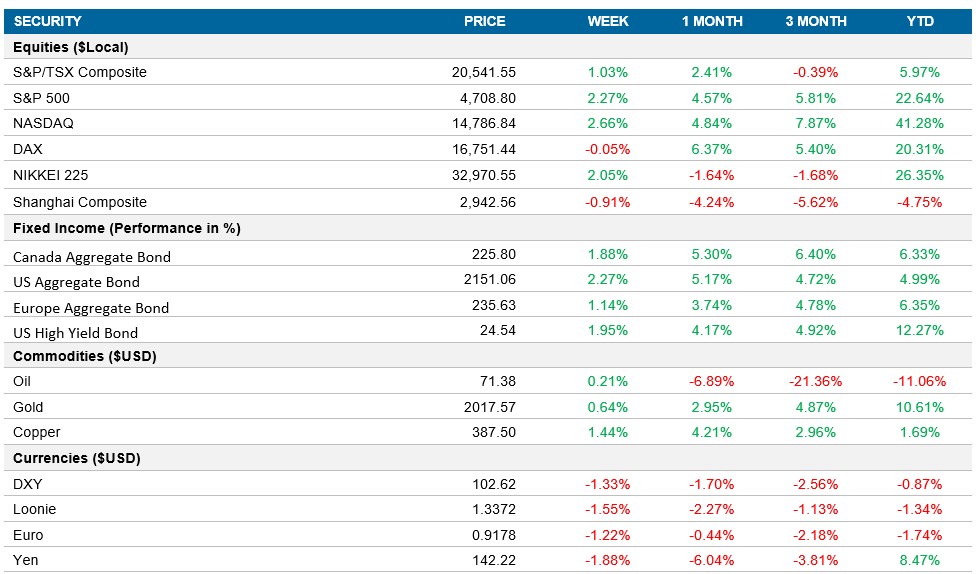

Equities: The Nasdaq 100 hit an all-time high, fueled by Jerome Powell's signaling that the Fed is nearing the end of its aggressive hiking campaign. Tech giants like Microsoft, Amazon, and Nvidia led the advance, as uncertainties impacted other market sectors. U.S. stock benchmarks, including the S&P 500, have seen a remarkable 10% rally in less than two months. Analysts anticipate a digestion phase, especially if Fed officials temper the market's enthusiasm.

Fixed income: While the Fed adopts a more dovish stance, European Central Bank (ECB) members, including Governing Council member Madis Muller and ECB President Christine Lagarde, express a hawkish position. The divergence raises questions, with analysts noting a contrast between the resilient U.S. economy and faltering European economies. Regardless of the differing tones between the central banks around the world, we saw a sharp decline in yields throughout developed markets, highlighted by the U.S. 10yr yield falling below 4%.

Commodities: Oil prices experienced pressure on Friday after a Federal Reserve official walked back dovish comments made earlier in the week by Fed Chair Jerome Powell. The clarification contributed to early declines in oil prices, with the U.S. and global benchmark crude managing to finish the week with a gain, the first in eight weeks.

Performance (price return)

As of December 15, 2023

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – U.S. Inflation Continues to Cool, Fed Funds Rate Remains Unchanged, Retail Sales Grows Above Expectations, Composite PMI Comes in Above Estimates

The U.S. annual inflation rate slowed to 3.1% in November, the lowest in five months. Energy costs declined, with notable drops in gasoline, utility gas service, and fuel oil prices. Prices increased at a softer pace for food, shelter, new vehicles, and apparel. Consumer prices edged 0.1% higher, contrary to expectations of a flat reading, while core inflation remained at 4%.

The Federal Reserve maintained the fed funds rate at 5.25%-5.5%, signaling 75bps cuts in 2024. Economic growth and job gains have moderated but remain strong, with inflation easing over the past year. Projections show higher GDP growth this year but slightly lower in 2024. PCE inflation and core PCE inflation were revised lower for both years. The dot plot indicated a decline in the median year-end 2024 projection for the federal funds rate.

U.S. retail sales unexpectedly increased by 0.3% in November, beating forecasts. Sales in various sectors, including food services, non-store retailers, and health/personal care, recorded significant increases. However, sales at gasoline stations decreased due to declining gas prices. Excluding certain sectors, retail sales rose a robust 0.4%, indicating a strong start to the holiday shopping season.

The S&P Global U.S. Composite PMI rose to 51.0, marking the private sector's third straight month of growth, driven by the service sector. Despite historically low expansion rates, a quick upturn in output was supported by a sharp increase in new orders. Employment grew at the fastest rate in three months, primarily in the service sector, while manufacturers continued to face challenges with decreased new orders and production. Input prices rose sharply, intensifying cost pressures, although the overall inflation rate for prices charged slowed compared to November.

Europe –BOE Maintains Interest Rates, U.K. PMI Rose to 51.7, ECB Holds Interest Rates at Current Levels, Eurozone PMI’s Fall to 47 and China Retail Sales Fall Below Market Estimates.

The Bank of England voted 6-3 to maintain its benchmark interest rate at 5.25% for the third consecutive time. Policymakers aim to combat inflation despite indications of a deteriorating economic landscape. Three members advocated for a rate hike, emphasizing a relatively tight labor market and persistent inflationary pressures. Investor forecasts anticipate a decline in UK interest rates in 2024.

The S&P Global/CIPS United Kingdom Composite PMI rose to 51.7 in December, indicating the fastest pace of expansion in private sector business activity since June. Services output experienced a moderate upturn, but manufacturing production declined for the 10th consecutive month. Total new work increased, and business sentiment reached its strongest point since September.

The ECB maintained interest rates at multi-year highs and signaled an early conclusion to its bond purchase scheme to combat high inflation. Projections indicate elevated inflation for 2023, gradually decreasing in the following years. President Lagarde emphasized that future decisions would be data-dependent and stated that policymakers did not discuss rate cuts during the press conference.

Eurozone Composite PMI fell to 47.0, down from November's 47.6 and below the market consensus of 48.0. This marked the seventh consecutive monthly reduction in business activity, with manufacturing output falling for a ninth straight month. Services activity contracted at the third-steepest pace since early 2021 lockdowns.

China's retail sales expanded by 10.1% YoY in November, missing market consensus but higher than the previous month. Sales growth was notable in clothing, communications equipment, autos, and other sectors. However, sales declined for cosmetics and office supplies. Retail trade growth eased for home appliances and daily necessities.

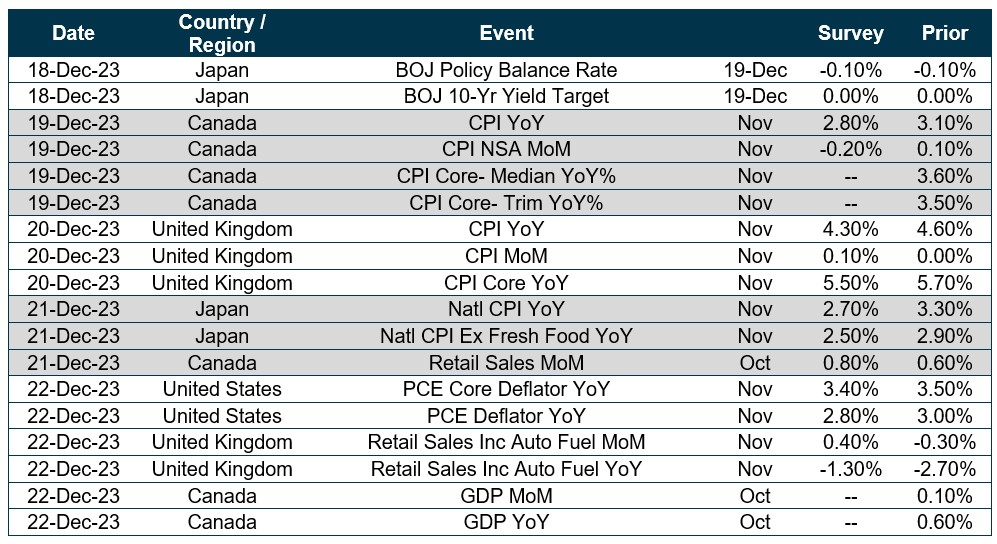

Quick look ahead

As of December 15, 2023