Weekly Market Pulse - Week ending January 12, 2024

Market developments

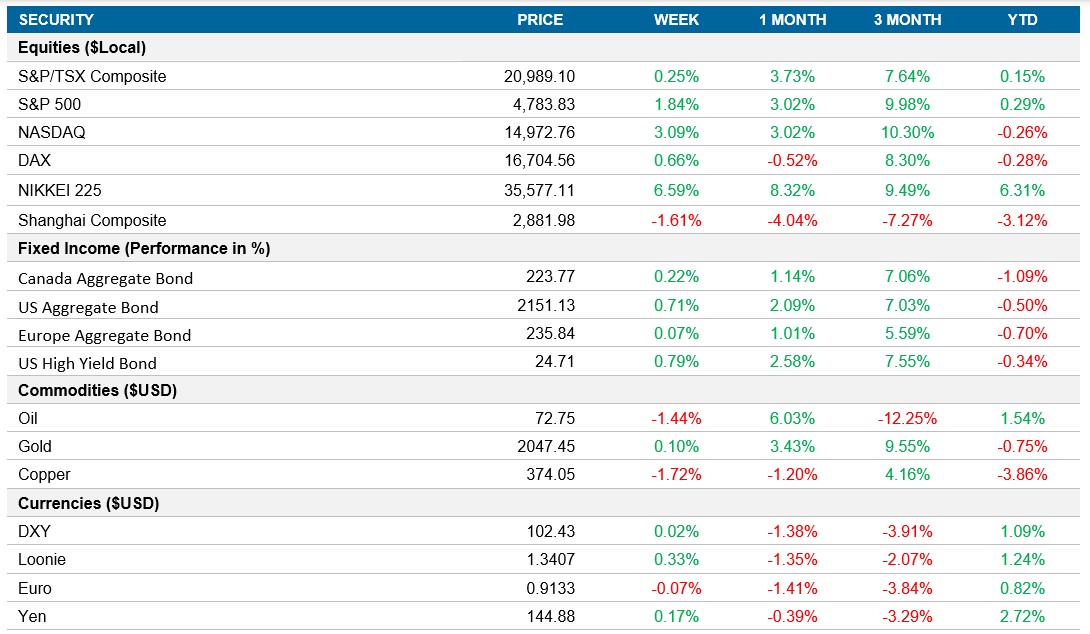

Equities: U.S. equities experienced a choppy session to the close the week, but the S&P 500 Index closed the week up nearly 2% and moved into positive territory to start the year. Mixed earnings from major banks and a surprising decline in producer prices influenced investor sentiment. Citigroup's disappointing Q4 results, coupled with Bank of America's revised 2024 profit outlook added uncertainty. Analysts emphasize the significance of 2024 guidance amid high valuations. Earnings season has officially kicked off and going forward, it will play an important role for early 2024 investor sentiment.

Fixed income: Following the producer price data, traders increased bets on a Federal Reserve rate cut in March, with an 80% probability, up from just over 50% a week earlier. The economic data followed a hotter-than-estimated reading on consumer prices, highlighting the challenges in achieving the 2% inflation target. Analysts anticipate ongoing market focus on geopolitical developments and potential impacts on inflation. The mix of economic data led to a slight increase in bond prices this week.

Commodities: Oil prices experienced a bump on Friday but closed the week down 1.4% after the U.S. and its allies launched airstrikes against Houthi rebels in Yemen. The escalation follows attacks on ships in the Red Sea, disrupting fuel and goods flow. President Biden confirmed strikes against Iran-backed Houthi targets, raising concerns about broader Middle East conflict.

Performance (price return)

As of January 12, 2024

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – U.S. Inflation Rose Above Expectations, U.S Producer Prices Fall by 0.1%

The annual U.S. inflation rate rose to 3.4% in December, surpassing market expectations, driven by slower declines in energy prices. Gasoline, utility gas, and fuel oil saw milder drops, while prices for food, shelter, and certain goods increased at a softer pace. Core inflation eased to 3.9%, slightly above expectations.

Unexpectedly, U.S. producer prices declined by 0.1% in December, consistent with November figures. Goods costs dropped due to falling diesel fuel prices, while service prices remained unchanged. Core producer prices, excluding food and energy, remained flat, with a slight increase in the headline PPI rate year-on-year.

International – U.K. Economy Contracts by 0.1%, Eurozone Retail Sales Fall in November, China’s CPI Falls

The British economy contracted by 0.1% in Q3 2023, contrary to initial estimates of flat growth. Services declined, especially in information and communications, while revisions showed slight improvements in production and construction. Household spending, business investment, and government consumption were all revised, with exports and imports lower. Q2 figures were also revised to indicate no GDP growth, raising concerns about a recession.

Retail sales in the Euro Area fell by 0.3% in November, following an upwardly revised increase in October. The decline, especially in non-food sales and online retail, contributed to the sharpest drop in retail volume since August. Germany's significant contraction offset France's modest increase. On an annual basis, retail sales marked the 14th consecutive period of contraction.

China experienced a third consecutive month of declining consumer prices in December, with a 0.3% year-on-year fall. The trend moderated from the steepest decrease in three years in November. Food prices decreased at a slower rate, while non-food inflation saw a slight uptick. Core consumer prices remained steady. For the full year, consumer prices in China rose by 0.2%, with a marginal monthly increase in December, falling below consensus expectations.

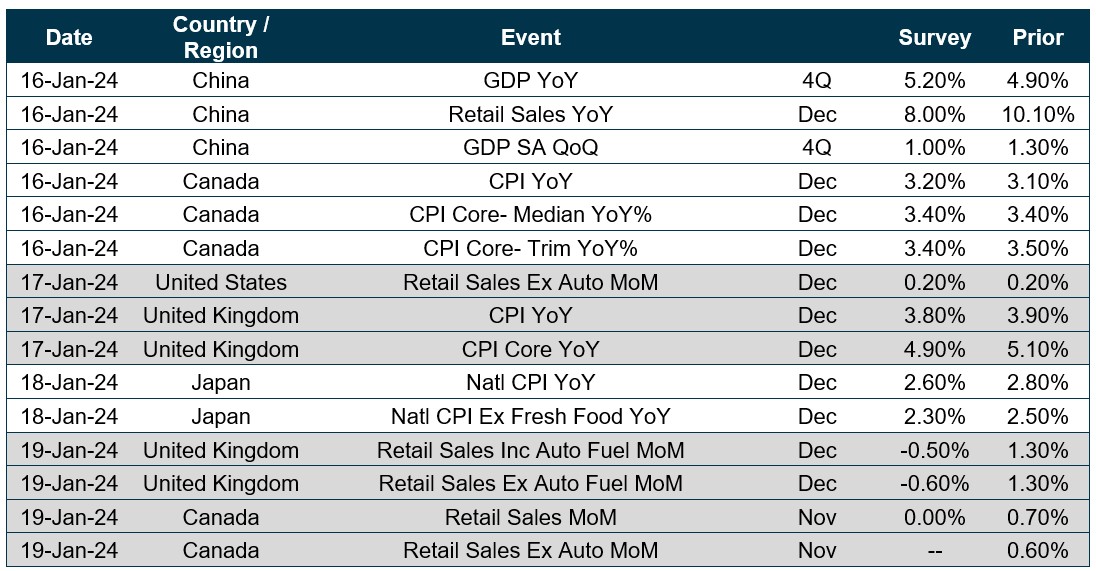

Quick look ahead

As of January 12, 2024