Weekly Market Pulse - Week ending January 26, 2024

Market developments

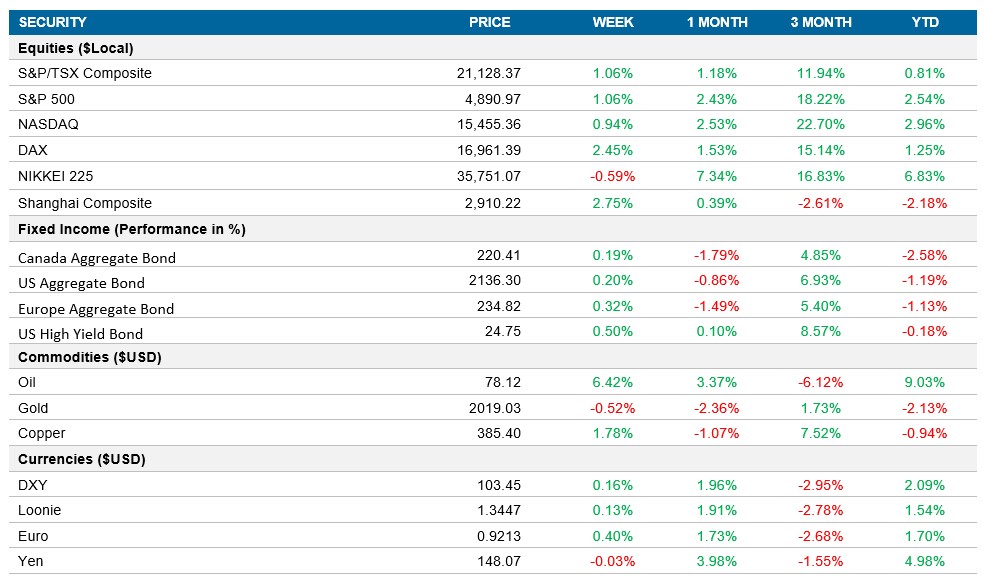

Equities: The S&P 500 notched a third consecutive weekly gain despite a slowdown in momentum. Traders are closely watching the upcoming labour market figures, with economists forecasting a rise in U.S. payrolls for January. Additionally, results from mega caps like Apple, Microsoft, and Alphabet are expected next week and will play a crucial role in shaping market sentiment. The ongoing fourth-quarter earnings season will be a key factor in determining the market's direction in 2024.

Fixed income: Mixed economic data has kept Treasuries under pressure on Wall Street, with traders betting the Federal Reserve will signal patience before considering rate cuts in 2024. Shorter maturities led bond losses as personal spending exceeded estimates, while underlying inflation slowed. Investors, though still anticipate a rate cut in Q1, and are fully pricing in a cut in May.

Commodities: Oil closed higher for the largest weekly gain since September. Factors such as lower U.S. stockpiles and the prospect of more government stimulus in China have propelled crude oil out of its recent stagnant range.

Performance (price return)

Source: Bloomberg, as of January 26, 2024

Macro developments

Canada – Bank of Canada Maintains 5% Overnight Rate Amid Inflation Concerns

The Bank of Canada has held its overnight rate at 5% for the fourth consecutive time, maintaining high borrowing costs. The central bank remains concerned about inflation risks, especially underlying price growth, and anticipates headline inflation to stay near 3% in the first half of 2024.

U.S. – Robust Growth in U.S. Business Activity Despite Challenges, Strong 3.1% Year-on-Year Growth in U.S. Economy

The S&P Global U.S. Composite PMI rose to 52.3 in January 2024, indicating a rapid increase in business activity, driven by strong service sector expansion. Despite a slowdown in job creation and a decline in new export orders, business confidence reached its highest level since May 2022.

The U.S. economy expanded by 3.1% year-on-year in Q4 2023, the strongest rise in about two years. In December, the personal consumption expenditure price index increased by 0.2%, marking the first rise in three months, with services prices up 0.3% and goods down 0.2%.

International – U.K. Composite PMI Shows Output Growth, Manufacturing Contraction, Eurozone Business Activity Declines, Optimism Improves, European Central Bank Maintains High Interest Rates, Bank of Japan Holds Key Rates, Japan Composite PMI Shows Strength in Services

The S&P Global United Kingdom Composite PMI rose to 52.5 in January 2024, indicating the strongest output growth since June. While service sector activity expanded, manufacturing production decreased. Business confidence reached the highest level since May 2023.

The Eurozone Composite PMI increased slightly to 47.9 in January 2024, showing a slower rate of business activity decline. Input costs and selling prices rose the most since May, but business optimism for the next 12 months improved, hoping for reduced cost of living pressures and lower interest rates.

The European Central Bank kept interest rates at record-high levels, emphasizing a commitment to restrictive measures to bring inflation back to its 2% target. Despite concerns about a potential recession, the ECB remains cautious about rate cuts.

The Bank of Japan kept its key rates unchanged, adjusting CPI readings for FY 2024 and lowering 2023 GDP growth forecasts. BoJ Governor Ueda emphasized maintaining support for the economy and minimizing disruptions in the event of potential rate hikes.

The au Jibun Bank Japan Composite PMI rose to 51.1 in January 2024, with services activity leading the expansion. Manufacturers continued to shrink, but new orders rose marginally. Input prices remained elevated, but output charge inflation eased to the lowest since February 2022.

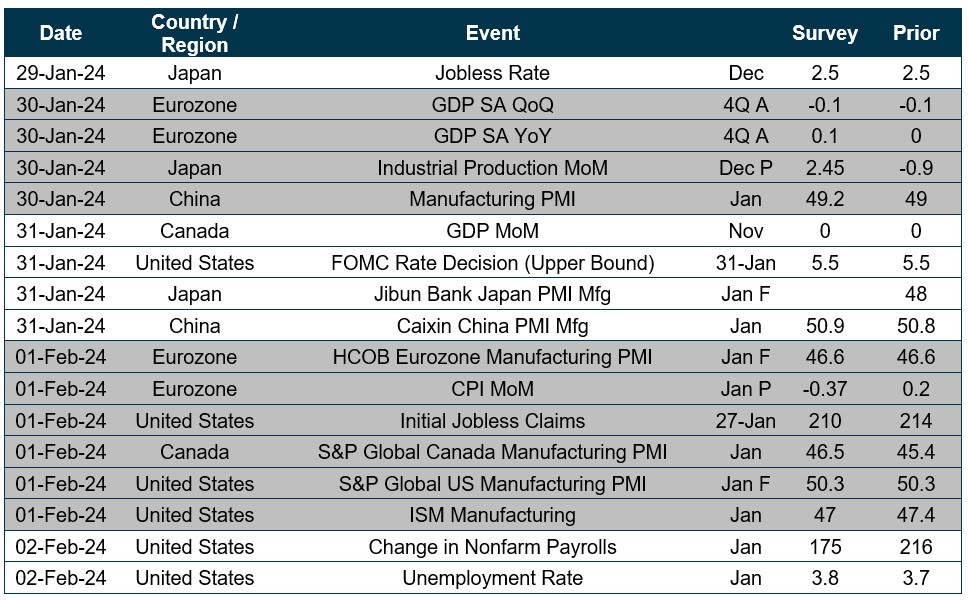

Quick look ahead

As of January 26, 2024