Weekly Market Pulse - Week ending October 13, 2023

Market developments

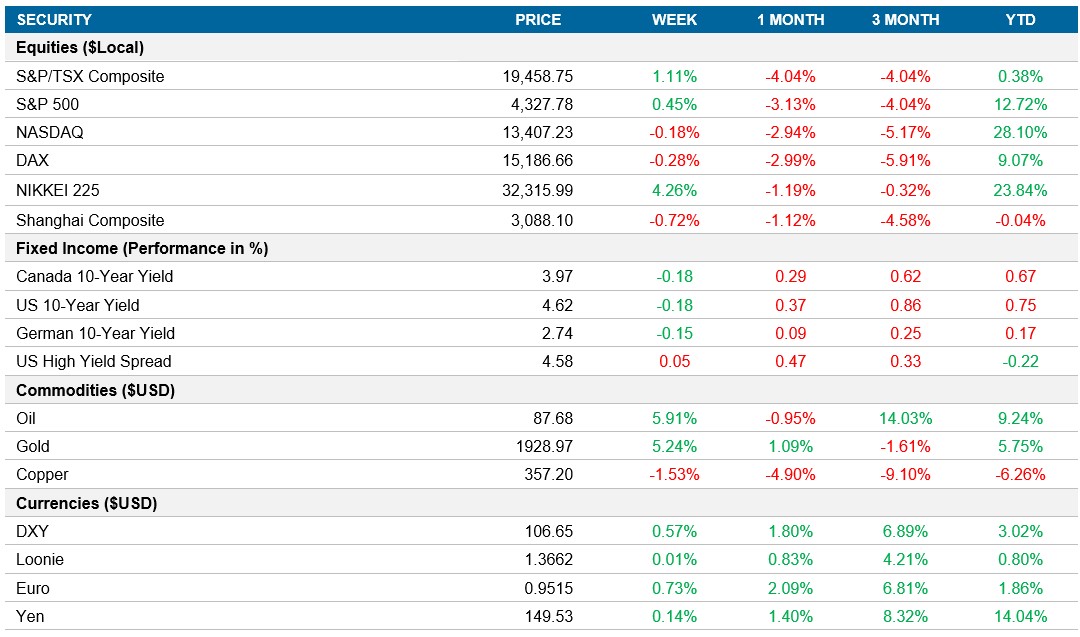

Equities: In response to signs of Israel preparing for a ground invasion of Gaza, stock prices fell as traders sought safety. Big tech stocks, represented by the Nasdaq, saw a 1.3% drop on Friday and closed slightly negative for the week, while the S&P 500 closed up 0.4%. U.S. earnings started off strong as Delta Airlines, JPMorgan, Wells Fargo, and Citigroup saw gains after reporting positive earnings. There is some unease heading into the weekend as political and economic risks could lead to a deterioration in the U.S. economy, including issues related to Russia's invasion of Ukraine, the Hamas attack on Israel, and complications in the U.S.-China relationship.

Fixed income: In the U.S. bond market, Treasuries gained across the curve on Friday, reversing a bear-steepening move from the previous day. Demand for safe havens increased due to the likelihood of the ground invasion in Gaza by Israel. The University of Michigan sentiment cooled things off a little as they now estimate a higher-than-expected level of inflation over the next year. The U.S. 10-year yields closed the week down 18bps to 4.62% while the Canadian 10-year yields closed just below 4%.

Commodities: Oil prices surged nearly 6% higher this week due to growing geopolitical tensions, particularly violence in Israel, which raised concerns about a broader regional conflict. Escalating Middle East tensions were a key driver of this oil price increase, with concerns about potential supply disruptions if the conflict spreads to involve other oil-producing nations.

Performance (price return)

As of October 13, 2023

Macro developments

Canada – No Notable Events

No notable events this week.

U.S. – U.S. Inflation Rate Holds Steady at 3.7% in September

Summary: In September 2023, the U.S. inflation rate remained at 3.7%, defying expectations of a slight decrease. This was due to a softer decline in energy prices, with other categories also experiencing slower inflationary pressures. Food, new vehicles, apparel, medical care commodities, shelter, and transportation services saw softer price increases. Used cars, trucks, and medical care services costs continued to decline. The core CPI, excluding food and energy prices, slowed to 4.1%, its lowest reading since September 2021.

International – British Economy Grows 0.2% in August, China's Consumer Prices Unchanged in September, Japan's Producer Prices Rise by 2.0% in September

The British economy grew by 0.2% in August 2023, in line with market estimates and rebounding from a 0.6% contraction in July. The growth was driven by a 0.4% increase in services output, with professional, scientific, and technical activities and education leading the way. However, consumer-facing services saw a 0.6% contraction. Production output and manufacturing declined, while construction output contracted by 0.5%. Over the three months to August, the GDP increased by 0.3% across all sectors.

China's consumer prices remained unchanged in September 2023, disappointing market expectations of a 0.2% gain. Persistent deflationary pressures in the Chinese economy raised concerns about the sustainability of its economic recovery. Food prices dropped significantly, particularly pork prices, while non-food inflation accelerated. Transport prices fell at a slower rate. The annual core inflation rate, excluding food and energy prices, remained at 0.8% in September. On a monthly basis, the CPI rose by 0.2%.

Producer prices in Japan rose by 2.0% year-on-year in September 2023, slowing from the previous month and falling short of market forecasts. This marked the lowest producer inflation since March 2021. The slowdown was observed in various sectors, including transport equipment, beverages & food, petroleum & coal, and more. However, some sectors, like production machinery and business-oriented machinery, saw cost increases. On a monthly basis, producer prices fell by 0.3%, the first drop in 3 months.

Quick look ahead

As of October 13, 2023