Weekly Market Pulse - Week ending September 23, 2022

Market developments

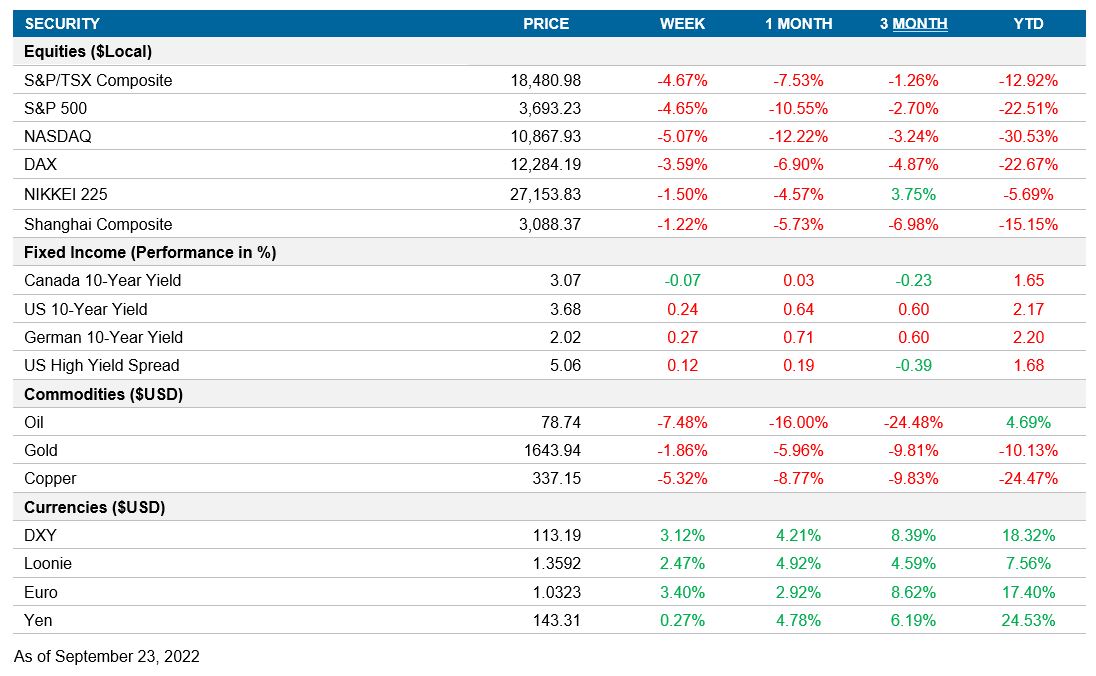

Equities: The selloff driven by the recent hawkish Fed projections negatively affected stock markets. The S&P 500 reached an intraday low for the year, in line with the risk-off sentiment in the global equity markets.

Fixed income: On Friday, the U.S. Treasury 10-year yield achieved an intraday level of 3.8%, the highest level since 2011. The surge in yields is another market reaction based to the Fed's recent hawkish messaging.

Commodities: The West Texas Intermediate Crude Oil ended the week under $80 a barrel, which marks four weeks in a row of price declines. The main driver for this drop is the projected decrease in energy demand. Central banks reinforced this view after calling for further interest rate hikes that dampened the outlook for global growth.

Performance (price return)

As of Sept 23, 2022

Macro developments

Canada – CPI decreases

No notable releases for the week.

U.S. – Fed increases reference rates, Manufacturing PMI decreases

As expected, the Federal Open Market Committee (FOMC) raised the U.S. reference rate by 75 bps, increasing it from 2.50% to 3.25%. In addition, the FOMC also presented its economic projections that guide how the Federal Reserve members see the future of the American economy. The FOMC revised the expected unemployment upwards to 4.4% for 2023 and 2024 (above the 4.0% longer-run unemployment). The FOMC also increased the expected rate path, seeing the reference rate at 4.4% at the end of 2022, 4.6% for 2023, and 3.9% for 2024. This upwards correction of the economic projections was interpreted as a hawkish signal that reinforces the idea that the Fed is determined to bring inflation back to 2%, even if it has a cost on the shorter-term growth of the economy.

S&P Global released September’s Manufacturing PMI Index data, which increased to 51.8. This month, the index surprised to the upside, being higher than the previous reading of 51.5 and above the market consensus of 51.0. Even though the index improved, it is the second-lowest reading since July 2020.

International – U.K.’s Central Bank increases rates; Japan’s Central Bank Meeting maintains reference rates; Euro Area’s PMI decreases

In line with market expectations, the Bank of England decided to hike U.K.’s reference rate by 50 bps, increasing it to 2.25% from 1.75%. Of the nine-member committee, three favoured a 75-bps increase, while 1 preferred a more modest 25-bps hike. On the fiscal side, Kwasi Kwarteng (Chancellor of the Exchequer) announced a £161 billion package that included a series of tax cuts and regulatory reforms. The government announced these measures in an attempt to promote growth in the U.K. economy. However, given that the monetary and fiscal policies are going in opposite directions, the market assumes this might bring higher inflation in the long term. Consequently, the U.K yield curve shifted upwards.

The Bank of Japan kept the policy rate unchanged at -0.1%, even though the latest 3% YoY inflation reading was above its 2% target. Additionally, the Central Bank sent a dovish signal by extending the deadline for application for its Covid-19 lending facility by up to six months.

S&P Global published September’s Eurozone Manufacturing PMI survey. The index continues with its negative trend reaching a 27-month low of 48.5. This value was below the 48.8 market consensus and continues to hint that the Eurozone economy is decelerating. From the Eurozone, Germany is the country that is facing the harshest conditions, with figures not observed (besides the pandemic) since the global financial crisis.

Quick look ahead

Canada – No notable releases

No notable releases for the week.

U.S. – No notable releases

No notable releases for the week.

International – Japan’s Jobless Rate (September 29), China’s Manufacturing PMI (September 29); Germany’s CPI (September 29) and Euro Area’s CPI (September 30).

The Ministry of Internal Affairs and Communications will release Japan’s unemployment rate. July’s reading of 2.6% was virtually unchanged from the previous month and in line with market expectations. The market expects the Japanese labor market to improve slightly with a jobless rate of 2.5%.

The China Federation of Logistics and Purchasing will publish September’s Manufacturing PMI. In the previous release, the index grew to 49.4 from 49.0, beating the market survey of 49.2. This month, the market consensus is that the Chinese economy will continue to slow, with an unchanged index at a contraction territory of 49.4.

On Thursday, the German Federal Statistical Office will release the August CPI data. The following day Eurostat will release CPI data of the Eurozone. These indicators will be crucial to understanding if inflation is decelerating as a result of the contractive policy of the ECB. The market expectation is that Germany’s YoY inflation will rise from 7.9% to 9.5% and that the Eurozone CPI will grow at a rate of 9.7% (vs 9.1% in the previous month).