Monthly Market Insights - Data and opinions as of July 31, 2021

Investors look past COVID concerns

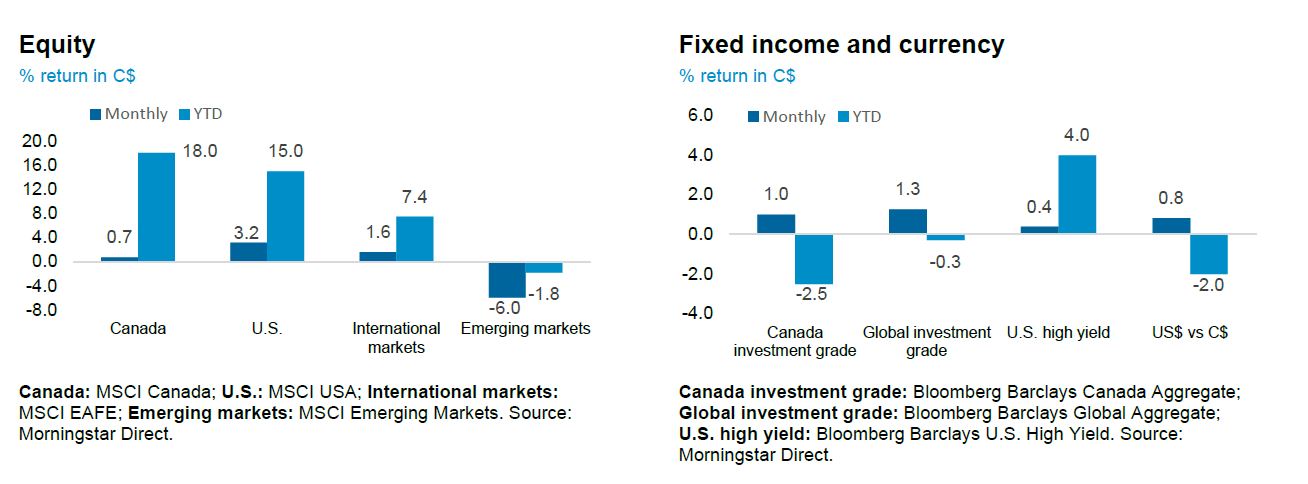

Markets continued to rally in July despite many countries experiencing a renewed wave of COVID-19, especially with a rise in Delta variant cases. Investors remained upbeat despite coronavirus concerns, looking past rising case counts and continuing to anticipate economic reopenings, as hospitalizations have not followed the same trend relative to case counts as have been reported in previous waves. The focus remains on central banks and markets attempting to pre-empt monetary policy changes. Bonds gained in July as longer-term yields fell, even as inflation readings gained in June. Investors continued to warm to the idea that inflation is transitory and should normalize over the next 12–24 months. The U.S. Federal Reserve’s acknowledgement of economic progress hints that the central bank is moving closer toward tightening. However, when considering the Fed’s dual mandate of maximum employment and price stability, lagging employment recovery is expected to keep the federal funds rate low for now.

The NEI perspective

Corporate results beat expectations. Stocks rose on the back of a strong Q2 earnings season. To date, the percentage of S&P 500 Index companies beating EPS and revenue estimates are at record highs. Q2’s year-over-year earnings growth is expected to be 85%.

Low rates may persist. Bond prices also rose as investors looked past peak economic and earnings growth, peak inflation, and peak monetary and fiscal stimulus. The European Central Bank’s new inflation framework and lagging U.S. employment recovery could mean lower-for-longer interest rates.

Chinese equities dip on regulatory shifts. Changing regulations negatively impacted Chinese stock prices, from the online payments sector to private tutoring companies. These changes have affected high-profile companies such as Alibaba, Tencent, and Didi.

As of July 31, 2021

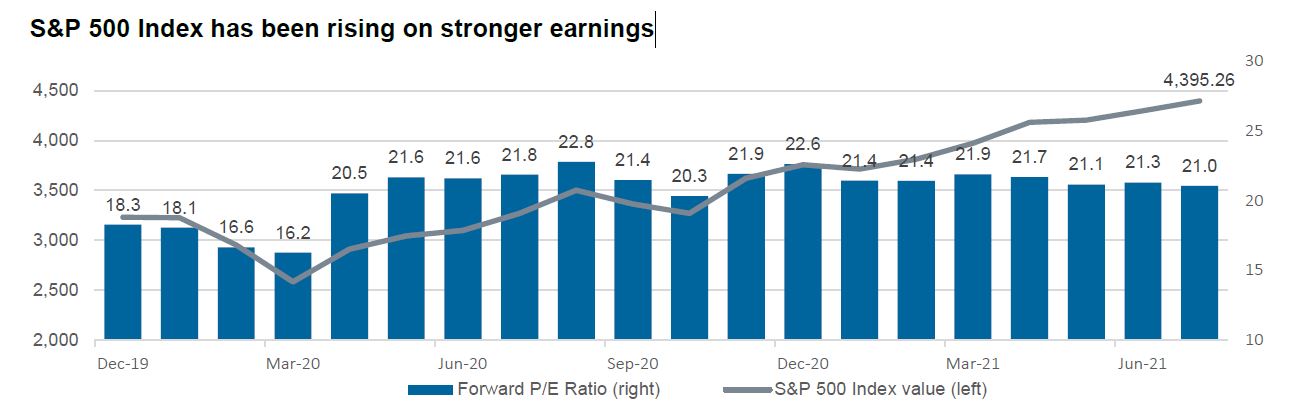

Earnings growth backing up equity valuations

Stocks continue to trend higher into record territory, but rebounds in corporate earnings and decreases in bond yields have eased concerns around equity valuations. While the S&P 500 Index has extended its rebound from pandemic lows by another 17% so far this year, valuations continued to edge lower. For example, stock prices can be evaluated relative to profits, a measure known as price-to-earnings (P/E) ratio. Entering the pandemic, the “E” in this ratio fell sharply with the global shutdown. Still, investors looked past the pandemic, largely thanks to vaccines and accommodative monetary and fiscal policy, driving equity prices to all-time records and leading to substantial P/E expansions.

However, forward-looking P/E ratios have continued to improve, despite higher prices, thanks to stellar earnings (nudging future guidance higher). Approximately 59% of companies in the S&P 500 Index have reported earnings (as of July 30), and 88% have beaten already-high earnings expectations and 88% have beaten revenue expectations. The aggregate year-over-year earnings growth rate stands at 85%, the highest level since Q4 2009. High growth rates might be misleading due to 2020’s lows, but the bull case is that valuations can revert lower to their historical averages, even with higher stock prices, if strong earnings continue. The bear case, however, is that stock prices are “priced to perfection,” and some good earnings seasons might not be indicative of the long term, leaving stocks vulnerable to corrections.

Source: Bloomberg, Statistics Canada. Data as of July 31, 2021