Weekly Market Pulse - Week ending May 13, 2022

Market developments

Equities:

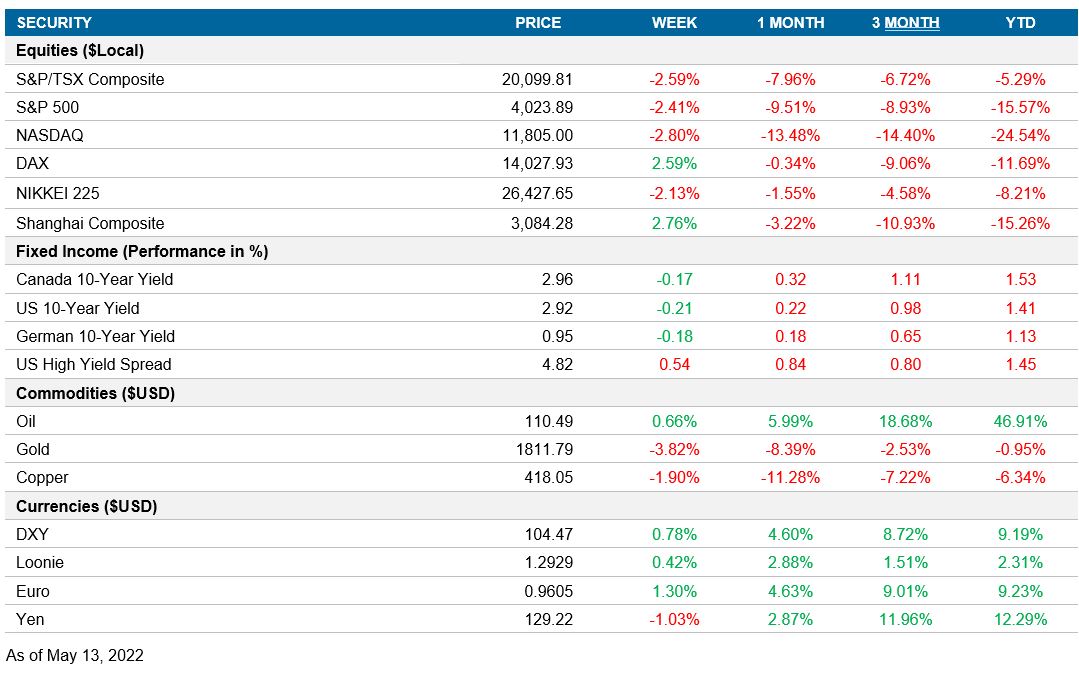

U.S. markets fell for a sixth consecutive week, with the S&P 500 Index down nearly 5% prior to the partial relief rally on Friday. The U.S. consumer price index, although declining on a year-over-year basis, came in stronger than expected and continued to indicate strong upward price pressures. U.S. Federal Reserve speakers this week indicated the central bank would stay on an aggressive hiking path to counter stubbornly high inflation. Uncertainty in China amid the lockdowns also weighed on investor sentiment.

Fixed income:

Yields declined for the week amid the risk-off sentiment, even as the Fed and the European Central Bank remain on their tightening paths. The Fed indicated multiple 50 basis point hikes to come, and the ECB said hikes could start as early as July and sees the possibility of rates above zero by the end of the year.

Commodities:

Copper prices slumped further on global demand fears amid a weaker economic backdrop. Gold prices also declined as policy tightening remains well on track and the U.S. dollar strengthening added to pressures.

Performance (price return)

As of May 13, 2022

Macro developments

Canada

A quiet week for Canada with no notable data releases.

U.S. – CPI rises; Consumer sentiment declines

CPI rose 0.3% seasonally adjusted in April. Inflation continued to post a solid increase even as energy prices fell in the month as gasoline declined 6.1%. Goods prices rose 0.3% in the month, driven by food surging 0.9%. Services prices rose 0.8%, as shelter prices rose 0.6% and airline fares surged 18.6%. On a year-over-year basis, CPI slowed to 8.3% from the 8.5% peak in March.

Consumer sentiment declined further in May, as the University of Michigan Consumer Sentiment Index declined to 59.1, from 65.2 in April. Declines were broad based, as consumers viewed their financial situation as worse and buying conditions for large purchases declined on higher prices.

International – China’s exports slow; Chinese CPI accelerates; German sentiment remains depressed; U.K. GDP contracts in March

Chinese exports rose 3.9% year over year in April, compared to an increase of 14.7% year over year in March, reflecting a slowdown from lockdowns in the country.

Chinese CPI meanwhile accelerated to 2.1% in April, from 1.5% in March. Prices of food rose during the month, likely associated with panic buying amid lockdowns. Fresh vegetable prices rose 24.0% year over year, while pork prices continued to fall, plunging 33.3%. Fuel prices also rose for the month. The increase in Chinese CPI has largely been commodity driven. Core CPI, excluding food and energy, had declined to 0.9% year over year from 1.1%.

The Germany ZEW Economic Sentiment Index rose slightly but remains negative at -34.3 in May, from -41.0 in April. The outlook for Germany remains negative. Restrictions in China as well as expectations for interest rate increases from the ECB are weighing on sentiment in Germany.

UK GDP slowed 0.1% in March, with contractions in services and goods production. For the first quarter, GDP grew 0.8%. Growth in the quarter was driven largely by capital investments rising 5.4%. Household spending had risen 0.6%, while net exports dragged as exports declined 4.9% and imports surged 9.3%.

Quick look ahead

Canada – Housing starts (May 16); CPI (May 18)

Canadian housing starts for the month of April will be of interest. The housing sector is very sensitive to interest rates and will be one of the best indicators of the real economy as monetary policy tightens.

CPI for April will also be closely watched by markets. CPI for the month is set to increase another solid 0.5%, but should nonetheless show a decline year over year as seen in the U.S.

U.S. – Empire Manufacturing Survey (May 16); Retail sales and industrial production (May 17)

The Empire State Manufacturing Survey will provide a first glimpse of business activity for May. New business growth had shown signs of slowing in April, and as usual we will watch for signs of supply chain challenges.

Retail sales could have increased 0.5% in April. Automobile sales are likely to see an increase in the month, though lower gasoline prices could have pushed sales into decline. Spending on services is likely to continue to gain as we head into the summer, though the only indication will be restaurants as other services are not included in the reading.

Industrial output should see a solid increase of 0.4% in April.

International – China’s industrial production and retail sales (May 15); Japan’s GDP (May 17); Japan’s CPI (May 19)

Internationally, the focus will be on Asia. China will release a slew of data, which are expected to slow a significant slowdown as the country continues to battle COVID outbreaks and lockdowns. Economies and firms globally are concerned on the downstream supply chain effects of these lockdowns.

Japanese GDP is expected to have contracted 1.8% in the first quarter according to consensus estimates. Activity was restricted in the quarter on a renewed COVID wave weighing on consumption.

Japanese CPI meanwhile is expected to have surged to 2.5% year over year in April, from 1.2% in March. A large portion of the increase will be due to base effects as telecommunications rates stabilize, but there should still be upwards pressure from commodities such as energy and food.