When and how to start investing

When should I start investing?

If you’re asking, “when should I start investing?”, the short answer is as soon as you can. Time is your greatest opportunity to grow your money and to meet your goals. The earlier you start to invest, the more time you’ll have to accumulate and benefit from compounding returns (when your investment income is continually re-invested). The longer you’re invested, the easier it is to ride out any short-term downturns in the market. In general, you want to be able to hold your investments as long as possible, and that means you won’t want to access them.

To help you stay invested longer, it’s critical that you have some savings to act as an emergency fund (most financial experts recommend having three to six months’ worth of expenses put away). That way, if you lose your job or have unforeseen financial expenses, you won’t have to access your investments and be forced to sell an asset at a time when the market is down. So, before you start to invest significantly, ensure you have accumulated some savings to handle your shorter-term needs.

If, after you’ve set aside sufficient emergency funds, you’ve got money to put away that you don’t need for the next five years or more, it’s probably time to start investing.

How do I start investing?

Step 1: Set your goals

It’s hard to achieve financial goals if you never set them. If you’re just starting out, set smaller, achievable investing goals and as you hit those milestones, set larger goals. It’ll boost your confidence.

Your goals should:

- Have a purpose. You may have several different financial goals – buying a car, putting aside a house down payment, funding your child’s education, or saving for retirement. Each may require a different strategy depending on the dollar value needed and investment time horizon.

- Be specific. It’s difficult to achieve a goal that is vague. Be specific about the dollar amount you’re working toward, as well as the time you have to invest. In other words, think about how much you want to invest, and when you’ll need to access the funds. This could impact what you invest in and the amount of risk you can tolerate.

- Be achievable. Set smaller goals that you can achieve. If you frequently fail to achieve the goals you set, you could become discouraged. Set yourself up for success.

Step 2: Choose your investments

The type of investment – the “asset”, the “security”, or the “product” – you choose should be aligned with your goals, investment time horizon, and risk tolerance.

Many investment types – stocks, bonds, ETFs, mutual funds, etc. – come with some level of risk, especially over the short term. But the longer your investment time horizon, the longer you have to recover from downward fluctuations in your asset.

For example, if you are 35 years old and your goal is to save for retirement, your investment time horizon is long term. So, if you decided to invest in stocks, which generally carry more risk than other common investments, you would have the benefit of time to ride out any dips in the stock market. Conversely, if you’re investing toward a home you plan to purchase in the next year or two, it might be prudent to avoid a higher-risk investment. If the investment value dips just when you need to access your money, you’d end up with less money than anticipated just when you need it.

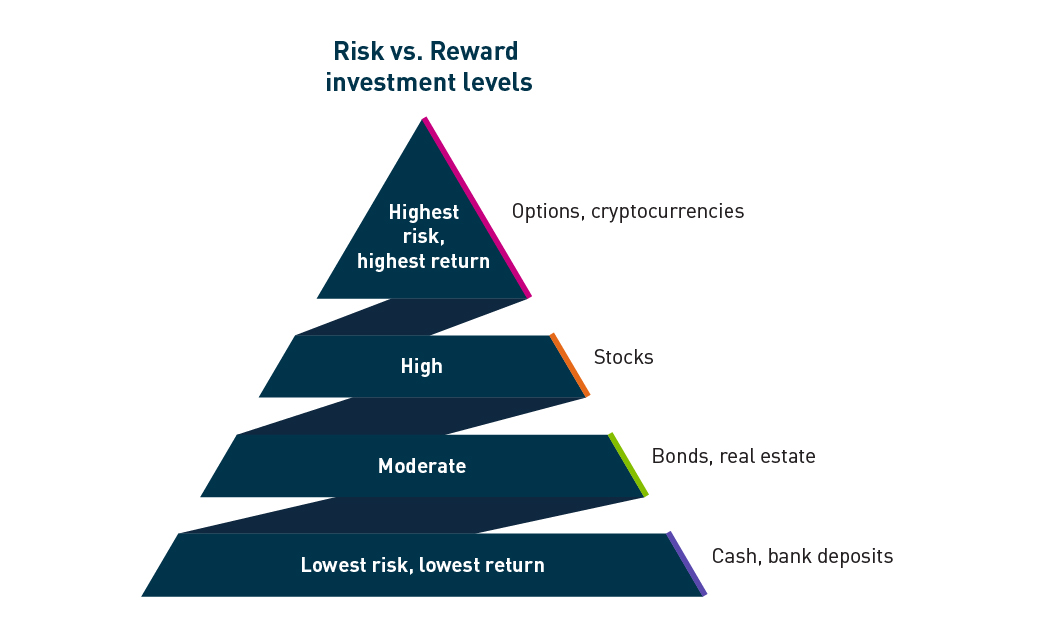

Risk v Reward

To narrow down your individual investment choices, you’ll also need to do a little bit of research. Qtraders have access to all sorts of resources to help them find and evaluate investments, from screening tools and technical research to analyst reports and company performance metrics. Qtrade Direct Investing™ also provides Portfolio Analytics tools to help you build your investment portfolio, test investment scenarios, and score the health of your portfolio across key dimensions.

Step 3: Support your goals

Many people don’t start investing early because they believe you need a lot of money to invest. You really don’t. Most investing accounts don’t require a minimum investment, and there are a number of ways to help boost the amount of money you invest. A little at a time is all you need to start – and you can get on the path to reaching your financial goals.

Automatic contributions/deposits. Most accounts allow you set up a regular deposit, whereby you automatically transfer a specific amount from your chequing account to your investing account (weekly, bi-weekly, monthly, etc.). You could set it up to coincide with your payday, and then you don’t have to think about it. Accumulate cash in your investing account and be ready to make an investment trade/purchase when the time is right.

You can also make automatic contributions to Qtrade Guided Portfolios, an online service that helps you invest based on your financial goals. Every time you make a deposit to your account, your money is automatically invested in your portfolio.

Systematic contributions to a mutual fund. Some investment products, such as mutual funds, allow you the flexibility to automatically purchase units with each regular, automated transfer.

Dividend reinvestment plans (DRIP). These programs allow you to automatically reinvest the cash dividends received from your investment to purchase more shares. You benefit from compounding returns over time, and you accumulate more shares.

New investing products and technology advances have made it easier than ever to start investing – in a way that fits your goals, your comfort with risk, and the amount of time you want to spend on it. You don’t need a lot of money to get started. And if you’re a beginner, you might want to start small as you learn and gain confidence as an investor. Learn more about how to start investing with A beginner’s guide to online investing.

Online brokerage services are offered through Qtrade Direct Investing, a division of Aviso Financial Inc. Qtrade and Qtrade Direct Investing are trade names or trademarks of Aviso Wealth Inc. and/or its affiliates.

Aviso Wealth Inc. ('Aviso') is a wholly owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited. The following entities are subsidiaries of Aviso: Aviso Financial Inc. (including divisions Aviso Wealth, Qtrade Direct Investing, Qtrade Guided Portfolios, Aviso Correspondent Partners), and Northwest & Ethical Investments L.P.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes, and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. Information, figures, and charts are summarized for illustrative purposes only and are subject to change without notice. All investments are subject to risk, including the possible loss of principal.