Weekly Market Pulse - Week ending February 9, 2024

Market developments

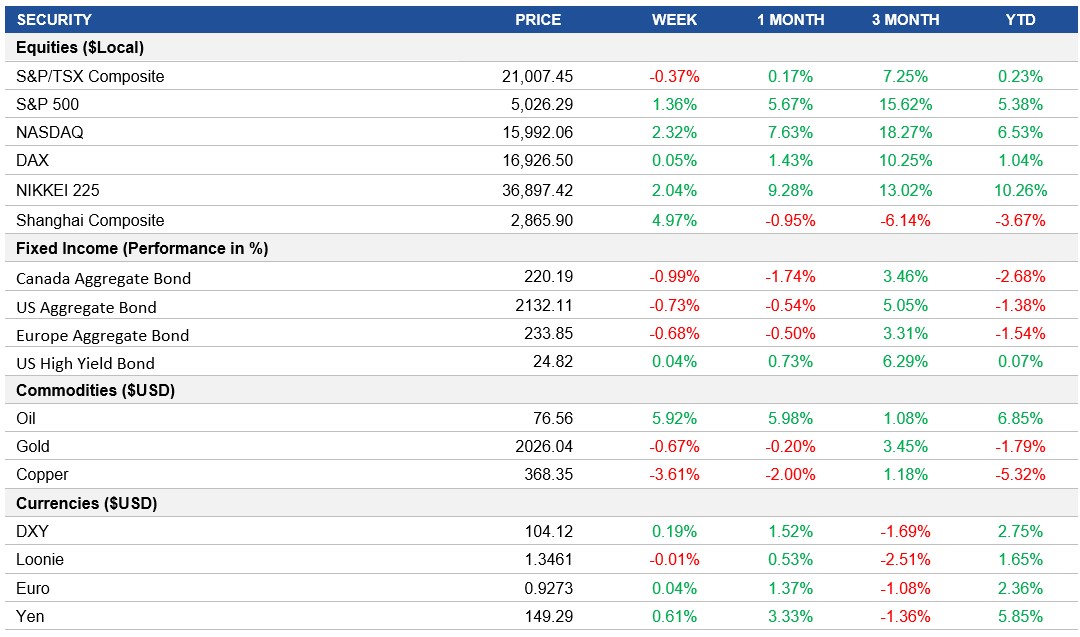

Equities: The S&P 500 reached a record high, heading towards its fifth consecutive week of gains, driven by optimism around a soft landing and excitement over artificial intelligence. Technology stocks led the surge, with the Nasdaq 100 rising and Nvidia Corp. threatening to become the fourth most valuable U.S. company. The outlook for corporate profits sustained the stock market's strength, with earnings season surpassing expectations. Around 80% of S&P 500 companies have exceeded forecasts, prompting analysts to raise projections. Wall Street anticipates fourth-quarter earnings to grow 6.5% from the previous year, a significant increase from earlier projections.

Fixed income: Investors were reassured by a government report showing steady inflation, which contributed to gains in bonds fueled by the expectations of rate cuts. Despite overheating concerns, analysts remain cautiously optimistic, expecting a soft landing for the U.S. economy and potential Fed rate cuts later in 2024.

Commodities: Oil prices rose for the week due to diminishing hopes of a cease-fire in the Middle East, with Israel gearing up to strike southern Gaza, heightening geopolitical tensions. Technical indicators also suggested continued strength in oil markets. Additionally, in the U.S., the gasoline premium over crude reached its highest level since September following a decline in nationwide inventories.

Performance (price return)

Source: Bloomberg, as of February 9, 2024

Macro developments

Canada – Canadian Unemployment Rate Declines in January 2024

Canada's unemployment rate dropped to 5.7% in January 2024, defying expectations of an increase, easing concerns about the impact of higher interest rates. The decrease, the first in over a year, led to a reduction in the unemployed population by 19,200, with 37,300 new jobs being added to the economy. However, the participation rate slightly declined to 65.3%.

U.S. – U.S. Unemployment Benefit Claims Dip, Labor Market Slowing

In the U.S., unemployment benefit claims decreased by 9,000 to 218,000, slightly below estimates, but remaining above the recent average. Continuing claims eased by 23,000, indicating a slowing but still strong labor market. However, the four-week moving average increased, with mixed trends in different states.

International – China's Consumer Prices Decline in January 2024

China experienced a significant decline in consumer prices, with the CPI falling by 0.8% year-on-year, the most in over 14 years. This marked the fourth consecutive month of decline, with food prices dropping at a record pace. However, non-food inflation moderated, and core consumer prices increased by 0.4% year-on-year, indicating some stability in underlying inflationary pressures.

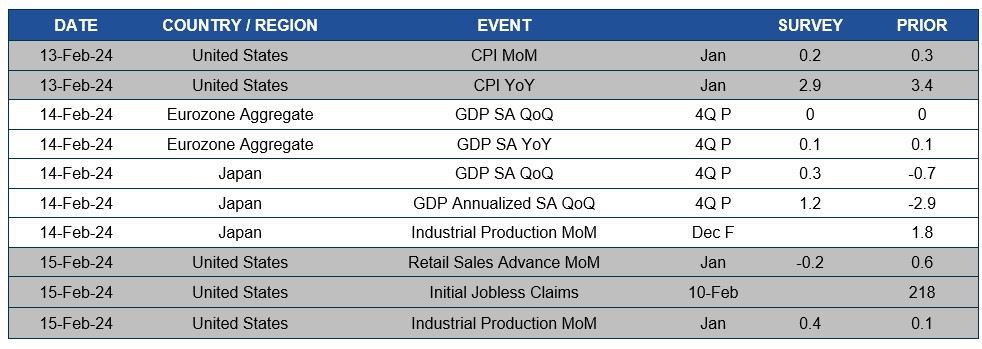

Quick look ahead

As of February 9, 2024