Weekly Market Pulse - Week ending March 17, 2023

Market developments

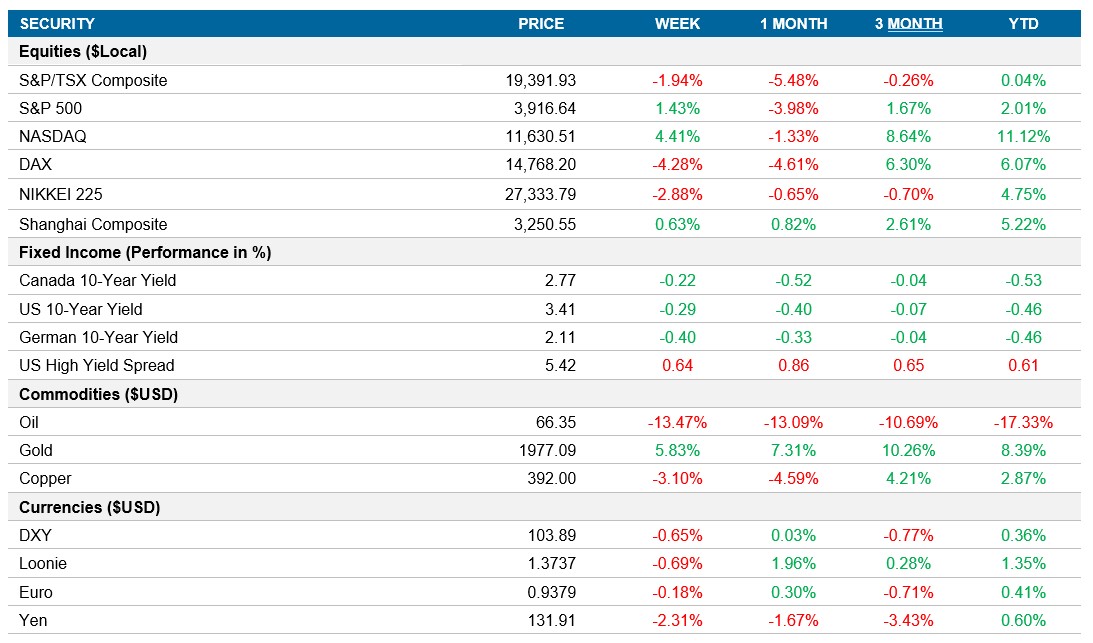

Equities: On Friday the U.S. market gave back some of the weekly gains as major banks put restrictions on trading with Credit Suisse and First Republic dragging the regional banking sector index lower. First Republic got a show of support from the big U.S banks on Thursday but fell over -30% on Friday when sentiment shifted more negative as investors (most notably Bill Ackman) questioned if it would be enough to stop contagion. Next week the Fed decision will be in focus as the market is split on whether the Fed will continue to raise rates. Despite the concerns in the banking sector and the potentially bleaker growth outlook, investors shifted to high quality tech. The combination of investors searching for companies with fortress balance sheets and strong cashflows, paired with lower rates expectations drove the Nasdaq to its best week of the year, closing 4.4% higher.

Fixed income: The short end of the U.S curve was volatile this week as the U.S. 2yr whipsawed by at least 20bps and closed more than 40bps lower as traders shifted rate-hike bets, while the U.S 10yr closed near 3.4%. As expected, the ECB did raise rates by 50bps this week and made it clear that the stress on the banking industry as well as the economic data will determine future rate decisions. Up next is the Fed decision as they battle between financial stability and high inflation. Ahead of the FOMC next week, we’ve seen expectations for peak rates come down dramatically and cuts being priced to begin this summer.

Commodities: Oil had its worst week of 2023 this week, closing near $66 (down -13.5%) as recession fears were amplified by the collapse of the Silicon Valley Bank and the struggles at Credit Suisse. Supply was pushed higher this week as Russia’s output was higher than expected despite the sanctions. The imbalance in supply and demand paired with uncertainty in the banking sector drove oil lower and gold higher this week.

Performance (price return)

As of March 17, 2023

Macro developments

Canada – No notable releases

No notable releases this week

U.S. – Headline inflation falls to 6%, PPI drops to 4.6% and retail sales comes in below expectations

The annual inflation rate in the U.S. dropped to 6% in February, the lowest since September of 2021 and matching market expectations. Food prices, energy and fuel oil all decelerated and used cars continued to decelerate. On the other hand, electricity and shelter continued to rise. The Producer Price Index for final demand decelerated, increasing by 4.6% compared to 5.7% a month earlier and below expectations of 5.4%, adding to signs that inflation may be cooling in the U.S.

Retail sales were down -0.4% MoM last month, below forecasts of 0.3%, following the 3.2% surge seen in January. Food services, furniture stores and auto dealers saw the largest decreases, where increases were seen in non-store retailers and health.

International – ECB raised key rates by 50bps, unemployment rate in the U.K. was 3.7% and China retail sales jumps to 3.5%

The ECB raised interest by 50bps, in line with expectations and pushing borrowing costs higher to battle inflation. The ECB now sees inflation averaging 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025

The unemployment rate in the U.K. came in at 3.7% from November to January, unchanged from the previous three months and below market expectations of 3.8%

China’s retail sales jumped by 3.5% this month, in line with market expectations and the strongest data point since August 2022. The recovery in consumption after lifting Covid restrictions was seen in the bounce back for oil products, jewelry, clothing, cosmetics and personal care, while automobiles saw a steep decline.

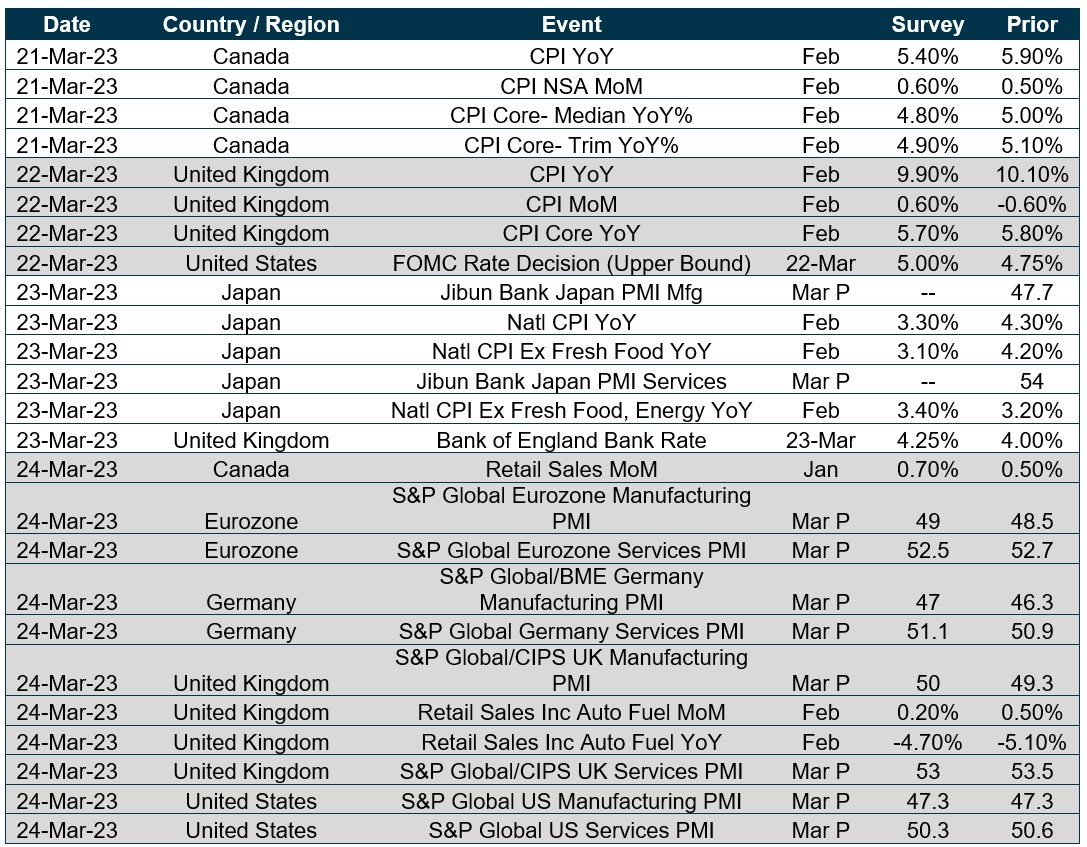

Quick look ahead

As of March 17, 2023