Weekly Market Pulse - Week ending March 8, 2024

Market developments

Equities: Stocks retreated after a rally that drove markets to multiple records this year, with traders weighing mixed jobs data. The S&P 500 erased weekly gains due to weakness in the technology sector and the Nasdaq also fell this week, closing 60bps lower as companies like Tesla and Broadcom declined. Concerns about overbought conditions and potential divergences in momentum led to worries about a pull back. In Canada, Materials and Utilities have been driving the TSX returns this month as these sectors have benefited from falling rates, helping the Canadian market to close some of the YTD performance gap compared to the U.S.

Fixed income: Reports showed the economy continued to add jobs without spurring wage surges, potentially allowing the Fed to achieve a soft landing. Treasuries fell and bond indices rose, with traders pricing in a quarter-point Fed cut in June as Fed Chair Jerome Powell indicated confidence in starting to lower interest rates soon.

Commodities: Oil prices eased lower despite a brief outage on North America’s Keystone pipeline. Oil has traded in a tighter range this year, with prices confined to their narrowest range since September 2021. OPEC+ cutbacks and tensions in the Middle East have been balanced by increased supply from non-OPEC producers like the U.S. Concerns about China's growth have also impacted oil prices.

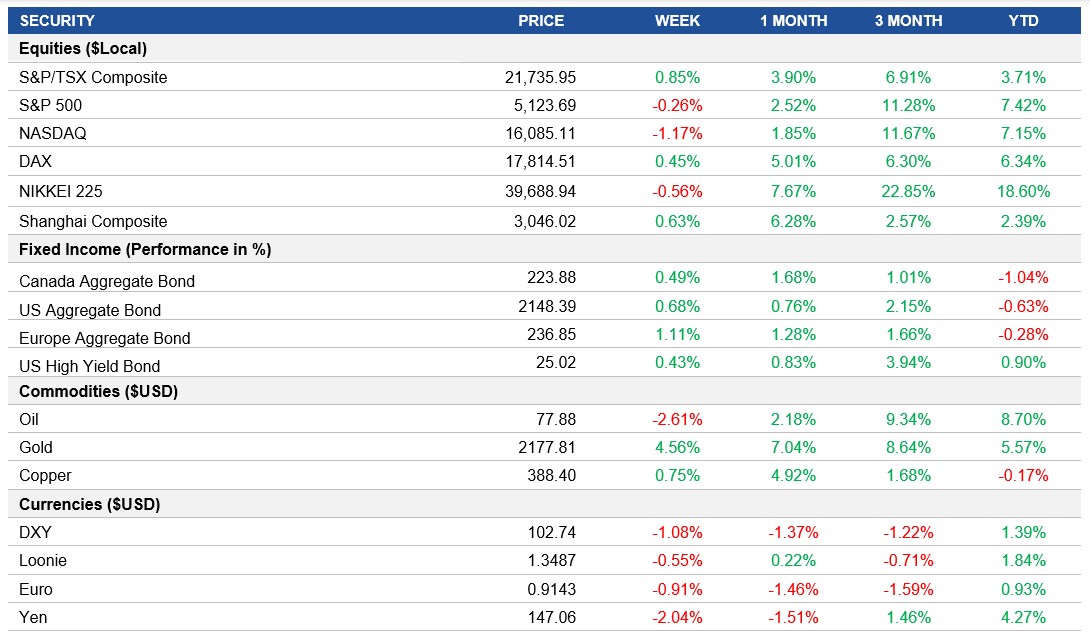

Performance (price return)

Source: Bloomberg, as of March 8, 2024

Macro developments

Canada – Canada Holds Rates at 5% and Unemployment Rose to 5.8%

The Bank of Canada maintained its overnight rate target at 5% and committed to normalizing its balance sheet to address inflation concerns. Policy makers aim to continue quantitative tightening until observing sustained easing in core inflation, which currently stands at 3% to 3.5%. GDP growth remains weak, below potential, and employment growth lags population growth, with signs of easing wage pressures. Macklem emphasized the need for more time before considering rate cuts to ensure inflation aligns with the 2% target.

Canada's unemployment rate rose to 5.8% in February 2024, with an increase of 35,800 in the unemployed population. Despite adding a net 42,000 jobs, the jobless rate remained relatively stable compared to previous months.

U.S. – Unemployment Rose to 3.9%, U.S. Adds 275K Jobs in February

The U.S. unemployment rate increased to 3.9% in February 2024, surpassing market expectations of 3.7%, with 334,000 more people unemployed. Labour force participation remained steady at 62.5%, while the employment-population ratio was relatively unchanged at 60.1%.

The U.S. economy added 275K jobs in February, exceeding forecasts and showing growth in various sectors like healthcare, government, food services, and transportation.

International – ECB Maintains Interest Rates, China’s Private Sector Continues to Grow

The European Central Bank maintained historically high interest rates amid concerns over a potential recession and persistent inflationary pressures. Projections indicate a downward revision in growth forecasts for 2024 but anticipate a gradual economic uptick in subsequent years.

China's private sector activity continued to grow for the fourth consecutive month with mild cost pressures and marginal increases in selling prices. Confidence levels dipped as policymakers focused on stabilizing growth and market confidence amidst ongoing economic challenges.

Quick look ahead

As of March 8, 2024