Why You Should Consider Going Global With Your Investments

By Pat Chiefalo, CFA, Managing Director, BlackRock | mai 26, 2015FR We have curated articles and videos from select third parties including research agencies, media and product providers. As an independent online brokerage Qtrade Direct Investing does not provide advice and this information is not a personal recommendation to trade.

Canadians tend to have a home bias within their investment portfolios, but that's not great for diversification. Pat Chiefalo discusses why investors should consider going global.

Most people would agree that the simple rule that everything in good in moderation is a good principle to follow. When it comes to investments, Canadians tend to follow a different tune. This is particularly relevant for Canadian investors, where the domestic market that is heavily concentrated in just three sectors: financials, energy and materials.

A basic principle to a sound investment portfolio is diversification – which is especially relevant to Canadian investors given our concentrated market; a theme I plan to explore over my next few blog posts.

In BlackRock's annual Global Investor Pulse survey, Canadians expressed a strong bias to domestic funds; the research revealed that Canadian investors hold approximately two-thirds of their investments in Canadian stocks and bonds[1]. As an investment professional, this rings some alarms. We can appreciate that Canadian investors can be quite bullish on Canada, however it's important to recognize the added risk this type of tilt can represent and the important role of diversification.

Diversification can be achieved in a number of ways

- Country: As a starting point, this could mean simply looking outside of Canada (or your domestic market) and gaining exposure to international funds.

- Sector: By broadening your holdings beyond Canada, investors could benefit from sector diversification. In a country where three sectors dominate, we are underweight consumer discretionary, industrials and health care, three sectors that had strong performance over the past year; which highlights one of the risks of being concentrated and less diversified.

- Market Capitalization: Going one step further, there are also opportunities to diversify in the types of companies that you're holding, from small-, mid-, to large cap securities.

- Asset Classes: When bonds rise, equities tend to fall, and vice versa. To ensure that investors are properly balancing out their risk, they should consider holding a mix of equities and bonds in proportion to their risk appetite.

Why it matters?

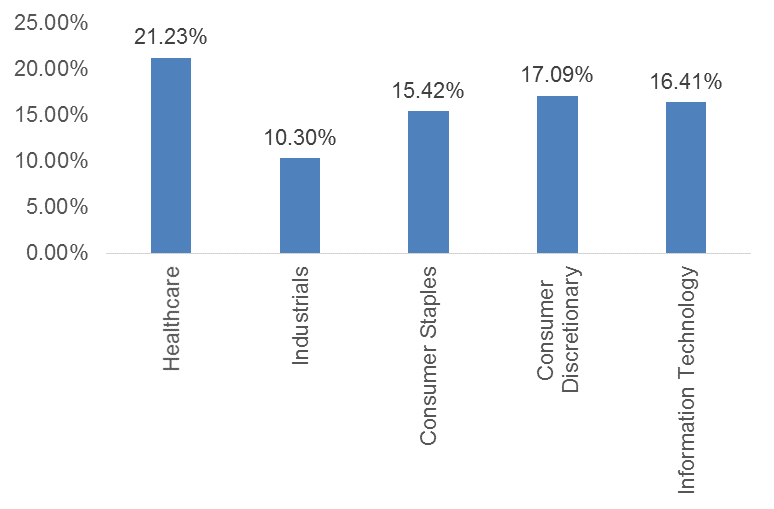

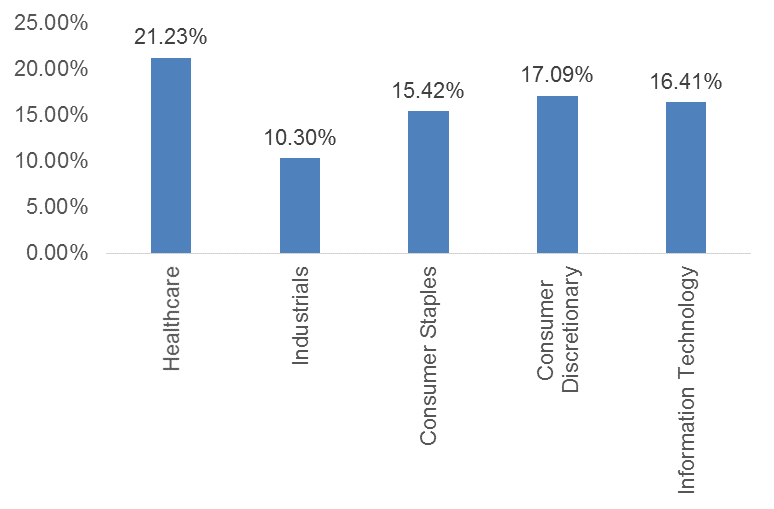

A well-rounded portfolio for most investors should include international equities and sectors that are underrepresented in Canada. As the chart below illustrates, health care, industrials and consumer discretionaries had a strong performance on the global equity markets last year, which helped the MSCI EAFE IMI Index outperformed the S&P/TSX Composite Index by 5.37 % over the last 12 months. If you were underrepresented in those sectors – which Canada is – you would have missed out on the rally. If you held a significant portion of your portfolio in Canadian exposures, the drop in energy prices and the negative performance in materials would have had significant impact on your overall investment performance.

[1] BlackRock Global Investor Pulse Survey, 2014.

MSCI EAFE IMI Index Select Sectors 1 Year Performance

Source: Bloomberg. One year returns to April 30, 2015

S&P TSX Composite Index Select Sectors 1 Year Performance

Source: Bloomberg. One year returns to April 30, 2015

During the period from 2003 to 2009 Canadian equity markets handily outperformed the U.S. by more than 2x annualized over the period or 11% for the S&P/TSX vs. 5.5% per year for the S&P 500. The Canadian equity market benefited from the strength in the commodities and when this cycle turned, so did the returns with the U.S. From 2010 to the end of 2014, the S&P 500 returned 15% annualized over the period compared to 7.5% for the S&P/TSX Composite. Investors with heavily concentrated portfolios can see periods of outperformance, but, this often requires an element of market timing, which introduces another element of risk usually reserved for more tactical plays.

While the message of diversification isn't a novel one, it's particularly relevant to Canadian investors given our concentrated market and bears repeating as we continue to see a strong home bias in Canadian's investment portfolios. Over the next few posts I'm going to dig deeper into how Canadians can start thinking about diversification, where we're seeing potential opportunities, how to access international markets effectively, and strategies to consider when looking to manage against market volatility.

Source: Bloomberg, BlackRock.

iShares® et BlackRock® sont des marques déposées de BlackRock, inc. et ses affiliés (« BlackRock »), et sont utilisées sous licence. BlackRock n'émet aucune déclaration ou garantie concernant tout produit ou service offert par Qtrade Investissement direct. BlackRock n'a aucune obligation ou responsabilité reliée à l'opération, à la commercialisation, à la négociation ou à la vente de tout produit ou service offert par Qtrade Investissement direct.

Le contenu et les recherches d'un tiers ne sont pas préparés ni approuvés par Qtrade Investissement direct. Qtrade Investissement direct ne représente ni ne garantit, de façon explicite ou implicite, le contenu d'un tiers et se déclare non responsable de toute erreur ou omission comprise dans ces documents, et décline toute responsabilité pour toute perte financière résultant de l'utilisation de ces rapports, de leur contenu, ou de la dépendance à ceux-ci.