Will you be ready to retire by age 65?

Getting an early start on saving for your retirement can make a difference. While retirement planning will involve some trade-offs, the earlier you start, the better position you should be in when the time comes to retire.

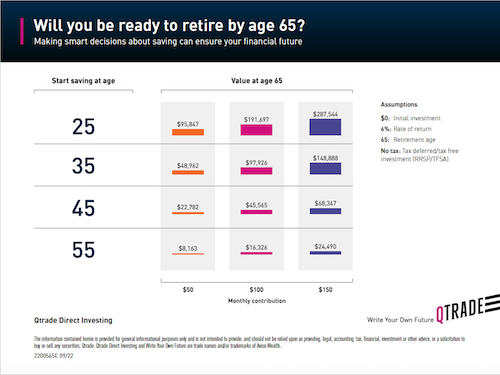

Essentially, the earlier you start saving and investing – along with the benefit of compounding – the more you’ll have when you decide to retire. It may feel like a monthly $50 contribution is just a drop in the proverbial bucket, but with 40 years of time to invest at that level, you could end with ten times the amount you’d have if you only had 10 years to invest.

For an enlarged view, download the infographic.

It’s all in the numbers

Your resulting nest egg at retirement could be drastically different, depending on when you start to invest. To illustrate, let’s do a little bit of math, and start with a few basic assumptions.

In our examples, we’ve assumed that:

- You’ll have a rate of return of 6% annually

- You’ll make monthly contributions until reaching the age of 65

- Your investments will be in tax-deferred/tax-sheltered accounts (RRSP or TFSA)

Based on these assumptions, if you started investing $50 a month at age 25, you’d end up with $95,847 at age 65. Compare that with your $50 contribution per month from the age of 45 to 65, which would give you only $22,782 – a difference of $73,065.

What’s the difference? If you start to invest at age 25, you have 40 years to benefit from compounding. If you start at age 45, you’ve shortened your time to benefit from compounding to just 20 years.

Check out our chart above to see how your age and the amount you contribute can affect the value of your investments at retirement.

What impacts the value of your savings at retirement?

- When you start investing. The earlier you start saving, the longer you’ll have to accumulate wealth for retirement. Having a longer investment time horizon also gives you more flexibility to ride out market dips.

- Your rate of return. This will generally fluctuate over time and with market conditions. The higher the return, the more capital you’ll have when you retire.

- The amount you invest. Increasing the amount you save and invest can give you more capital when you retire. Even an extra $50 a month can make a big difference over time.

- When you retire. Retiring later could mean more capital at retirement. An extra couple of years gives you more time to contribute to your nest egg, and means that you’ll withdraw the funds later.