You never stop planning.

We never stop progressing.

That’s the Qfactor.

You bring your knowledge and your experience.

We help make the most of your investments.

- Our innovative platform and tools

- Top-notch client service and education resources

- An uncompromising commitment to improvement

Together, we can achieve anything. That’s the Qfactor.

Your unrelenting drive. Our industry-leading tools.

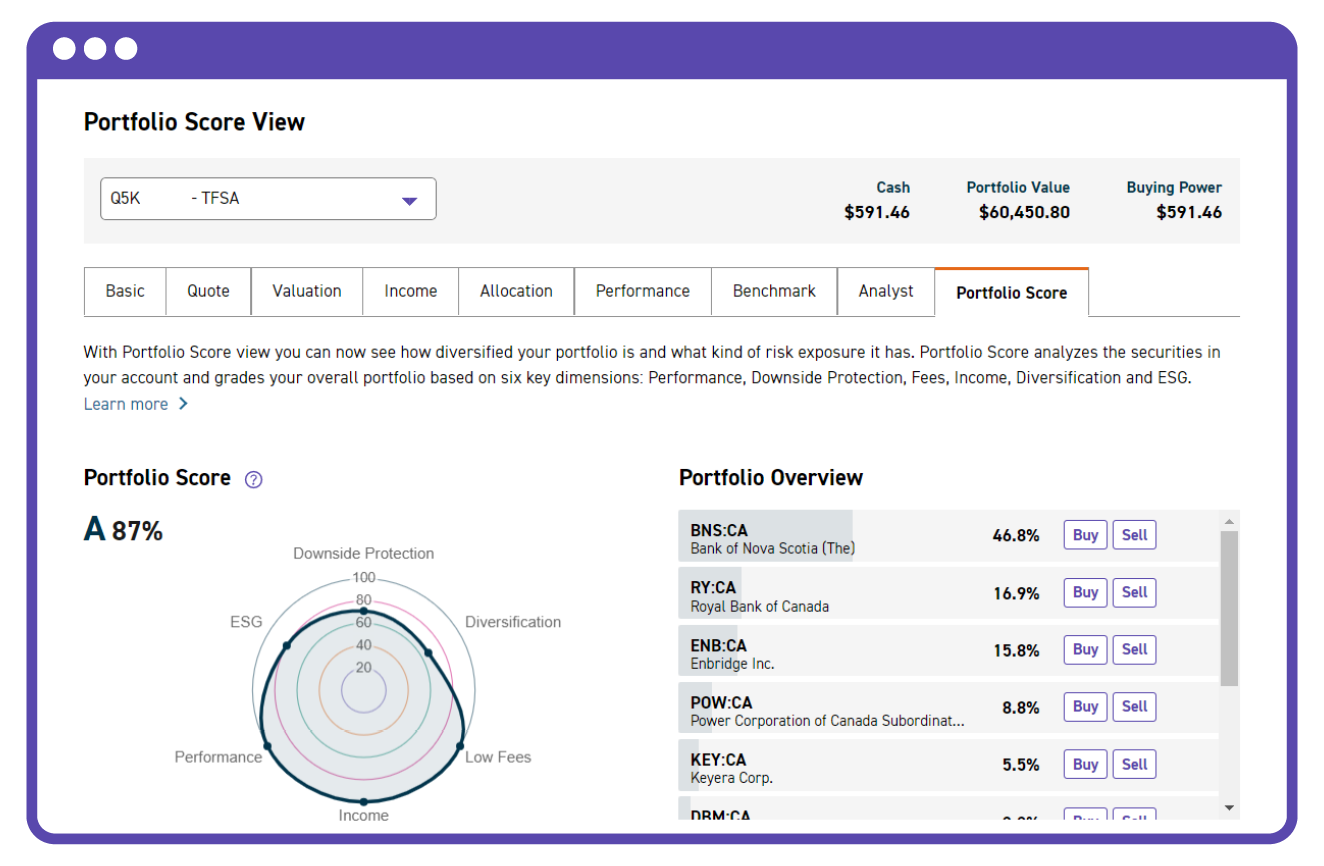

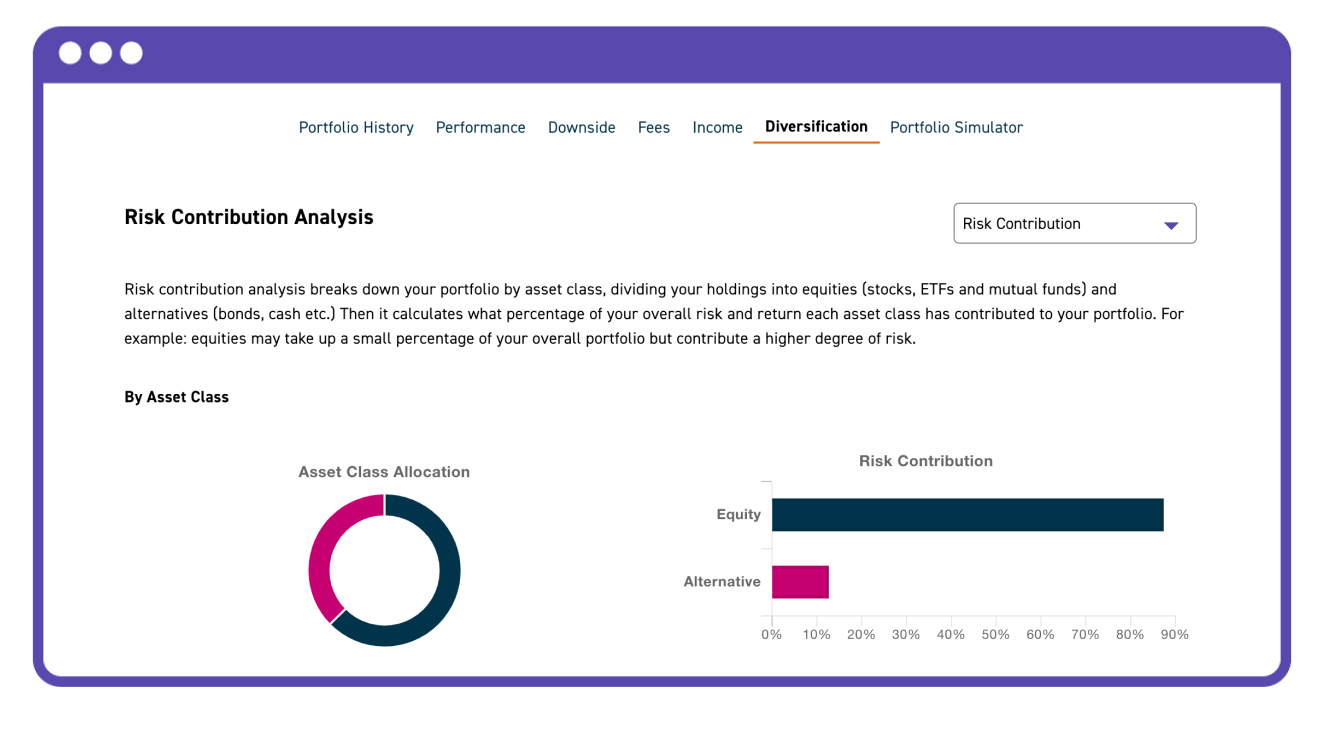

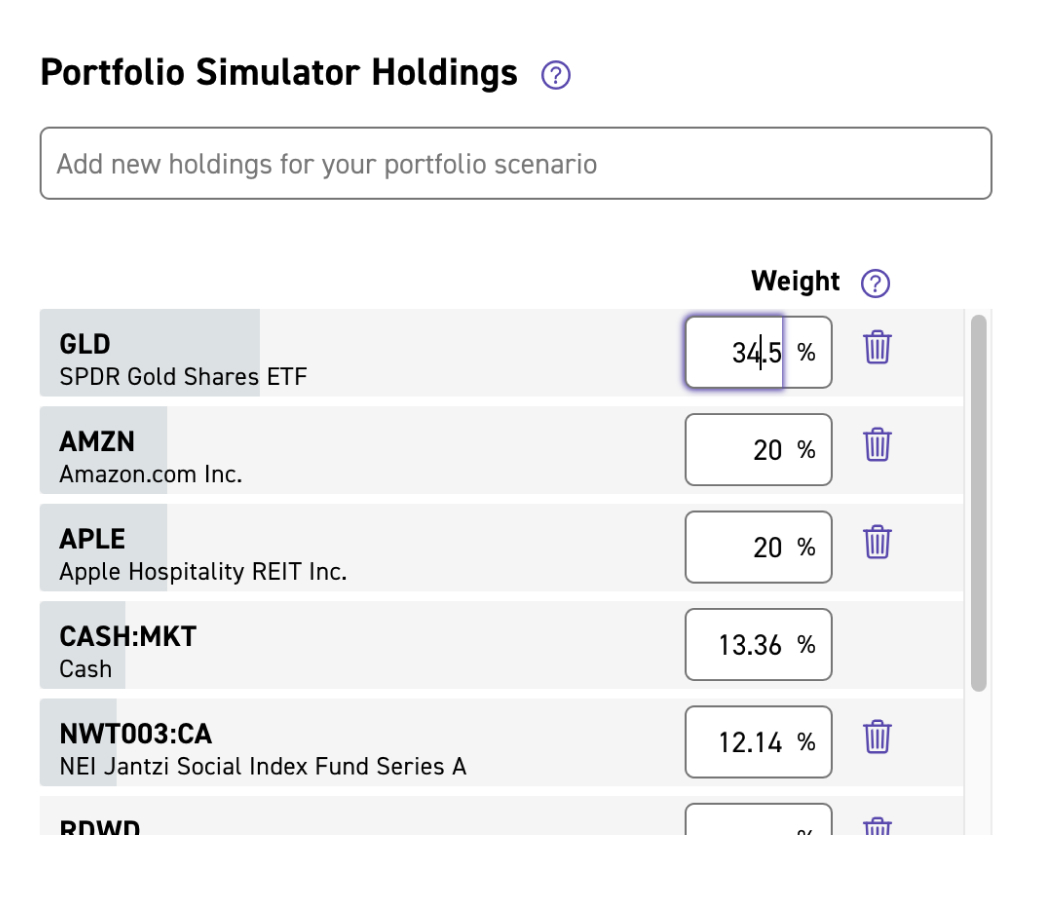

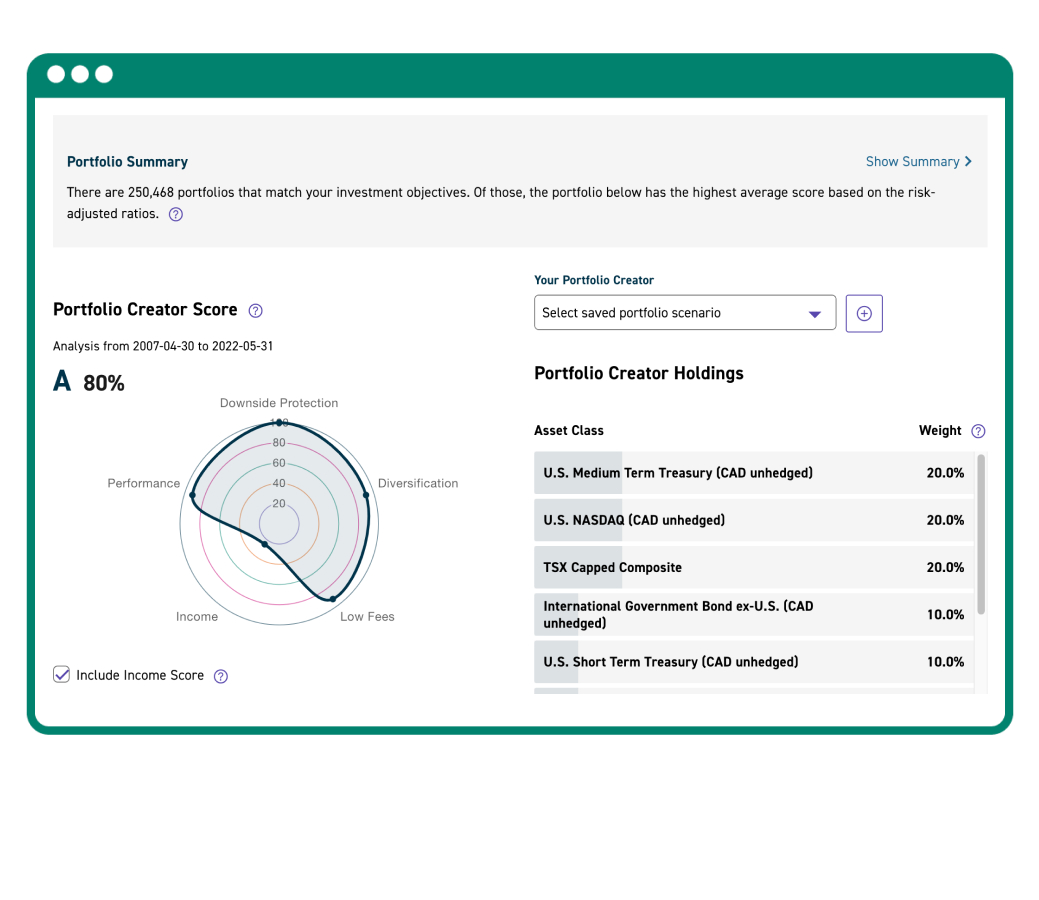

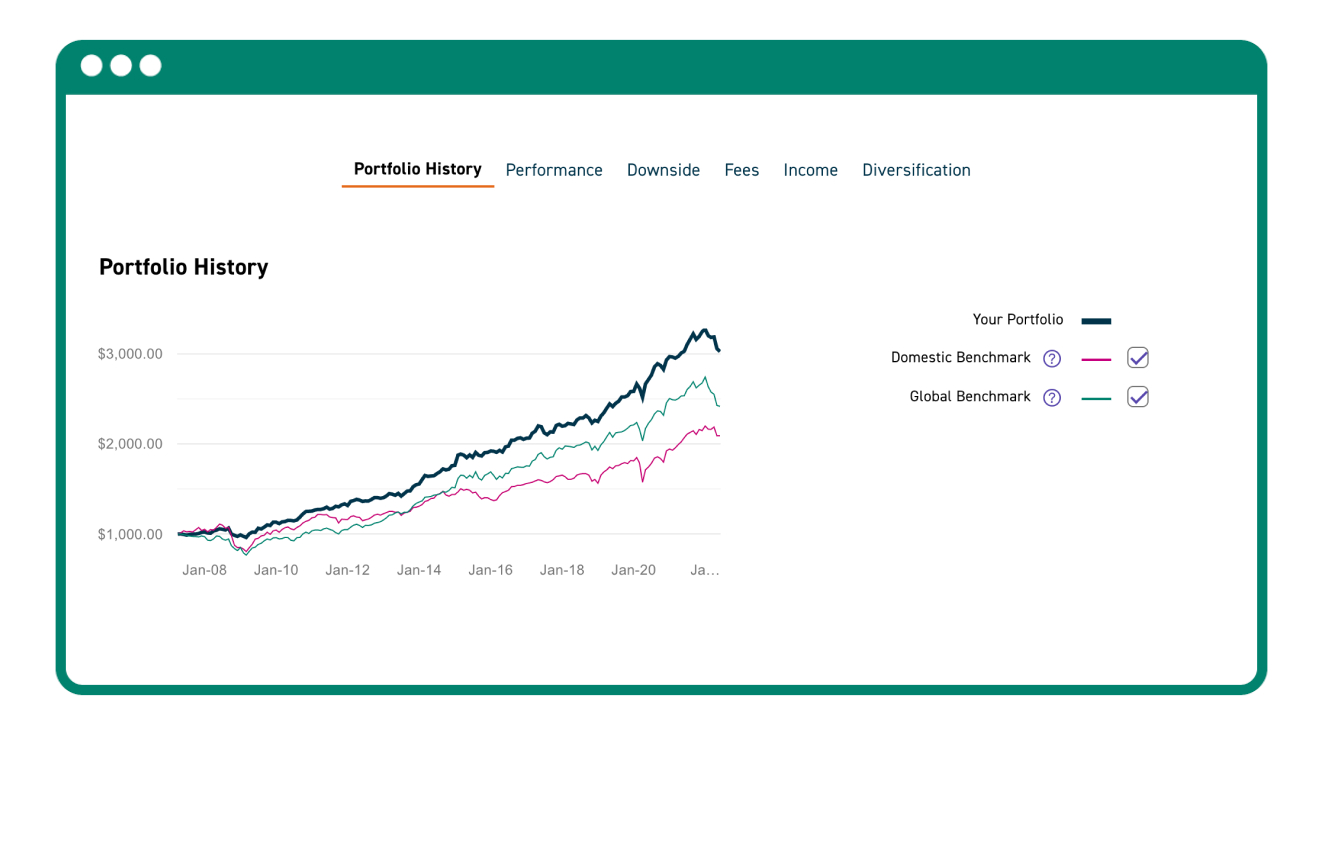

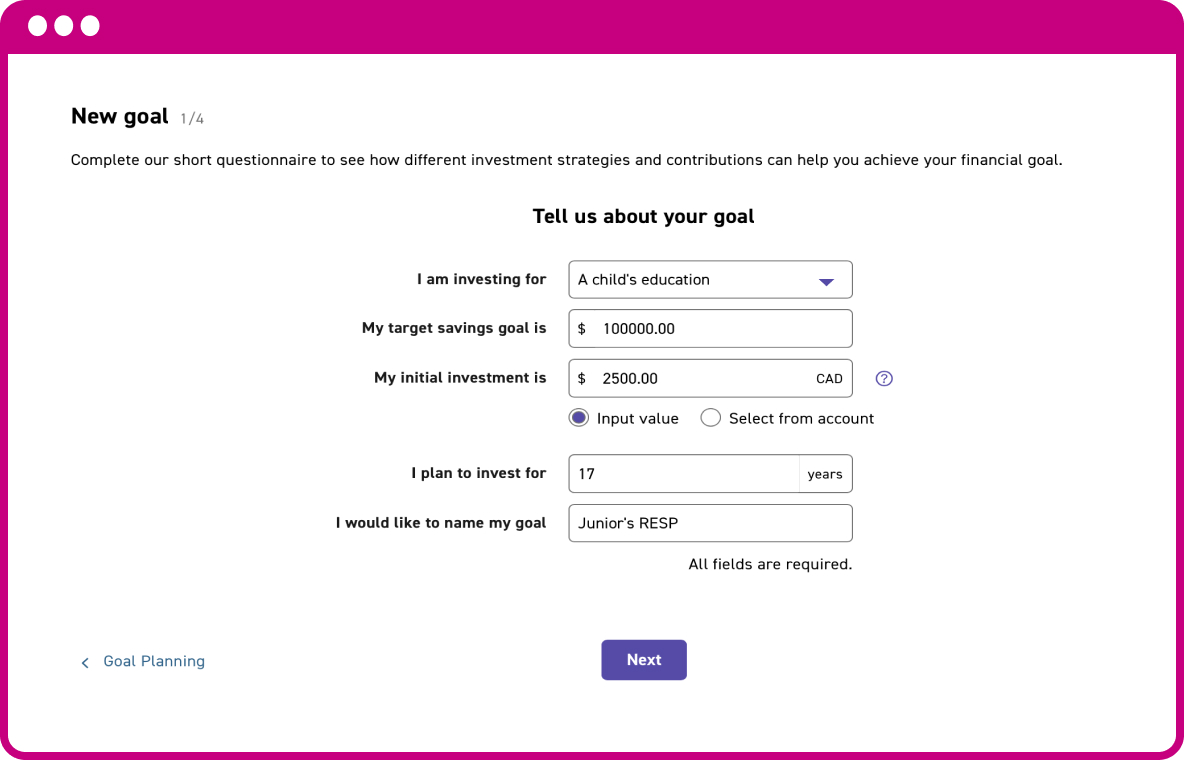

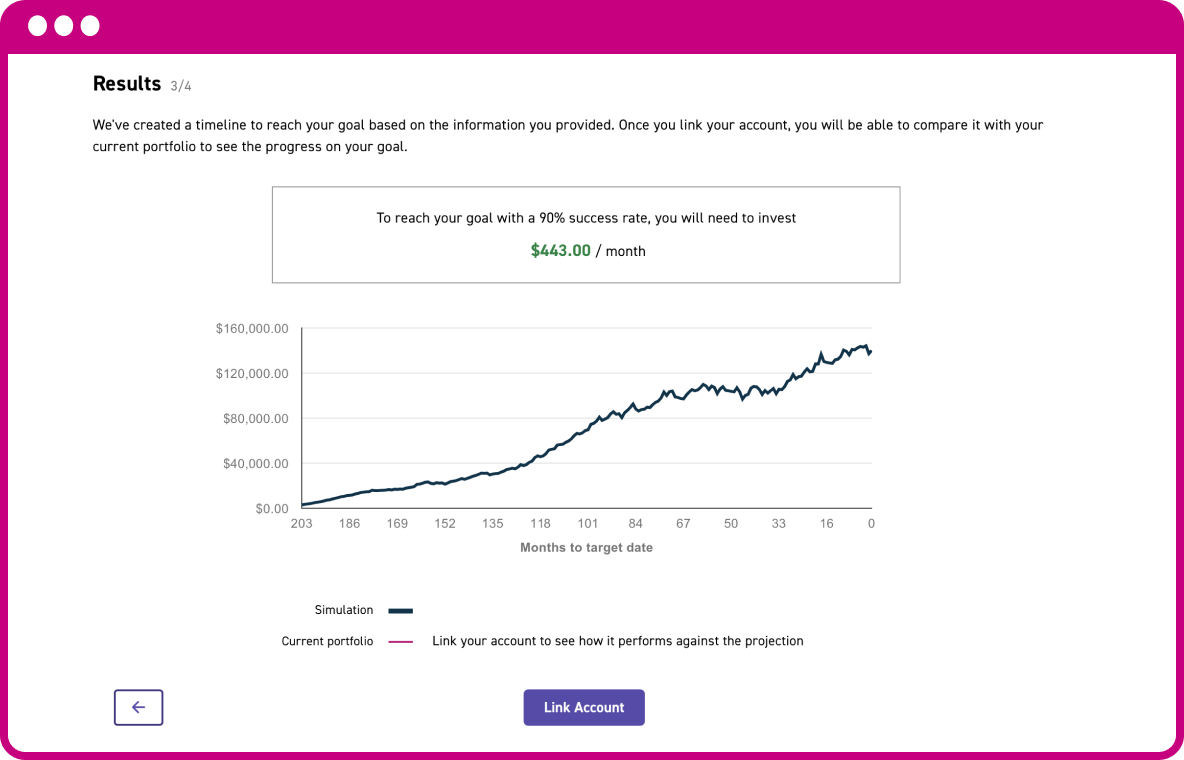

Being a DIY investor means taking your financial future into your own hands. Our portfolio analytics suite provides powerful tools to help you make the most of your investments.

Online brokerage services are offered through Qtrade Direct Investing, a division of Aviso Financial Inc. Qtrade and Qtrade Direct Investing are trade names or trademarks of Aviso Wealth Inc. and/or its affiliates.

Portfolio Simulator, Portfolio Creator and Portfolio Score are trademarks of Aviso Financial Inc.