How much will your CPP payments be?

Table of contents

- Key takeaways

- Who is eligible for CPP payments?

- How are CPP deductions from my income calculated?

- What is the CPP enhancement

- How long do I have to contribute to CPP?

- How much will my CPP payments be?

- Why do CPP amounts fluctuate?

- When do I start receiving CPP payments?

- Should I delay my CPP past 65?

- What is the CPP post-retirement benefit?

- What about death and disability benefits?

- What is the CPP enhancement?

- How do I apply for CPP?

Key Takeaways

- The Canadian Pension Plan (CPP) is a taxable benefit that provides income replacement upon retirement

- CPP is available to those over 60 who have made at least one valid contribution, with the amount of benefits determined by the number of years and amount contributed

- All Canadians over 18 working outside of Quebec are required to contribute 5.95% annually, with payments subject to annual adjustments via the Consumer Price Index (CPI)

- Payments commence in the last week of each month and can be delayed up to age 70 for higher payout

Canadian Pension Plan (CPP) payments are a monthly, taxable benefit that is designed to replace part of your income at retirement. As you earn employment income, a portion is deducted to go toward your CPP benefits once you retire. CPP can play a key role in retirement planning, so it’s important to understand how much your payments will be. CPP applies to workers in Canada who earn more than $3,500 per year, except for Quebec residents (who are part of the Quebec Pension Plan).

Related Articles

- How much will your OAS payments be?

- How to prepare for retirement

- Seven reasons to transfer your RRSP to a RRIF

- Investing during retirement

Who is eligible for CPP payments?

To be eligible to receive CPP benefits, you must be:

- be at least 60 years old

- have made at least one valid contribution to the CPP

The Government of Canada defines a “valid contribution” as coming from work you did in Canada, or credits received from a former spouse/common-law partner at the end of a relationship. For all the details, please visit the Government of Canada’s website.

How are CPP deductions from my income calculated?

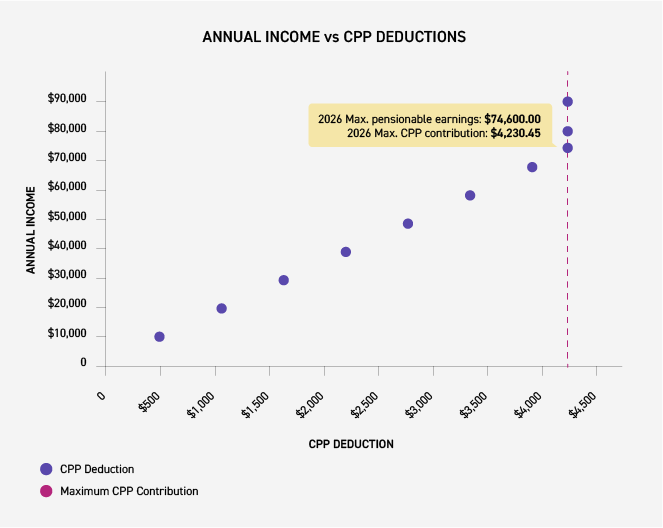

All Canadians over 18 years of age who work outside of Quebec are required to contribute 5.95% in 2026 of their pensionable earnings of up to $74,600 per year (less the basic CPP exemption amount of $3,500). This works out to $4,230 a year, an amount that's matched by your employer. If you're self-employed, you're both the employer and employee so your maximum contribution is set at $8,460.90.

This graph illustrates CPP deductions, and the maximum CPP contribution based on annual income, using 2024 figures.

What is the CPP enhancement?

Starting in 2019, the CPP gradually began to increase employer and employee contribution rates by 1% over five years. The increase brought the contribution rate to 5.95% for 2023 and following years. For the self-employed, who are both employer and employee, the rate has gone from 9.9% to 11.9% in the same time period.

The rate is applied to the year’s maximum pensionable earnings (YMPE), which is $74,600 in 2026. At that rate, the maximum CPP contribution in $4,230.45 for both you the employee and for your employer. Self-employed individuals pay both parts, totalling $8,460.90.

How long do I have to contribute to the CPP?

You're required to make CPP contributions every year you work from age 18 to 65. After that, if you choose, you can continue to contribute until you're 70. Choosing to continue contributing for these five additional years will allow you to earn a partial replacement of earnings in retirement, a disability benefit, a survivor benefit for your spouse or dependent children, and a death benefit.

How much will my CPP payments be?

Your CPP payment amount when you retire will depend on three things:

- How many years you've contributed

- How much money you've earned during that time

- The age you decide to start receiving your CPP pension

The chart below shows current monthly average CPP payments for retirement pensions. For information on payments on other types of benefits, check out the Government of Canada’s website.

| Average monthly amount for 2024 | Maximum monthly amount for 2026 | |||

|---|---|---|---|---|

| Retirement pension at age 65 | $815.00 | $1,507.65 | ||

| Post-retirement benefit at age 65 | $19.84 | $54.69 |

Why do CPP payment amounts fluctuate?

CPP pension benefits are adjusted to the Consumer Price Index (CPI) each January. That's why the CPP maximum monthly pension has grown dramatically from $19.97 when it was first introduced in 1967, to today's maximum monthly pension of $1,364.60 (for those starting their pension payments at age 65).

CPP payment dates for 2026

Monthly CPP payment dates change each year, but typically are made in the last week of each month. CPP payments in 2026 are as follows:

- January 28, 2026

- February 25, 2026

- March 27, 2026

- April 28, 2026

- May 27, 2026

- June 26, 2026

- July 29, 2026

- August 27, 2026

- September 25, 2026

- October 28, 2026

- November 26, 2026

- December 22, 2026

When do I start receiving CPP payments?

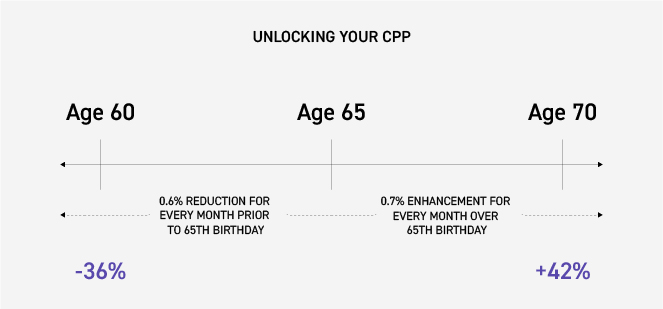

While your full retirement pension is available at age 65, you can still claim a partial pension if you're between the ages of 60 and 65, or you can delay your pension payments until you turn 70 in order to receive a higher amount. Your age will affect your CPP payment amount.

If you claim your CPP payments before age 65, your payments will be reduced by 7.2% per year (0.6% per month) up to maximum 36%.

If you delay your CPP payments until after age 65, your payments will be increased by 8.4% each year (0.7% per month) to a maximum of 42% if you start payments at age 70 or after

Should I delay my CPP payments past age 65?

As shown above, delaying your CPP benefit after age 65 can significantly increase your payments. Whether or not a delay is the right thing for you depends on your situation – your finances, your health, your lifestyle.

Some things to consider:

- Employment income: If you’re still working at age 65, may not need your CPP benefits. Because CPP payments are taxable income, if you’re still earning income when you receive payments, you may be increasing your tax burden.

- Life expectancy: If your health is good, and expected to continue that way, delaying your CPP payments can help you fund you later years with higher payments. Alternatively, if your health is poor, there’s no reason to defer CPP.

- Inflation protection: CPP payments are indexed to inflation, which means payments increase as inflation increases.

This graph illustrates how CPP payments can decrease or increase from ages 60 to 70 based on when you start collecting it.

What is the CPP post-retirement benefit?

The world of work is changing rapidly, with many Canadians working long past the traditional retirement age of 60 or 65. If you are working past the age of 60, you can still contribute to your CPP.

The CPP post-retirement benefit (PRB) allows you to work while receiving your CPP retirement pension if you:

- are under the age of 70

- continue to contribute to CPP.

Your additional CPP contributions are directed toward the PRB, which will increase your retirement income.

What about disability and death benefits?

As a CPP contributor, CPP disability benefits are available if you become disabled and can't work on a regular basis (a benefit may also be payable to your children). When you die, CPP survivor benefits may be paid to your estate, surviving spouse or common-law partner, and your children. The CPP death benefit provides a one-time payment to (or on behalf of) the estate of a deceased contributor. Learn more about other types of CPP benefits at the Government of Canada website.

If you'd like to know more about your projected CPP pension benefits, you can request a CPP pension statement through Service Canada.

What is the CPP enhancement?

Starting in 2019, the CPP gradually began to increase due to the CPP enhancement. The enhancement works as a top-up and will mean higher benefits in retirement in exchange for making higher CPP contributions. It only affects you if you work and make CPP contributions as of January 1, 2019.

From 2019 to 2023, the CPP gradually increased the contribution rate for employees by one percent on earnings. In 2024 and 2025, a higher contribution limit was introduced that allows you to contribute more toward your CPP, increasing your retirement pension benefits

How to apply for CPP

CPP payments are not automatic; you must apply for them. It’s best to apply for CPP before you want your pension to start. It can take up to six months to process a paper application for CPP benefits but is completed much faster (two weeks) if you submit an online application through your My Service Canada account. Plan accordingly. Find out more about how to apply for CPP benefits.

Often, CPP goes hand-in-hand with Old Age Security (OAS) benefits. You can learn more in our article about OAS.

For more information about CPP, check out this guide from Million Dollar Journey.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters.