How much will your OAS payments be?

Table of contents

- What is Old Age Security?

- Who is eligible for OAS?

- How much will your OAS payments be?

- When can I start receiving OAS payments?

- OAS payment dates for 2026

- How to increase your OAS payments

- Are there spousal benefits?

- What is the Guaranteed Income Supplement?

- Do I need to apply for OAS payments?

Key Takeaways

- The Old Age Security (OAS) is a taxable monthly pension designed to help seniors with basic living expenses, and payments are reduced or eliminated for high-income earners.

- Canadians aged 65 or older who are citizens or legal residents and have lived in Canada for at least 10 years after turning 18 are eligible.

- Payment amounts are adjusted quarterly based on the Consumer Price Index (CPI).

- Benefits typically begin the month after an individual turns 65. However, recipients can choose to defer payments for up to five years (until age 70).

While most Canadians will qualify for the Old Age Security (OAS) pension when they retire, not everyone understands how the benefits work, or how much is paid out. If you're still wondering what you're entitled to when you retire, this article explains the basics.

Related Articles

- How much will your CPP payments be?

- How to prepare for retirement

- Seven reasons to transfer your RRSP to a RRIF

- Investing during retirement

What is Old Age Security?

Launched in 1927, OAS is designed to provide seniors with a modest monthly pension to cover basic living expenses. It is a taxable benefit.

Who is eligible for OAS?

As soon as you turn 65, you are eligible to receive OAS. The month after you turn 64 you should receive one of two letters from Service Canada:

- A notification that you were selected for automatic enrolment

- A notification that you could be eligible for OAS and that you must apply as soon as possible

To qualify for OAS, you must be a Canadian citizen or legal resident, and have resided in Canada for 10 years after age 18. Or, if you are a Canadian and you are working outside the country for a Canadian employer, your working time abroad can qualify as residence if you return to Canada within six months of ending employment or if you turned 65 while still employed.

You may also qualify for an OAS pension or a pension from another country if you have been living in a country that has a social security agreement with Canada or if you’ve contributed to the social security system of a country which Canada has an agreement with. Learn more at the Government of Canada website.

How much will your OAS payments be?

The amount of OAS payment you could receive is determined by your income and how long you have lived in Canada after the age of 18. Payment amounts are adjusted quarterly (in January, April, July, and October) according to the cost of living in Canada, as measured by the Consumer Price Index (CPI).

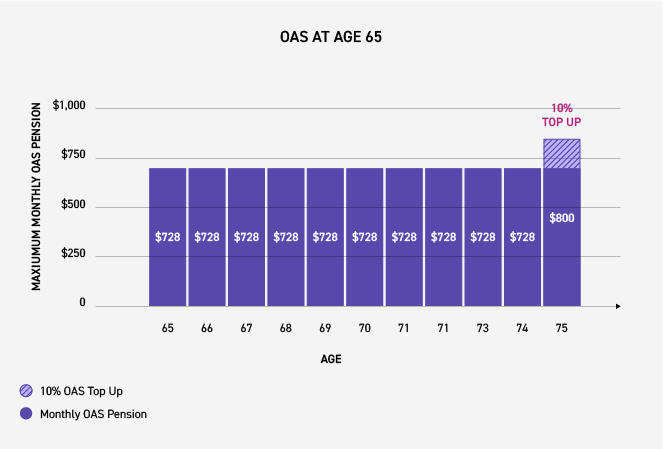

As you can see from the chart below, the 2026 maximum monthly amount paid by OAS is $742.31 for people between the age of 65 and 74, which comes out to $8,907.72 a year. If you are age 75 or over, the maximum payment is $816.54 in 2026.

| Maximum monthly amount for 2026 | OAS eliminated when income reaches | |||

|---|---|---|---|---|

| OAS pension benefit - Age 65 to 74 |

$742.31 | $152,062.00 | ||

| OAS pension benefit - Age 75 and over |

$816.54 | $157,923.00 |

The amount you're eligible for also depends on the income you receive. Any OAS pension is eliminated if you earn over the maximum threshold, which in 2026 is $152,062 (between ages 65 and 74) or $157,923 (for recipients aged 75 and over) per year.

When can I start receiving OAS payments?

OAS payments generally begin the month after you turn 65 years old.

OAS payment dates for 2026

Monthly OAS payment dates change each year, but typically are made in the last week of each month. OAS payments in 2026 are as follows:

- January 28, 2026

- February 25, 2026

- March 27, 2026

- April 28, 2026

- May 27, 2026

- June 26, 2026

- July 29, 2026

- August 27, 2026

- September 25, 2026

- October 28, 2026

- November 26, 2026

- December 22, 2026

How to increase your OAS payments

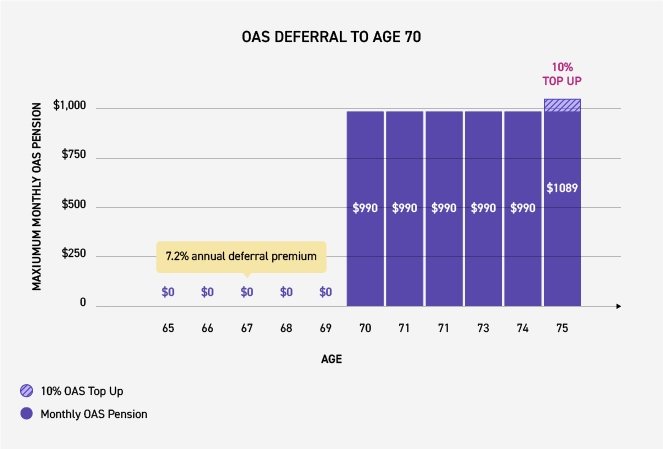

Like with Canada Pension Plan payments, you can also defer receiving OAS pension payments for up to five years, or until you turn 70. By deferring, your monthly OAS pension will increase by 0.6% (or 7.2% annually) for each month that you delay receiving benefits, up to a maximum of 36%. If you are automatically enrolled in OAS, you can request your deferment through your My Service Canada account or by completing and returning your automatic enrolment letter. Learn more about applying at the Government of Canada website.

Are there spousal benefits?

Surviving spouses and common-law partners of OAS recipients are entitled to a survivor pension. Like the OAS pension itself, this benefit can be offset by recovery tax if your surviving spouse or partner is earning an income and eliminated if their earnings exceed $29,712 (in 2025). Spousal benefits can differ significantly based on your individual situation. Please refer to the Government of Canada website for more details.

What is the Guaranteed Income Supplement?

Based on your income and marital status, you may also be eligible for the Guaranteed Income Supplement (GIS) if:

- you are a resident of Canada aged 65 or older

- you receive OAS payments

- your income is below the maximum annual income threshold for the GIS based on your marital status

Some Canadians are automatically enrolled for the GIS at the same time as OAS payments based on their income, but you can also apply for the GIS. Learn more about how to apply at the Government of Canada website.

Do I need to apply for OAS payments?

In many cases, Canadians don’t need to apply for OAS payments. You should receive a letter from Service Canada if you have been automatically enrolled.

If you do need to apply (usually if the Government doesn’t have enough information to automatically enrol you, or if you’ve elected to start your OAS payments later than age 65), or you do not receive a letter, you can complete your application online through your My Service Canada account, or mail a paper application to Service Canada. Learn how to apply at the Government of Canada website.

Often, OAS goes hand-in-hand with Canada Pension Plan (CPP) benefits. You can learn more in our article about CPP.

For more information about OAS, check out this guide from Million Dollar Journey.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters.