TFSA basics

Table of contents

- Eligibility

- Tax Treatment on TFSAs

- Annual TFSA Contribution Limit

- TFSA Contribution Room Carry-Forward

- TFSA Withdrawals

- Over-Contribution Penalty

- Tax-free earnings and withdrawals

- Equal Eligibility

- Liquidity

- No age limit on TFSA contributions

Key Takeaways

- Canadians 18+ with a SIN can open a TFSA.

- Contributions are made with after-tax income, but earnings and withdrawals are tax-free.

- You can withdraw funds anytime, and the amount withdrawn is added back to your contribution room the following year.

- You can hold a wide range of eligible investments in your TFSA

The tax-free savings account (TFSA) is a versatile general-purpose investing account. Like RRSPs and RESPs, the TFSA is a registered account that provides tax-sheltered earnings within the account. An added benefit is that TFSA withdrawals are not subject to ta

These are some of the key TFSA rules, features and advantages to be aware of.

Related Articles

- How much can you contribute to your TFSA?

- Build your TFSA portfolio with Qtrade

- More on Qtrade TFSA benefits

Eligibility

Individuals with a valid Canadian Social Insurance Number who are 18 years of age or older and who live in Canada.

Note: A person with a valid SIN who is a non-resident of Canada for income tax purposes can open a TFSA, but contributions made while the person is a non-resident are subject to a 1% tax for each month that the contribution remains in the account.

Tax Treatment on TFSAs

Contributions must be made from after-tax income. However, earnings within the account are not taxable. And you also don't pay tax when you withdraw your money from your TFSA.

Annual TFSA Contribution Limit

The TFSA annual contribution limit is $7,000 for 2026.

TFSA Contribution Room Carry-Forward

Unused contribution amounts can be carried forward and used in subsequent years.

If you have never contributed to a TFSA, and you were at least 18 years old in 2009, then as of 2026, you will have accumulated $109,000 of contribution room.

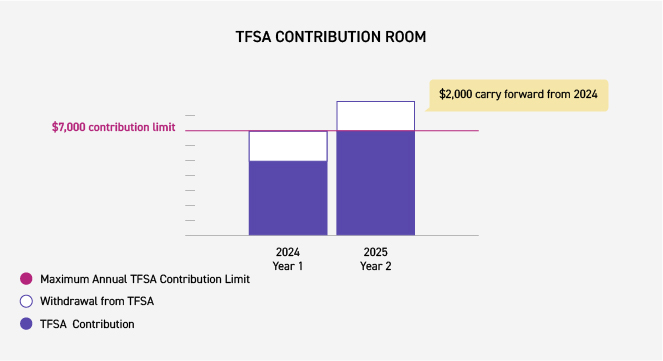

This graph illustrates the annual TFSA contribution limit and how unused contributions can be carried forward into future years.

TFSA Withdrawals

TFSA withdrawals can be done at any time. Amounts withdrawn in a given year are added back to your contribution room for the next year — regardless of whether the amounts withdrawn are your original contribution or the earnings from your investments.

Over-Contribution Penalty

There is a penalty if you accidentally contribute more than your allowable limit. In that case, a tax equal to 1% of the highest excess TFSA amount in the month will be applied for each month that you are in an excess contribution position.

TFSA advantages

The TFSA is attractive to a wide range of Canadian investors in different circumstances because of it offers several key advantages.

Tax-free earnings and withdrawals

TFSA contributions must be made-from after-tax dollars. But once contributed, your money is completely sheltered from Canadian tax. Income, dividends and capital gains accrue in the TFSA tax free. And your TFSA withdrawals are not treated as taxable income. No other registered plan offers equivalent tax advantages.

Since earnings and withdrawals are not included as income for tax purposes, they don't impact your eligibility for Old Age Security, or for any other income-tested federal benefits.

Equal Eligibility

Everyone has the same contribution room. You don't need to have earned income in order to accumulate contribution room. So, if you are retired or not currently working, you can still contribute to a TFSA.

Liquidity

You can make TFSA withdrawals whenever you want, for any purpose. This liquidity makes the TFSA an extremely useful general-purpose account for a wide range of long- and short-term saving and investing goals. You can use a TFSA to grow your retirement nest egg or to save in order to start a business. You can also use a TFSA to build an emergency fund, or save for a major purchase, such as a home, new car, or vacation.

No age limit on TFSA contributions

As long as you are eligible, you can contribute every year to your TFSA for as long as you like. And you can maintain your TFSA for as long as you like — there is no requirement to withdraw assets or collapse your account by a certain age (like there is with an RRSP). This makes the TFSA a valuable complement to your RRSP or RRIF.

TFSA investment choices

Investment choice is another key benefit of the TFSA. With a self-directed TFSA, you are in full control. You can hold a wide range of eligible investments in your TFSA, and create an asset mix that is appropriate for your objectives, timeline and tolerance for risk.

Generally, the types of investments permitted in a TFSA are the same as those permitted in an RRSP. These include:

- Securities such as stocks and exchange-traded funds (ETFs) listed on a designated stock exchange

- Bonds

- Mutual funds

- Guaranteed Investment Certificates (GICs)

- Cash

Wondering if you can hold U.S. stocks in your TFSA? Yes, you can. As long as the stock (or ETF) is listed on what the CRA calls a designated stock exchange. In fact, you can hold stocks or ETFs listed on several European, Asian and other world exchanges.

For more information about qualified investments, visit the TFSA section of the Canada Revenue Agency website.

If you transfer TFSA assets from another institution to your Qtrade Direct Investing, we will cover your transfer-out fees up to $150. Make the switch today.