Monthly Market Insight - November 2022

Markets advance to the next round

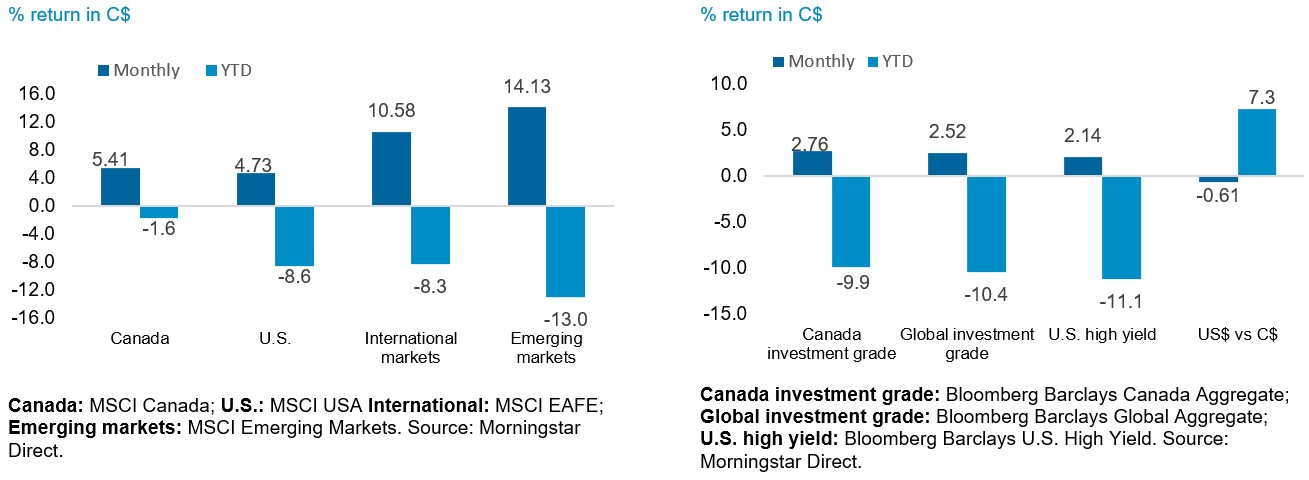

Like Argentina’s strong performance following a weak start to the FIFA World Cup, markets bounced-back in November following a pull-back in mid-October. U.S equities advanced on the back of better-than-expected U.S CPI data, further boosting optimism that the Fed may be able to tame inflation without causing a recession. The S&P 500 closed the month up 4.7%, European equities advanced 10.7%, Canadian equities saw gains north of 5% and even Emerging markets, which have been underperforming year-to-date, made a strong comeback in November. On the fixed income side, 10-year yields dropped by 44bps in the US and 32bps in Canada over the month on hopes that central banks might be able to downshift on the magnitude of rate hikes. US and Canadian bonds gained 3.7% and 2.8% respectively, while Bloomberg US HY 2% bonds closed +2.1%.

The NEI perspective

Price pressures are easing as tighter monetary policy is starting to curb excess demand and easing supply chains are lowering costs for materials and freight. However, the labour market remains tight, and wages continue to increase in real terms. As a result, core inflation may remain higher for longer, even as headline inflation begins to moderate.

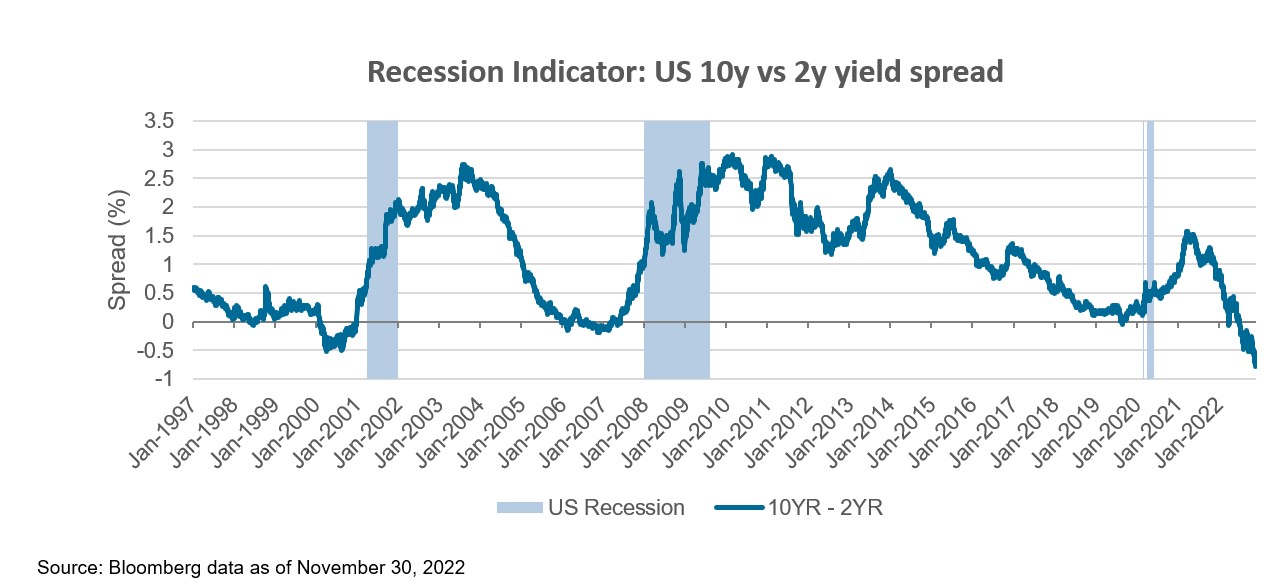

Recession risk looms as recent data shows the global economy is weakening with both manufacturing and services slowing as business and consumer confidence hit their lowest point in two years. Plus, the deeply inverted US yield curve also points to the possibility of a looming recession.

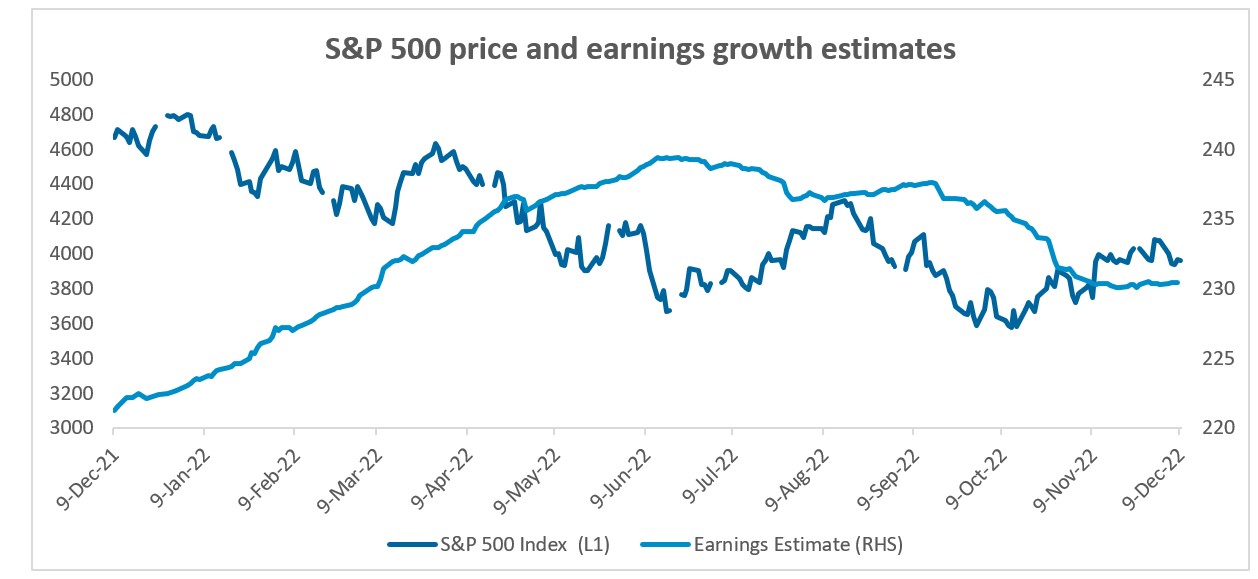

Market prices not reflecting recessionary concerns despite already being revised downward since the summer, markets may still not be fully pricing in the impact lower demand and higher costs will have on corporate profit margins. Earning estimates may have to be revised further as current market pricing may still be too optimistic if a recession is on the horizon.

Performance (price return)

As of November 30, 2022

Price pressure eases but wage inflation remains high

The unprecedented strain supply chains faced during the pandemic was a key contributor to global inflation, but it appears the worst may be behind us according to the Global Supply Chain Pressure index. Tighter central bank policies across major economies have started to take effect on price pressures. Raw material prices and freight costs have also cooled dramatically, leading to lower growth in input costs, and output price inflation in October.

However, wage gains still show no sign of abating. The recent Global Wage Report showed that, while global monthly wages fell in real terms by –0.9% in the first half of 2022, the picture in nominal terms is quite different as nominal wages have risen to unsustainable levels in many countries. In the US, wage gains remain strong, driven by a tight labour market. Average hourly earnings continue to increase more quickly than the pre-pandemic average of 3% gains annually, continuing to put pressure on inflation.

Headline inflation will likely continue to retreat, but core inflation may remain higher for longer. Although the bulk of the tightening is already behind us and the central banks may downshift in the upcoming rate hikes, it is likely that rates will need to remain higher for longer in order for tighter financial conditions to work through the economy and for inflation to moderate.

Recession risk looms

With aggregate demand quickly cooling, growth momentum in manufacturing activities is now firmly on a negative trajectory. In October, S&P Global PMI confirmed that the global economy is weakening as the slowdown deepened at the start of the fourth quarter with both manufacturing and service activities decelerating and output contracting at a faster rate. At the same time, business and consumer confidence have weakened and are now at lowest point in two years, which signals weakness in future business investments and consumer spending.

Another important recession indicator is also flashing warning signals. The spread between the U.S 2-year and 10-year Treasury yields is one of the credit conditions indicators most watched by the US Fed. The indicator has a good track record of predicting recessions shortly after the spread turns negative. It is now firmly in negative territory and is at its lowest level since 1981, with the 10-year Treasury yield 83 basis points below the 2-year yield.

Market prices not reflecting recessionary concerns

Consensus estimates for next year’s earnings growth for S&P 500 companies have gradually been revised lower since July. Earnings estimates have fallen from over 11% to 5.3% for 2023. Further downward revisions are likely as corporate profitability comes under pressure from lower consumer demand, higher input costs and higher labour costs, resulting in lower output prices and shrinking profit margins. Earnings estimates of companies in Europe Stoxx 600 have also been revised lower, which is in contrast to the Asia Pacific region, India in particular, which has shown upward revisions to company earnings estimates.

Source: Bloomberg data as of November 30, 2022

Current market pricing levels across bonds and equities may still be too optimistic. This optimism could lead to near-term market volatility as core inflation may persist, rates may need to remain higher for longer, economic growth momentum may continue this negative trend, and earnings estimates continue to be revised lower. The market may not hit an inflection point until central banks reach peak hawkishness and inflation shows sustained signs of moderating.