Monthly Market Insight - October 2022

Is bad news good news?

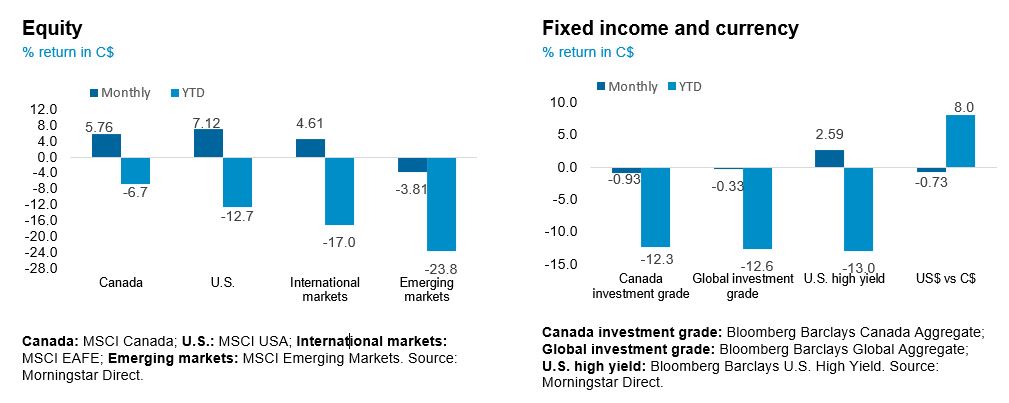

October saw most global financial assets rebound, following weak performance in the prior two months. The market responded positively to soft economic data such as downward revisions to global growth and weakening manufacturing PMIs, as a sign that tightening policies are effective and central banks could pause on hikes sooner. This led the market to speculate that central banks could begin to pause on rate hikes based on the softer tone from the European Central Bank (ECB) and Bank of Canada (BoC) raising rates by 50 basis points (bps) instead of the 75bps that was expected. Some signs of easing of inflation also supported this. However, there were other areas of strength in the economic data. The U.S labor market continued to show strength with non-farm payroll increasing by 263K in September, exceeding the five-year monthly average while retail sales consumption remained resilient.

The NEI perspective

Central Banks decelerating rate hikes but may take longer to get to their peak as oversized rate hikes maybe coming to an end. Policy leaders may take a more cautious approach going forward as they analyze how higher rates are impacting different parts of the economy. A slower pace of tightening may result in a longer journey to peak rates.

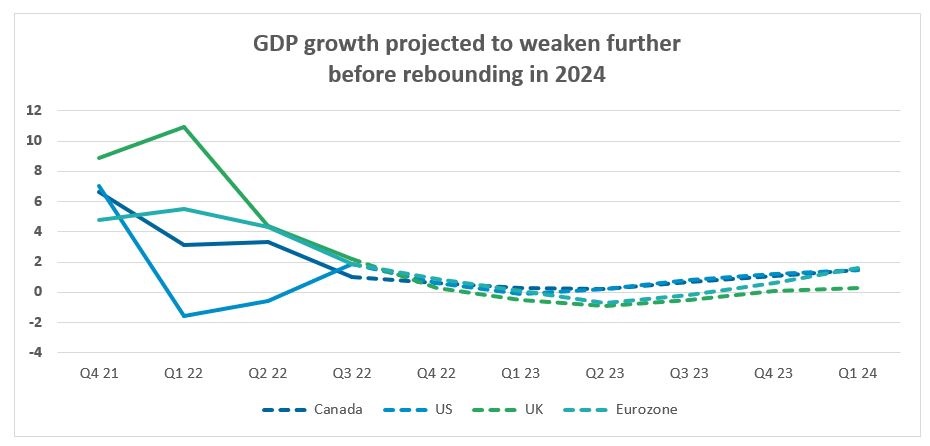

Economic growth weakens as monetary tightening takes effect based on the recent contraction in the Manufacturing PMI and weaker projections for GDP growth in the year ahead. On the other hand, it appears inflation may finally be moderating according to recent data on input prices, supply chains and food prices.

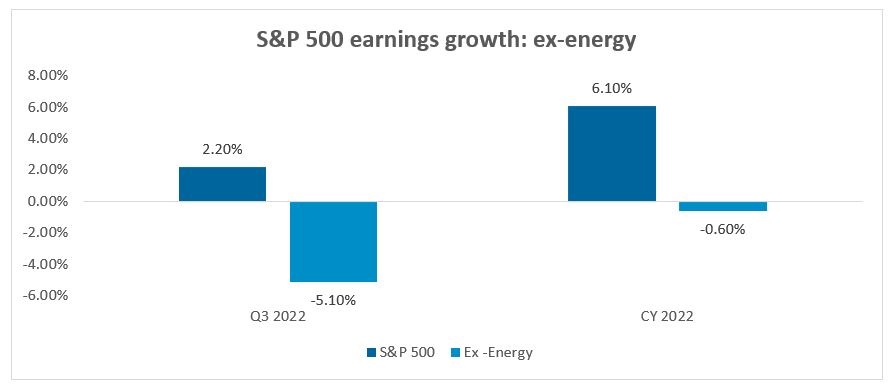

No patience for earning misses as well-known mega-cap companies like Alphabet, Amazon and Google see significant decline in share price following the release of their Q3 results. Overall, Q3 earnings were strong with 71% of companies beating estimates, however investors expect slower earnings growth in Q4. Most of the S&P earnings growth came from the energy sector and would have been negative if excluded.

Performance (price return)

As of October 31, 2022

Economic growth weakens as monetary tightening takes effect

Manufacturing PMIs across many regions have dipped below 50, indicating economic contraction. Declines in new orders and output were general themes across Canada, U.S and other regions. In Canada, S&P Global Manufacturing PMI registered at 48.8 in October, down from 49.8 in September. The latest result pointed to a quicker deterioration in operating conditions, and one that was the second strongest since the tail-end of the first wave of the COVID-19 pandemic in June 2020. Weak demand conditions were apparent in October's survey data with firms often mentioning that high prices deterred demand. New orders fell solidly and at one of the quickest rates in the survey's history. Export conditions were also subdued with international demand for Canadian goods contracting for the fifth month in succession.

Already, there are signs of economic weakness as growth is expected to stall in Canada through the end of this year and the first half of next year as the effects of higher interest rates spreading through the economy. The Canadian economic growth is expected to slow from 3.75% this year to just under 1% next year before rebounding to 2% growth in 2024. Softer growth prospects are also expected for Europe and the U.S, with the U.S expected to grow below trend next year. Globally, growth estimates have been revised downwards to 2.2% in 2023 and 2024 by the OECD in its Interim Economic Outlook Report.

Source: Bloomberg, data as of October 31, 2022

Numerous signs that inflation is moderating

There are numerous signs that headline inflation across many regions is rolling over: WTI crude oil prices have declined over 30% from its June high, after surging close to 60% this year, other commodity prices have continued to moderate, global supply chain disruptions continue to ease, freight costs continue to fall sharply, and prices paid by manufacturers, which is a leading indicator of end-consumer prices, have all softened.

Additionally, the World Bank projects that agricultural prices will decline by 5% next year. Wheat prices in the third quarter of 2022 fell nearly 20% but remain 24% higher than a year ago. The decline in agricultural prices in 2023 reflects a better-than-projected global wheat crop, stable supplies in the rice market, and the resumption of grain exports from Ukraine. Metal prices are projected to decline 15% in 2023, largely because of weaker global growth and concerns about a slowdown in China. However, this forecast is subject to risks such as weather events or a deepening of the Russia-Ukraine war.

No patience for earnings misses…

As of October 28th , 52% of the companies in the S&P 500 have reported Q3 results, about 71% are beating earnings expectations and 68% have reported positive revenue surprise, according to FactSet. That compares with the five-year average of a 77% beat rate. Companies missing earnings and revenue expectations, for instance Alphabet, Meta, and Amazon this quarter, were dealt heavy-handedly by the market with shares plunging significantly. On average, companies missing expectations underperformed the index by 6.7% on the next day.

Even though companies are beating estimates, these beats are quite small relative to the historical average. Overall, companies are reporting earnings 4.4% above estimates, which is below the five-year average of 8.7%. Much of the earnings surprise has come from the energy sector, which has so far surpassed earnings estimates by 12.2%.

The Energy sector is also the largest contributor to earnings growth for the S&P 500 for Q3 2022. In fact, if the Energy sector is excluded, the S&P 500 would be reporting a year-over-year decline in earnings of 5.1% rather than a year-over-year increase in earnings of 2.2%, according to Factset. This would mark the second consecutive quarter in which the index would be reporting a year-over-year decline in earnings excluding the Energy sector.

For the whole year 2022, the index is expected to report a year-over-year decline in earnings of 0.6% excluding energy. rather than an increase of 6.1%. From Q2 2023 onwards, the Energy sector is projected to report year-over-year declines in earnings, detracting from the overall earnings growth.

Analysts are predicting that earnings growth will slow to 0.5% in Q4 2022. Earnings growth for CY2022 has been revised downwards to 6.1%, relative to the almost double digit forecast earlier in the year

Source: Factset.