Monthly Market Insight - August 2022

Nowhere to hide

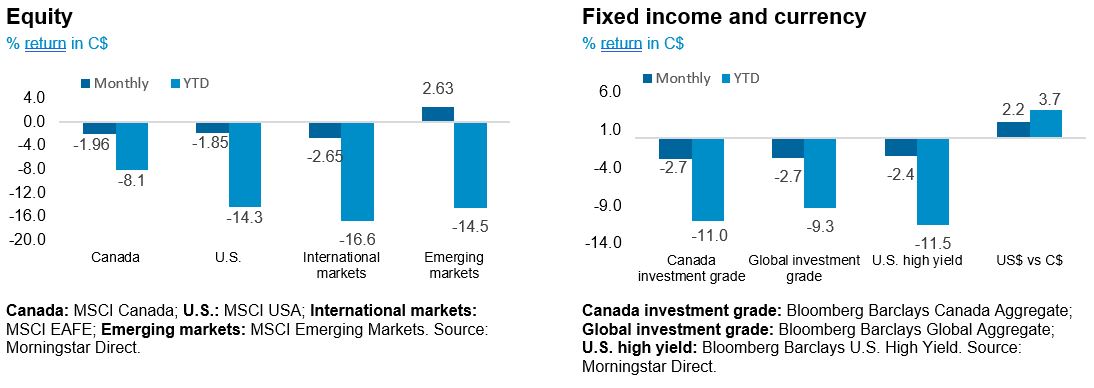

The month of August was a tale of two halves, as easing price pressures provided support to equities in the first two weeks, but the market lost steam mid-month as hawkish central bank messages caused fears of a recession to re-emerge. With tighter financial conditions and rising odds of recession, all major asset classes including equities, bonds, commodities, and high yield credit slid into negative returns, leaving investors with no place to hide. The U.S. dollar was the only haven as it strengthened against most currencies.

The NEI perspective

Major asset classes declined further. Markets retreated in August as central banks delivered a blunt message that they are willing to risk economic growth to tackle inflation. Global equity and bond markets pulled back from the July rebound and repriced lower as it became evident that there could be some “pain for businesses and households” in the near term.

Headline inflation may have peaked, but core inflation remains elevated. Headline inflation may have peaked in the U.S. as commodity prices continue to roll over and supply chains improve. However, core inflation remains unacceptably high across most regions due to wage gains and housing, for central banks to consider pausing rate hikes.

Rising risk of a sharp downturn in China threatens global economic growth China has been plagued by headwinds which have hampered economic growth: from a property sector slump and global consumption rotating from goods to services, to numerous Covid lockdowns. China has cut lending interest rates and recently launched a broad stimulus plan in hopes of stimulating credit demand and economic growth.

Performance (price return)

As of August 31, 2022

Part 2: GICs vs. Fixed Income

Last month we discussed the “60/40” portfolio and our outlook. This month we are looking at the benefits of a fixed income portfolio vs GICs.

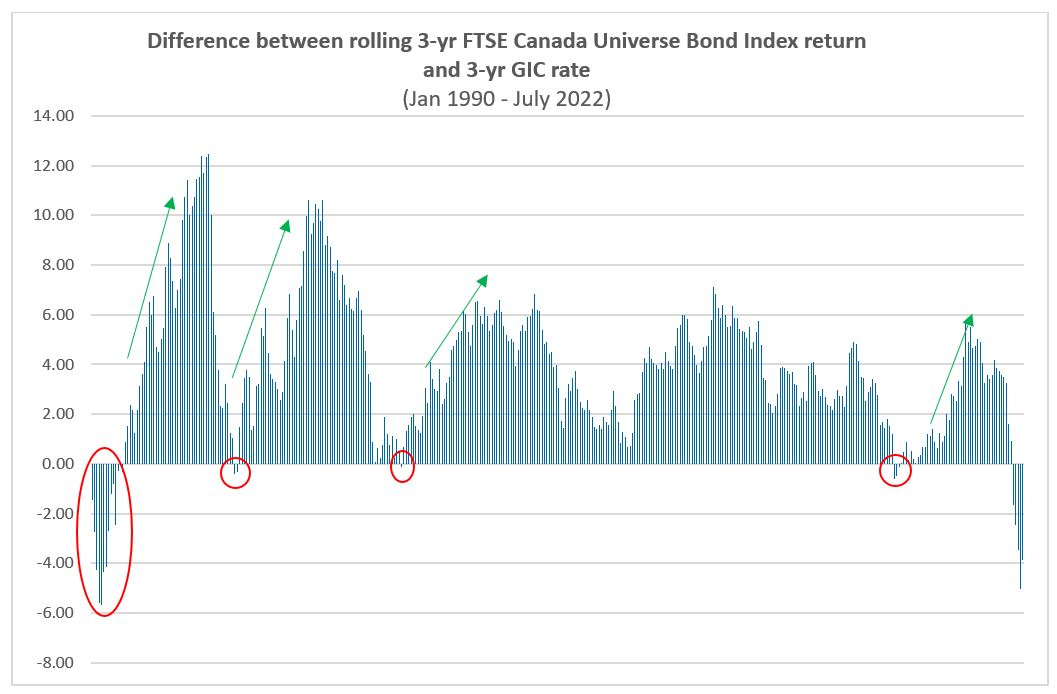

The benefits of GICs

Since April 2022, the rolling 3-year returns of the fixed income asset class dipped into the negative territory for the first time in over four decades. For many investors, the lackluster performance from fixed income has enhanced the relative appeal of GICs (Guaranteed Investment Certificates). GIC rates have moved up, which has been consistent with broader rate hike cycle initiated by the Bank of Canada. Investors can now comfortably access 3-year GIC rates between 2-3% on average, or even as high as 4-5%.

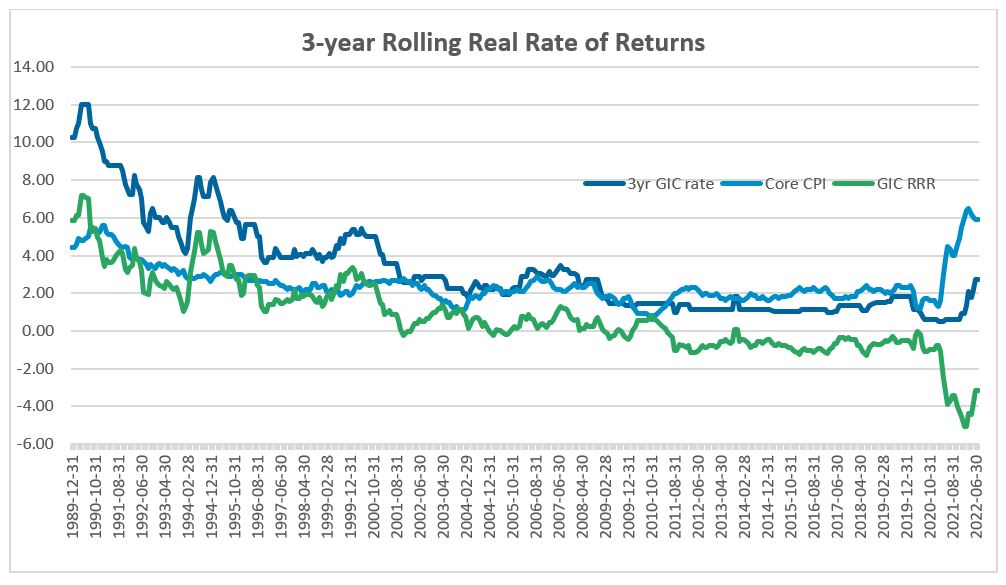

The most salient benefit from investing in a GIC is the “return of principal”. GICs are underwritten by either the Canada Deposit Insurance Corporation (CDIC) or Provincial credit union deposit insurance plans. However, this certainty on the return of principal comes at a cost of a negative real rate of return currently on offer. The following chart illustrates that the erosion of capital when adjusted for inflation is at the most aggressive in over 40 years.

Source: Bloomberg, data as of Aug 31, 2022

Accessing a better real rate of returns

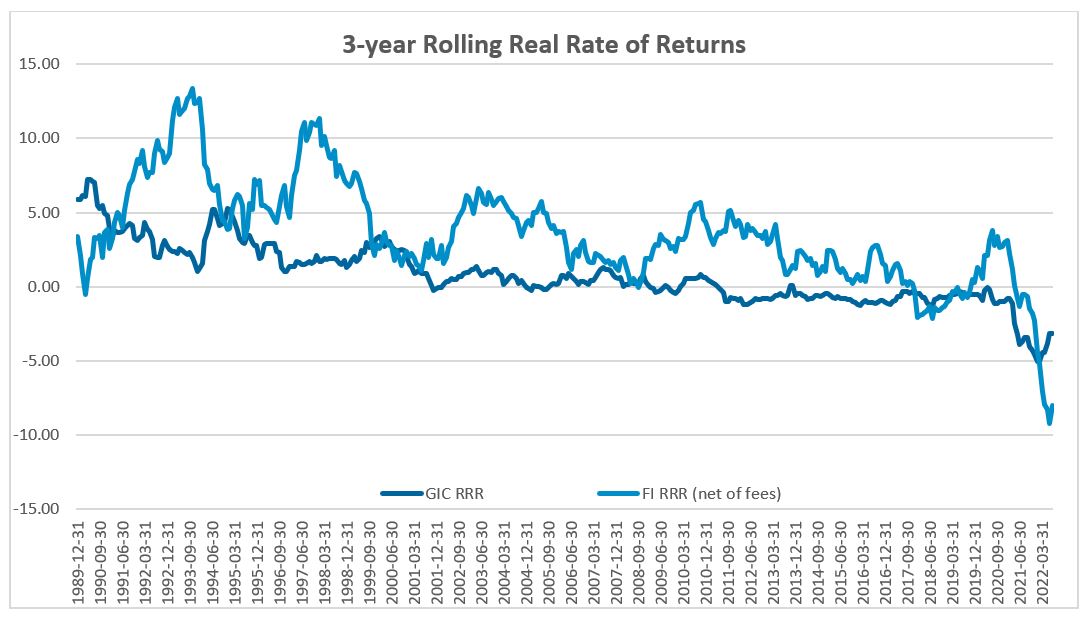

To access a better real rate of return, investors can look at well-managed fixed income portfolios that now offer higher starting yields with the potential of generating capital gains from a number of sources such as bond issues and credit selection, duration management through yield curve positioning, and sector tilts between government and corporate sectors. The following chart shows that fixed income portfolios have historically been able to generate real returns much higher than GICs after adjusting for inflation.

Source: Bloomberg, data as of Aug 31, 2022

The benefits of fixed income

Fixed income investing also offers superior tax benefits compared to GICs. In fixed income, the total return is composed of both capital gain and interest income (if the purchase price is less than par value). In a GIC, the return is entirely interest income. Capital gains are taxed at a lower rate than regular interest income. If the GIC is held in a non-registered account, the interest income will be taxed at the investor’s marginal tax rate.

Lastly, GICs offer poor liquidity, with a lock-up period. In non-cashable GICs, breaking the agreement before maturity has its own obstacles and there are usually penalties that include loss of some or all the accrued interest. While investors can access their funds in cashable GICs before maturity more easily, these come with sub-par returns. On the other hand, fixed income securities are highly liquid, publicly traded instruments that are traded over the counter and can be redeemed anytime without penalties.

Persistently high and rising level of inflation has led to the recent negative returns of the fixed income asset class, which can be unnerving to many investors. However, it is important to remember that it still has an important role to play in a well-diversified portfolio where it serves as a hedge to other asset classes in recessionary environments. It can act as an offset to other instruments such as equities and commodities, much like what happened as recently as in the year 2020.

Source: Bloomberg, data as of July 31, 2022