Monthly Market Insight - June 2022

Aggressive policy raises economic growth concerns

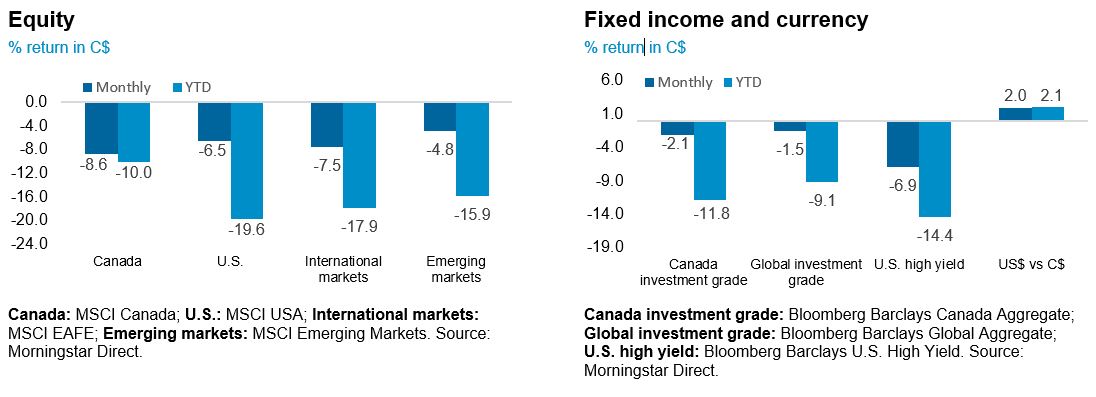

The persistent rise and broadening of inflation, sparked by pandemic-driven supply chain disruptions and compounded by the war in Ukraine, have led to aggressive tightening of monetary policies and increased concerns that many global economies could enter a recession. These factors have been the main cause of market declines since the beginning of the year, with the U.S. equity market officially entering bear market territory in June. The latest inflation reading on June 10 gave the U.S. Federal Reserve pause and confirmed the need for even more aggressive tightening to keep longer-term inflation expectations anchored. Equity markets dropped further mid-June and bond prices followed in anticipation of more aggressive rate hikes before reversing partially toward the end of the month.

The NEI perspective

High inflation rates driven by energy prices lead to aggressive rate hike in the U.S. Inflation showed no signs of slowing as it marched higher yet again in June readings, warranting the U.S. Federal Reserve’s decisive 75-basis point hike on June 17.

U.S. markets entered bear market territory as growth prospects soured. As odds of a potential recession rise, driven by higher interest rates and higher consumer prices for gas, groceries, and other goods, global growth forecasts are quickly being downgraded.

Path forward hinges on how quickly inflation moderates. Markets may be at a fork in the road—toward a bullish path if inflation were to peak soon, but bearish across asset classes if inflation were to stay persistently high.

Performance (price return)

As of June 30, 2022

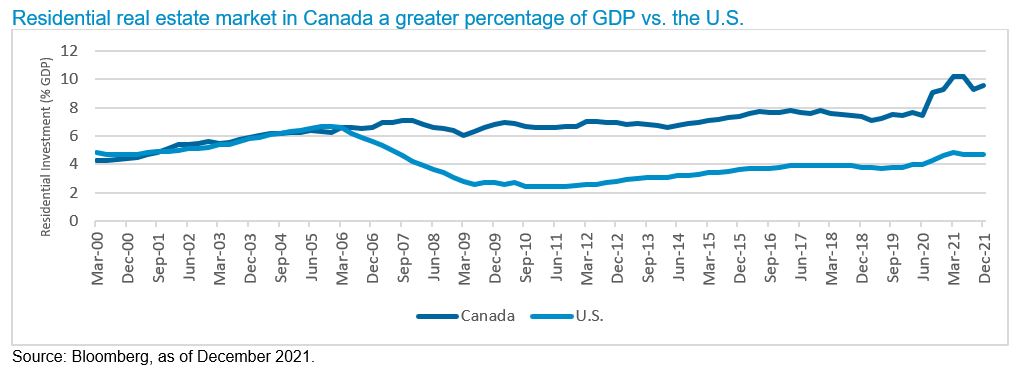

The impact of interest rates on the Canadian housing sector

Canada’s housing construction sector makes up a substantial part of the nation’s economy, with StatCan estimating housing accounting for 9.6% of GDP at the end of 2021, which is about twice that of the U.S. Consequently, the residential real estate market can be an important measuring stick for Canada’s economic health, while also making our economy more sensitive to rises in Bank of Canada interest rates. As we anticipate more rate hikes to come in the near future, softening in the real estate market in a rising rate environment poses increased risks to growth prospects for the Canadian economy.

As of December 2021

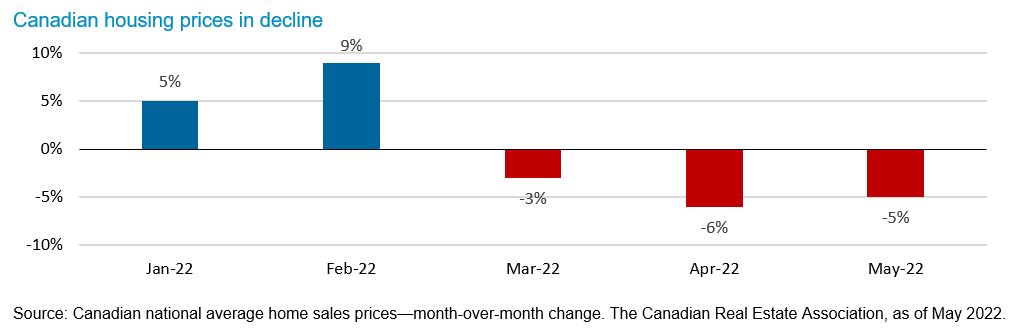

Higher interest rates are already putting noticeable downward pressure on Canadian residential real estate activity and prices, through higher mortgage rates. Fixed mortgage rates in Canada are based on Government of Canada bond yields, while variable rates are typically expressed as a discount to the prime rate. For context, the five-year Government of Canada bond yield has moved from 1.25% at the start of 2022 to 3.17% as of June 29. The prime rate has increased in line with increases in the Bank of Canada’s policy rate, from 0.25% to 1.50%, with more rate hikes anticipated.

Residential real estate values are estimated to have peaked in February 2022, when the national average home price was C$817,038. By May 2022, that figure had dropped 14% to C$711,316 in the span of just a few months. The decline has been concentrated around the areas that saw the biggest run-ups during the pandemic, including Toronto and its surrounding suburbs.

As of May 2022

National home sales activity has also declined for three consecutive months. The sales-to-new listings ratio dropped to 57.5%, its lowest level since April 2019, indicating a cooling of the market from a seller’s market to a more balanced market. Despite declines in house prices, housing affordability declined as well due to the impact of higher mortgage rates. In May 2021, for a home that was worth C$687,595 (the average home price at that time), a five-year discounted fixed mortgage rate of 1.68% for a 25-year amortization term on an uninsured mortgage (with a 20% down payment) would equate to a monthly mortgage payment of $2,245. In May 2022, with the five-year discounted fixed rate at 3.59%, the same home at the same price with the same amortization and insurance terms would require an increased monthly mortgage payment of $2,868. This represents a 28% increase in the monthly mortgage payment over the 12-month period, while wage growth only averaged 4.5% over the same period.

Currently, 35% of Canadian households own a home with a mortgage balance (28% own their home outright and 37% are renters). The increase in mortgage rates and the corresponding increase in mortgage payments raise the household debt servicing level while also lowering household disposable income. The increasing level of indebted households also increases the sensitivity of the Canadian economy to changes in interest rates. In addition, 22% of housing transactions are for investments using home equity loans, according to the latest figures released by the Bank of Canada, posing additional systemic risks should house prices drop.