Weekly Market Pulse - Week ending June 10, 2022

Market developments

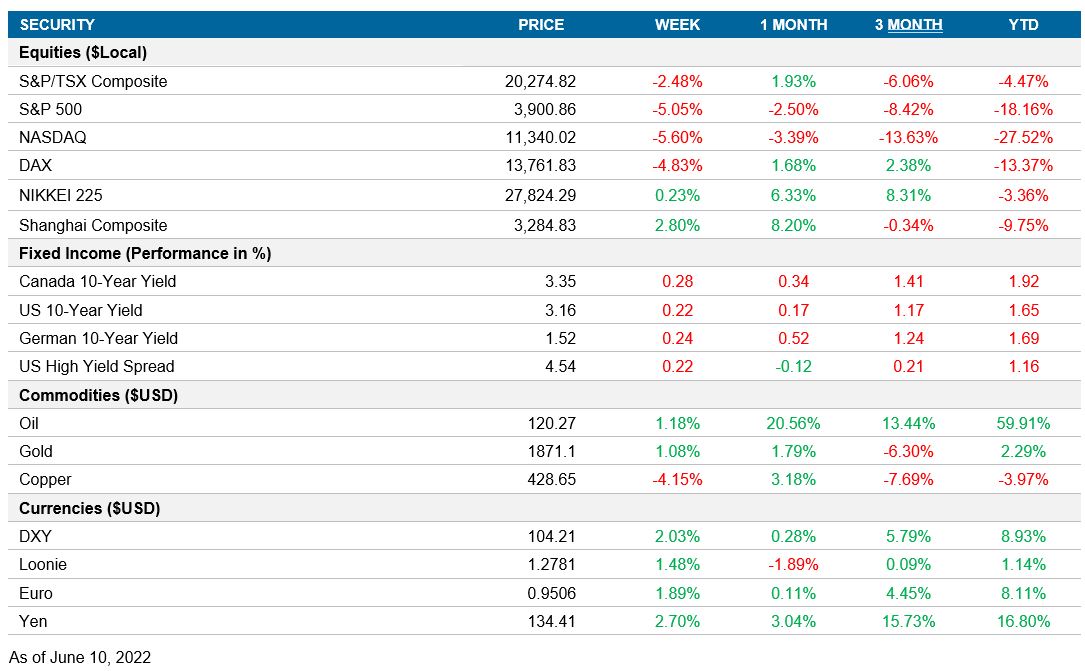

Equities

U.S. markets were down for the second week in a row. Concerns around quantitative tightening, hawkish central bank postures, and high inflation escalated. Asian markets managed to show some resilience, helped in part by China broadly easing lockdown measures.

Fixed income

Bond yields continued to rise for a second consecutive week. High inflation data, tight labour markets, and hawkish statements from the Bank of Canada and European Central Bank drove the yield increase.

Commodities

Oil continued to move higher. Demand for carbon fuels is increasing in Europe due to restricted access to Russian imports. The price of copper declined, partly due to copper supply chain disruptions starting to improve, adding downward pressure on the commodity. Higher U.S. inflation data drove up demand for gold, allowing the precious metal to end the week on a positive note.

Performance (price return)

As of June 10, 2022

Macro developments

Canada – Unemployment rate continues to decrease

StatCan released Canada’s employment data for May. The unemployment rate fell from 5.2% to 5.1%, a record low over nearly 50 years. The Canadian job market is seeing a higher average hourly wage, increasing by 3.9% to $31.12 year over year. Full-time work was a significant driver of employment growth in May, with a shift from part-time to full-time work. The number of people employed full time increased by 0.9%—an increase of 135K jobs. The number of part-time workers decreased by 2.6%, a decrease of 96K jobs. The participation rate stayed flat at 65.3%.

U.S. – Inflation comes in higher than expected; University of Michigan sentiment deteriorates

The Bureau of Labor Statistics released U.S. inflationary figures for May. The year-over-year consumer price index continued to increase, coming in at 8.6%, up from 8.3% the previous month. This is a 40-year high for U.S. inflation. The prices of gas (4.5%) and oil (4.1%) increased. The price of food also contributed to inflation, increasing by 1.2%, compared to a 0.9% increase in April. Core CPI decreased from 6.5% to 6.0% year over year. Month-over-month CPI increased to 1.0% from 0.7% the prior month.

The University of Michigan released its preliminary indicators for June. Similar to another survey released by The Conference Board the previous week, the preliminary June indicators found that consumer sentiment and expectations are deteriorating. The sentiment reading came in at 50.2, down from 58.4. The expectations reading was 46.8, down from 55.2. Expectations are likely low due to worrying inflation data.

International – German industrial production increases; ECB comments on monetary policy path; China’s trade surplus increases; Chinese inflation holds

Destatis released Germany’s industrial production data for the month of April. Month-over-month industrial production fell short of consensus expectations for an increase of 1.0%. The actual outcome was an increase of 0.7%, up from the decline of 3.7% the month prior. Capital goods (0.9%) and intermediate goods (0.4%) were up in April. Consumer goods declined by 1.3%, which was due to non-durable goods production falling by 2.3%. This was offset by an increase of 4.0% in durable goods production. Year-over-year industrial production managed to beat estimates, though it declined 2.2%. This is an improvement from the decrease of 3.1% the month prior.

The ECB Governing Council met to announce the central bank’s monetary policy decision. Interest rates did not change, but the ECB has declared that it will undertake a more hawkish stance to meet the challenge of rising inflation. The inflation target the ECB set is 2.0% but the central bank forecasted that year-over-year inflation will be 6.8% at year end. The Council has stated that rates will rise by 25 basis points in July and that consumers should expect another rate hike in September.

China’s trade surplus increased in May to a surplus of US$78.8 billion, up from US$51.1 billion the month prior. This increase in surplus stems from growth in exports, which increased by 16.9% year over year, compared to growth of 3.9% in April. Economists were not expecting this significant an increase in exports, with year over year exports forecasted to increase 8.0%—less than half of the actual growth. The growth was likely due to China’s zero-COVID strategy being slightly eased during May. It is unlikely that such high growth will be sustained for more than a couple of months. Since lockdowns ended on June 1, we can expect China’s exports to continue growing.

Chinese inflation remained stable in May. Year-over-year CPI came in at 2.1%, with no change from the previous month. Oil and gas continues to be a primary driver of inflation, despite China’s recent ability to get carbon fuels at a discount. Food inflation increased further—up 2.3% month over month, in contrast to 1.9% the month before.

Quick look ahead

Canada – Manufacturing sales (June 14); Housing starts (June 15); Wholesale sales (June 16)

StatCan will release manufacturing and wholesale sales data for the month of April. Manufacturing sales growth was 2.5% and wholesale sales growth was 0.3% in March.

CMHC will release housing starts data for the month of May. Housing starts remained relatively firm in April, coming in at 248K.

U.S. – PPI (June 14); Fed rate decision (June 15); Retail sales (June 15); Empire manufacturing survey (June 15); Housing starts (June 16); Industrial production (June 17)

The Bureau of Labor Statistics will release Produce Price Index data for May. Economists are expecting month-over-month PPI to increase 0.8%, and year-over-year PPI to increase 10.8%.

The U.S. Federal Reserve will be announcing a decision on the Federal Funds rate on June 15. Consensus expectations are for another 50-bp hike.

The Federal Reserve Bank of New York will release May’s Empire manufacturing survey. Economists are expecting an index reading of 4.0. Readings above zero imply business conditions are improving.

The Census Bureau will release May’s retail sales figures. Economists are expecting retail sales growth to start to flatten. Forecasts are averaging growth of 0.1% month over month, down from 0.9% in the prior month. However, economists are expecting core retail sales (retail sales excluding vehicles) to grow further. Core retail sales are forecasted to increase 0.7%, up from 0.6%.

The Census Bureau will release housing starts data for May. Consensus expectations are for housing starts growth to almost remain flat.

The Fed will release industrial production data for May. Economists are expecting industrial production to fall from 1.1% to 0.4%.

International – U.K. industrial and manufacturing production (June 13); China’s industrial production and retail sales (June 14); U.K. interest rate decision (June 16)

The Office for National Statistics will release the U.K.’s industrial and manufacturing production data for the month of April. Industrial production is expected to continue growing, with economists forecasting growth of 1.7% year over year, up from 0.7% growth in March. Manufacturing production is expected to see similar growth, with consensus estimates of 1.8%.

The National Bureau of Statistics will release Chinese industrial production for the month of May. Consensus is expecting a contraction of 1.0%, better than the contraction of 2.9% in the month prior. This is likely due to China’s lockdown restrictions easing from June 1 and manufacturers slowly bringing in more staff to prepare for increased demand.

Chinese retail sales for the month of May will be released on the same day. Economists are expecting Chinese retail sales to continue to decline, since the country was still in lockdown for the month. Year-over-year growth is expected to fall 7.1%.

The Bank of England will be making its interest rate decision on June 16. Expectations are for a 25-bp rate hike.