Weekly Market Pulse - Week ending April 26, 2024

Market developments

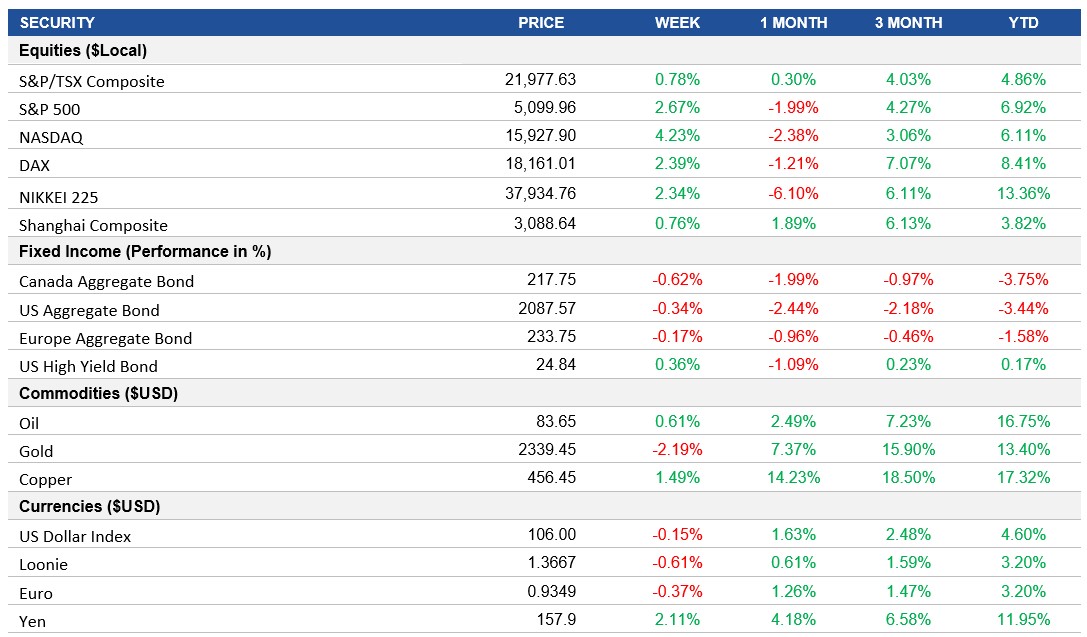

Equities: A rally in the world's largest technology companies, particularly Microsoft and Alphabet, has lifted stocks and provided relief to investors concerned about the economic backdrop and the potential for rate cuts this year. The strong fundamentals and spending on artificial intelligence and cloud computing by big tech companies have reinforced investor confidence, offsetting worries about the macroeconomic environment. The S&P 500 hit 5,100 as the index increased by 2.7% while the Nasdaq was up 4.2%.

Fixed Income: There was some relief as the Federal Reserve's favoured price gauge, the personal consumption expenditures (PCE) index, came roughly in line with estimates, keeping rate cuts on the table for 2024, likely towards the end of the year. The mix of macroeconomic data this week drove global rates higher and bond prices lower this week.

Commodities: Oil prices rose this week, the increase was driven by signs of a tightening physical market, including a drop in U.S. crude stockpiles to the lowest since January and strengthening supply-demand indicators. However, gains were limited by U.S. economic data showing persistent inflation in March, reinforcing concerns about price pressures.

Performance (price return)

Source: Bloomberg, as of April 26, 2024

Macro developments

Canada – Flat Retail Sales in Canada for March 2024

Preliminary data suggests that retail sales in Canada remained unchanged in March 2024, following a 0.1% decrease in February. Sales fell in five of nine subsectors, primarily led by declines at gasoline stations and fuel vendors.

U.S. – U.S. Retail Sales Surge, Moderate Growth for U.S. Economy in Q1 2024, Steady Inflation in U.S. with Slight Increase in Core PCE

The S&P Global U.S. Composite PMI dropped to 50.9 in April 2024, indicating a slight expansion and marking the softest growth since December. Factors contributing to this included slower activity growth, declining new orders, reduced employment, and decreased business sentiment.

The U.S. economy expanded by 1.6% annualized in Q1 2024, lower than the previous quarter and below forecasts. Notable changes included a slowdown in consumer spending and non-residential investment, a decrease in government spending, and a sharp slowdown in exports.

The personal consumption expenditure price index in the U.S. rose by 0.3% in March 2024, with prices for services increasing by 0.4% and goods by 0.1%. Core PCE inflation remained steady at 0.3% monthly, aligning with market expectations.

International – Strong Growth in U.K. Business Activity in April, Eurozone Services Sector Shows Improvement in April, Steady Growth in Japan's Private Sector Activity and Bank of Japan Maintains Interest Rates Amid Economic Outlook Revisions

The S&P Global U.K. PMI Composite Index surged to 54.0 in April 2024, indicating the strongest growth since May 2023. The robust recovery in the service sector offset a marginal decline in manufacturing production, driven by increased new orders and staff hiring.

The Eurozone Services PMI reached 52.9 in April 2024, an eleven-month high, with growth in new orders and employment. Despite rising costs, service sector confidence declined to a three-month low.

The au Jibun Bank Japan Composite PMI rose to 52.6 in April 2024, marking the fourth consecutive month of growth in private sector activity. Despite input cost increases, firms remained confident about future expansion.

The Bank of Japan kept its key short-term interest rate unchanged at around 0% to 0.1% in April 2024. Revisions to the economic outlook included higher CPI projections for FY 2024 and lower GDP forecasts for both 2023 and FY 2024.

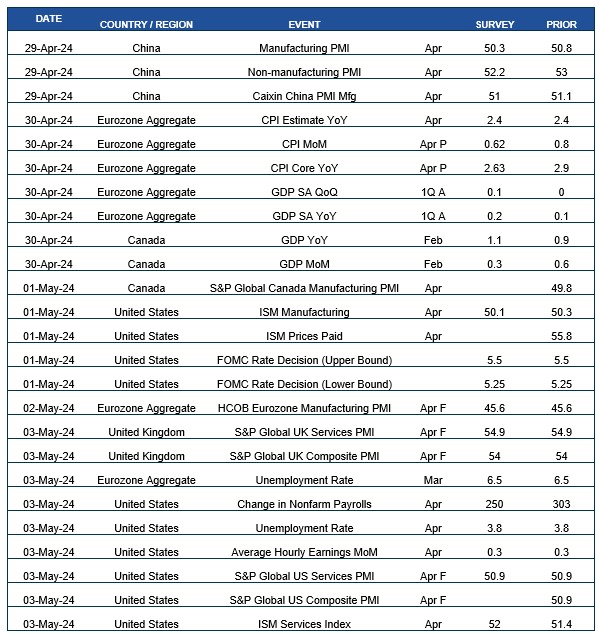

Quick look ahead

As of April 26, 2024