Weekly Market Pulse - Week ending February 16, 2024

Market developments

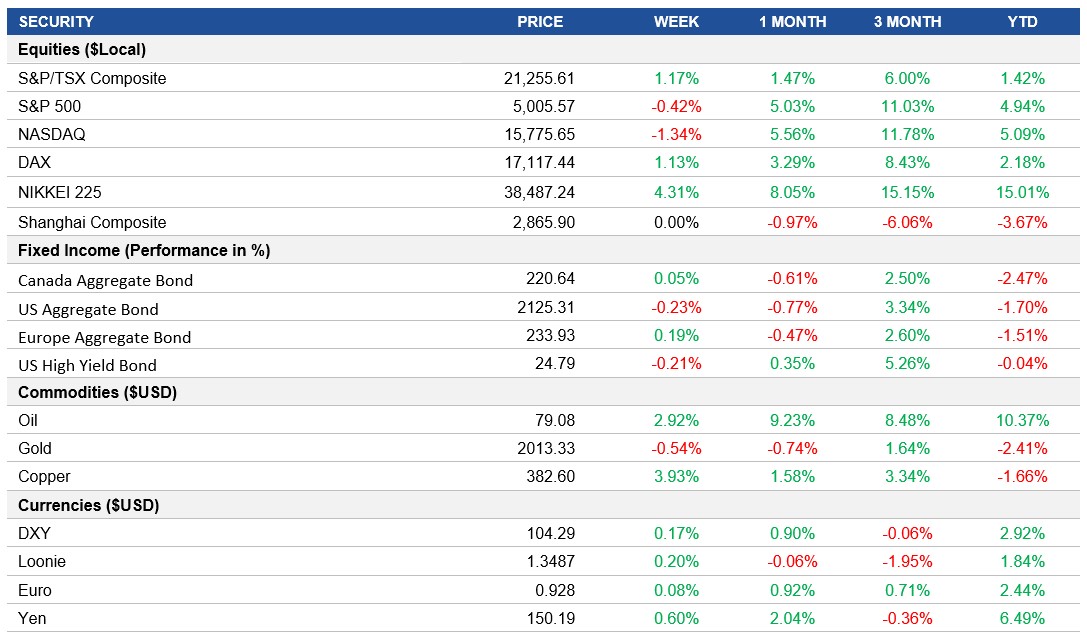

Equities: This week, the S&P 500 experienced a slight decline, closing at 5,005.57, a drop of 0.42%. Despite a run-up to the CPI report, equity markets showed restraint, with the S&P 500 wavering around the 5,000 level amidst mixed signals on inflation and Federal Reserve rate cut expectations. Investors remained cautious, reflecting on the rally's sustainability after consecutive weeks of gains and considering potential consolidation.

Fixed income: The bond market's movements reflect a nuanced view of interest rate expectations and inflation concerns, with investors weighing the impact of Federal Reserve policy on future rate paths. The slight uptick in the Canadian bond market suggests a cautious optimism towards domestic economic resilience, whereas the decline in the U.S. bond market underscores ongoing adjustments to inflationary expectations and speculation around the Federal Reserve's rate trajectory amidst mixed economic signals.

Commodities: Crude oil prices saw a notable uptick, closing the week at $79.08 per barrel, marking a 2.9% increase. This surge in oil prices can be attributed to escalating tensions in the Middle East, balanced against diplomatic efforts aimed at resolving the conflict. Additionally, production cuts from OPEC members and a tight supply scenario contributed to the upward pressure on prices. However, global supply concerns and demand uncertainties, particularly from China, continue to influence market sentiment, keeping oil prices within a constrained range.

Performance (price return)

Source: Bloomberg, as of February 16, 2024

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – U.S. Annual Inflation Rate Falls to 3.1% in January 2024, U.S. Retail Sales Decline 0.8% in January, Decrease in U.S. Unemployment Claims Maintains Labor Market Tightness

The annual inflation rate in the U.S. decreased to 3.1% in January 2024, down from 3.4% in December. This decline was driven by a drop in energy costs, particularly gasoline, utility gas service, and fuel oil. However, prices for food, shelter, new vehicles, apparel, and medical care commodities increased at a softer pace. Core inflation held steady at 3.9% annually.

Retail sales in the U.S. contracted by 0.8% in January 2024, marking the largest decrease since March the previous year. Declines were observed in various sectors, including building materials, garden equipment, miscellaneous store retailers, gasoline stations, and motor vehicles and parts. However, sales increased at furniture stores and food services and drinking places.

The number of people claiming unemployment benefits in the U.S. dropped by 8,000 to 212,000, below market estimates. This reading, coupled with historical tightness in the labor market, gives the Federal Reserve leeway to maintain a hawkish stance. However, continuing claims rose by 30,000, indicating challenges for the unemployed in finding suitable jobs.

International – Eurozone Economy Stagnates in Q4 2023, Japan's GDP Unexpectedly Shrinks in Q4 2023

The Eurozone economy stagnated in the last quarter of 2023, following a contraction in the previous period. Germany's GDP contracted by 0.3%, while France's GDP stalled. Spain and Italy experienced accelerated growth, but overall economic performance remained subdued due to high inflation, borrowing costs, and weak external demand.

Japan's GDP unexpectedly declined by 0.1% in the fourth quarter of 2023, resulting in the country entering a recession for the first time in five years. Private consumption decreased for the third consecutive quarter, while capital expenditures and public investment were muted. However, net trade made a positive contribution to GDP, with exports outpacing imports.

Quick look ahead

As of February 16, 2024