Weekly Market Pulse - Week ending January 27, 2023

Market developments

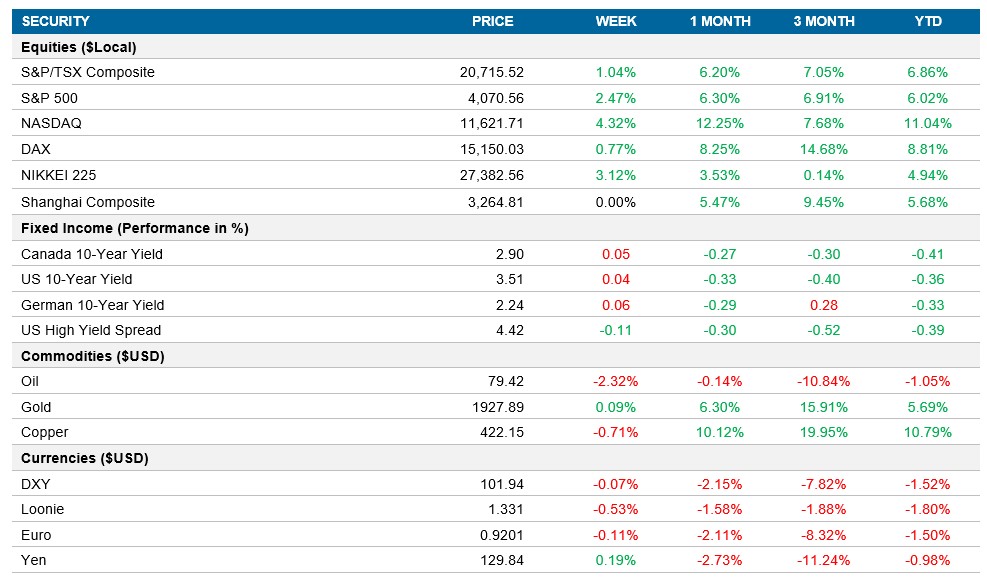

Equities: The US market was resilient this week after disappointing 2023 outlooks from several large companies was overshadowed by speculation of smaller Fed hikes as inflation continues to cool. We saw strong gains from Tesla and Microsoft while big names like Apple, Amazon and Meta are scheduled to report next week. The 2.5% climb in the S&P 500 led it to its 3rd positive week this year, while the Nasdaq is up four weeks in a row to start 2023 and up over 4% this week alone.

Fixed income: There was little movement in U.S treasuries this week with the 10yr closing slightly above 3.5% and the 2yr ~4.2%, as inflation data came in relatively inline on Friday and all eyes are now on the FOMC meeting next week, where a 25bps rate increase is expected. Canadian yield close slightly higher this week, with the 10yr at ~2.9% following the BoC’s expected 25bps interest rate increase.

Commodities: Oil closed down over -2% this week, falling below $80 a barrel as uncertainty over the outlook for the market rose ahead of the OPEC committee meeting next week and the European Union’s ban on Russia oil products. Oil prices did initially climb on Friday on the prospects of China’s reopening and the possibility the U.S economy’s potential for a soft-landing drove prices to $82.50, before eventually rolling over to $79.42 to end the day.

Performance (price return)

As of January 27, 2023

Macro developments

Canada – The Bank of Canada raises overnight rate by 25bps to 4.5%

The Bank of Canada raised interest rates by 25bps, in line with market expectations and signaled the end of this tightening cycle should the economy evolve in line with the bank’s outlook. They commented that households are still feeling the pressure of inflation as food and shelter continued to accelerate. Short term inflation is expected to remain elevated and only projected to come down meaningfully later in the year.

U.S. – U.S GDP expands by 2.9%, PCE prices index rose in line at 0.1% and initial jobless claims came in below expectations at 186K

The U.S economy grew by 2.9% annualized in Q4, ahead of forecasts of 2.6% and lower than the 3.2% seen in Q3. Consumer spending rose 2.1%, missing estimates of 2.3%. Spending on goods increased 1.1%, driven by automobiles and parts, while spending on services slowed to 2.6%. The contribution form net trade declined, as exports fell -1.3% and imports went down 4.6%.

The PCE price index rose by 0.1% MoM in December as services increased by 0.5%, while goods continued to decline at -0.7% and food prices were up 0.2%. The labour market remains tight as initial jobless claims fell by 6K to 186K on the week ending January 21st, below expectations of 205K.

International – Eurozone PMI increased ahead of expectations, U.K PMI fell to 47.8 and Japan PMI rose to 50.8

Eurozone manufacturing PMI increased to 48.8 in January, up from 47.8 in the previous month and above the market expectations of 48.5. New orders decreased at the slowest rate since May and employment accelerated. Supply chain constraints look to be behind us as factories reports unchanged supplier delivery times for the second straight month. Services PMI also came in above market expectations as it rose to 50.7 vs estimates of 50.2, with Technology and Health Care helping drive the expansion.

The U.K composite PMI fell to 47.8 in January from 49 a month ago; missing expectations of 49.1. This data point signaled the fastest rate of decline in business activity since January 2021, due to a weaker service sector performance. Manufacturing production also decreased but was the smallest contraction since July 2022. Improved business activity reflects the hope of a turnaround in 2023 as cost pressures may continue to slow throughout the year.

Japan Composite PMI climbed to 50.8 in January, up from 49.7 a month ago and the highest reading since last October. This result also pointed to the first expansion in private sector activity in three months as services made substantial gains.

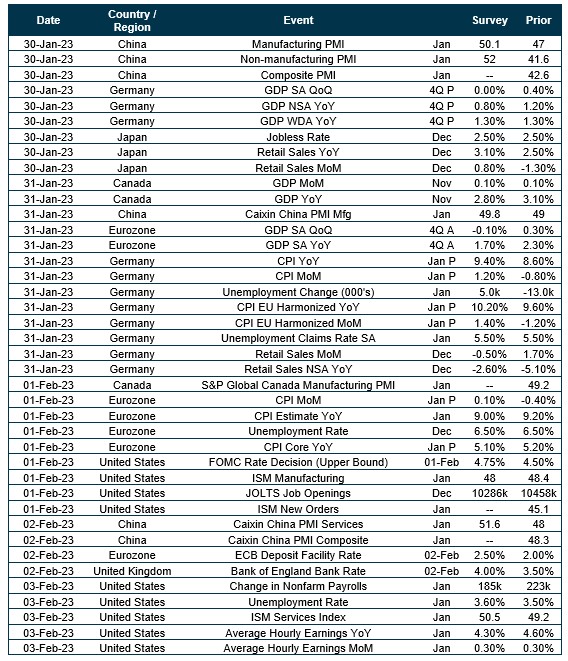

Quick look ahead

As of January 27, 2023