Weekly Market Pulse - Week ending July 5, 2024

Market developments

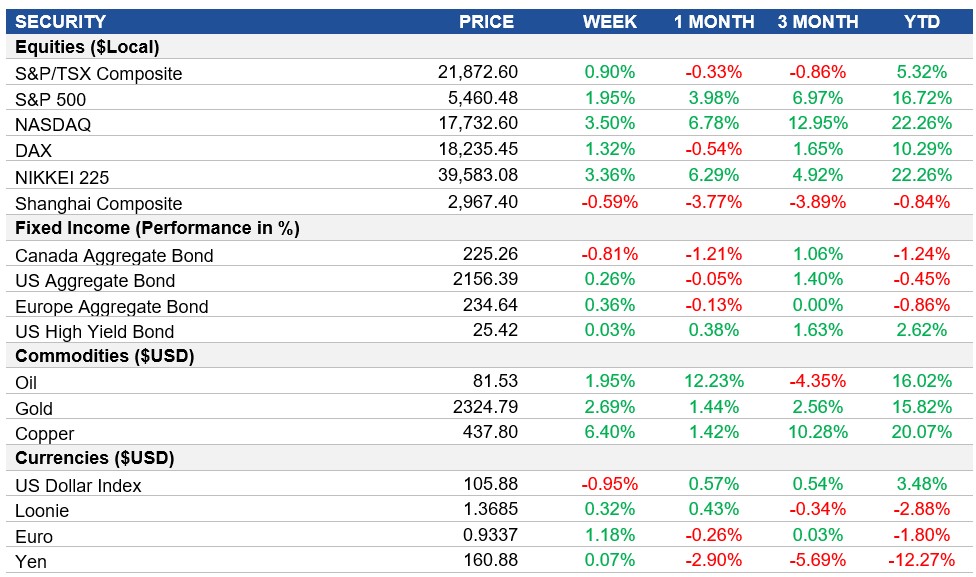

Equities: Even with a short trading week, the U.S. stock market is approaching new all-time highs, with the S&P 500 on track for its 34th record this year. Traders are focusing on potential Federal Reserve rate cuts despite signs of economic slowdowns. Overall, the market is navigating a complex landscape of economic data, policy expectations, and seasonal trends, with investors closely watching for signs that could prompt Fed action.

Fixed Income: June's jobs report showed nonfarm payrolls rising by 206,000, exceeding forecasts. However, the unemployment rate increased to 4.1%, and average hourly earnings cooled. Yields dropped as we closed out the week as this data has strengthened expectations for Fed rate cuts, with some analysts eyeing a potential September reduction.

Commodities: Despite the decline on Friday, oil prices have risen 13% over the past month. This increase is attributed to rising demand during the summer driving season, falling U.S. oil inventories, and restricted supply due to OPEC+ maintaining voluntary supply cuts of 2.2 million barrels per day through the end of September.

Performance (price return)

Source: Bloomberg, as of July 5, 2024

Macro developments

Canada – Persistent Contraction in Canadian Manufacturing, Rising Unemployment in Canada

The S&P Global Canada Manufacturing PMI remained at 49.3 in June 2024, unchanged from May, marking the fourteenth month of contraction. Output and new orders continued to decline due to weak demand, and inventory levels rose as sales were unexpectedly low. Employment dropped for the first time since January, and input costs increased slowly, limiting firms' ability to pass costs to clients. Future output confidence fell to its lowest of the year, reflecting concerns over costs and market conditions amid supply chain delays and rising input prices.

Canada's unemployment rate rose to 6.4% in June 2024 from 6.2% in May, the highest since January 2022, surpassing expectations of 6.3%. This increase aligns with the Bank of Canada's view that higher interest rates impact the labour market significantly, supporting arguments for potential rate cuts. The number of unemployed rose by 42,000 to 1,400,000, while net employment fell by 1,400, contrasting with expectations of a 22,500 increase.

U.S. – Declining U.S. Manufacturing Activity, Sharp Contraction in U.S. Services Sector, Moderate Job Growth in the U.S.

The ISM Manufacturing PMI fell to 48.5 in June 2024 from 48.7 in May, below forecasts of 49.1, indicating a third consecutive month of declining activity. Production and employment contracted, while inventories and backlog of orders decreased faster. New orders shrank less, and price pressures eased. The supplier deliveries index remained in 'faster' territory.

The ISM Services PMI in the U.S. dropped to 48.8 in June 2024, the sharpest decline since April 2020, missing the expected 52.5. The Business Activity Index also fell to 49.6, with new orders and employment declining. Survey respondents reported flat or lower business activity, easing inflation, but higher commodity costs and transportation challenges affecting supplier delivery performance.

The U.S. economy added 206K jobs in June 2024, slightly below the revised 218K in May and above forecasts of 190K. May's figures were revised down sharply from 272K, and April's by 57K to 108K. Job gains were seen in government, health care, social assistance, and construction, while losses occurred in manufacturing, retail trade, and professional services. The unemployment rate rose to 4.1%, the highest since November 2021.

International – Eased Inflation in the Eurozone, Steady Eurozone Unemployment, Slower Growth in China's Private Sector

The annual inflation rate in the Eurozone eased to 2.5% in June 2024, matching market forecasts, after rising to 2.6% in May. Prices for food, alcohol, tobacco, and energy rose at a slower pace, while non-energy industrial goods and services inflation remained steady. The CPI rose 0.2% month-on-month. Core inflation, excluding energy, food, alcohol, and tobacco, stayed at 2.9%, defying forecasts of 2.8%. Inflation varied across major economies, easing in Germany, France, Spain, and Ireland, but rising in Italy and the Netherlands.

The unemployment rate in the Eurozone remained at an all-time low of 6.4% in May 2024, unchanged from April. The number of unemployed individuals increased by 38,000 to 11.078 million. Youth unemployment stood at 14.2%. Spain had the highest unemployment rate at 11.7%, followed by France at 7.4% and Italy at 6.8%, while Germany had the lowest at 3.3%.

The Caixin China General Composite PMI dropped to 52.8 in June 2024 from May's 54.1. Despite this, it marked the eighth month of growth, with manufacturing output growth accelerating but services easing. New orders expanded at the slowest pace in four months, and employment shrank across both sectors. Input price inflation remained unchanged, and output prices moderated, mainly due to slower service sector price increases. Confidence weakened to a five-month low, with policy support needing further consolidation to address market confidence and demand challenges.

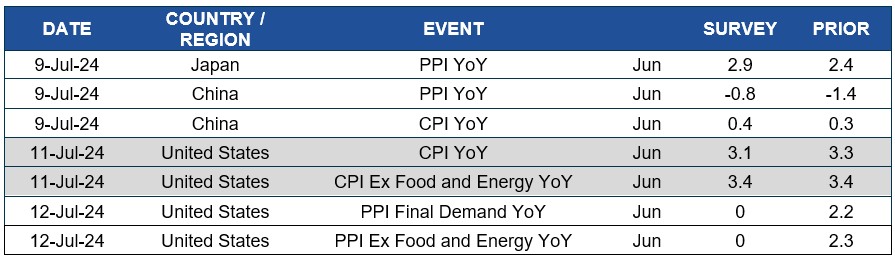

Quick look ahead

As of July 5, 2024