Weekly Market Pulse - Week ending March 1, 2024

Market developments

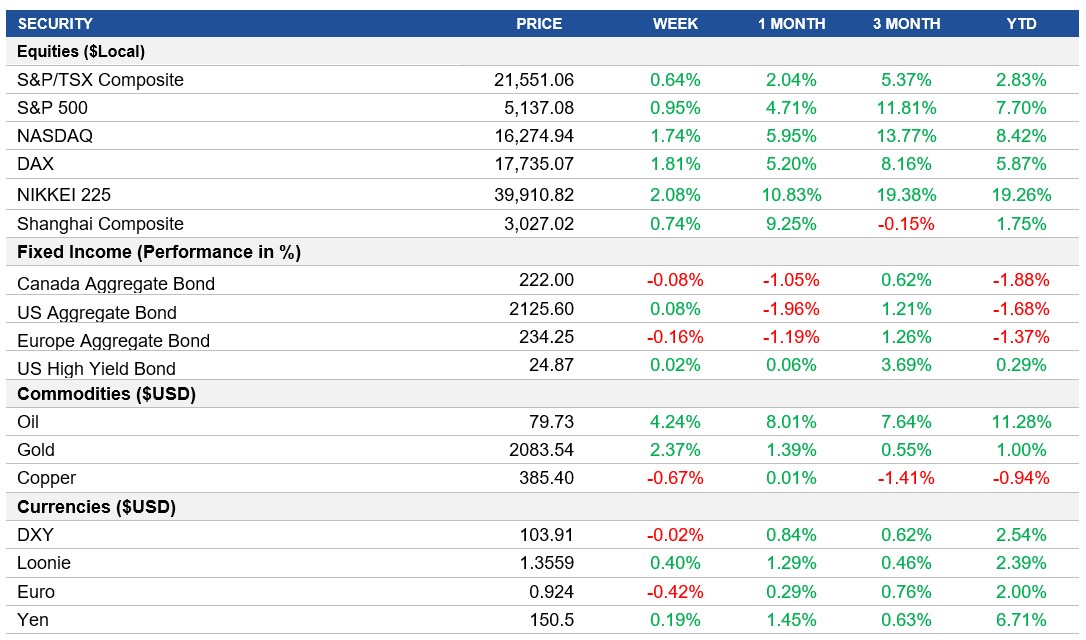

Equities: Tech stocks rallied, with the S&P 500 surpassing 5,100 and the Nasdaq rising about 1.7%. Wall Street firms have revised their S&P 500 forecasts upward, reflecting a stock market rally that has exceeded expectations. Despite concerns about consumer confidence and same-store sales, some retailers are expected to perform well, indicating consumer preference for deals on branded goods. During the fiscal first quarter, Canada's major banks experienced a boost in trading revenue, offsetting concerns about larger loan-loss provisions, and increasing credit stress. Five out of six of the country's largest lenders exceeded earnings expectations, driven primarily by robust capital-markets results.

Fixed income: Bond prices rose on Friday as disappointing factory data and declining consumer sentiment increased expectations for interest rate cuts, however global bonds ended the week relatively flat. U.S. two-year yields continued to decline after remarks from Federal Reserve officials hinted at a dovish stance. The ISM manufacturing index showed a faster contraction in February, leading to concerns about the manufacturing industry's stability. Treasuries saw an increase in demand, with yields falling across the curve, while traders slightly increased bets on a Fed rate cut in June.

Commodities: Crude oil prices rose to $79, up 4.4% this week as tensions in the Middle East escalated. Traders are also focused on any news regarding potential extensions to production cuts that expire at the end of March.

Performance (price return)

Source: Bloomberg, as of March 1, 2024

Macro developments

Canada – Canadian Economy Expands by 0.2% in Q4 2023 and S&P Global Canada Manufacturing PMI Rises to 49.7 in February

The Canadian economy grew by 0.2% in the fourth quarter of 2023, rebounding from a revised 0.1% contraction in the previous period. Higher exports, particularly of crude oil and crude bitumen, contributed to the expansion. However, business investment declined for the sixth time in the last seven quarters, while household spending edged up.

The S&P Global Canada Manufacturing PMI increased to 49.7 in February 2024 from 48.3 in the previous month. Although this marks the tenth consecutive contraction in factory activity, it is the slowest rate in the current sequence. The improvement was driven by a slower contraction in new orders, despite subdued client demand.

U.S. – U.S. Economy Expands by 3.2% in Q4 2023

The U.S. economy grew at an annualized rate of 3.2% in the fourth quarter of 2023, slightly below the initial estimate of 3.3%. Private inventories subtracted from growth, while consumer spending, government spending, exports, and imports increased more than anticipated. Non-residential investment was also revised higher, contributing to the overall growth rate.

International – Eurozone Inflation Rate Declines to 2.6% in February 2024, Eurozone Unemployment falls to 6.4% and Japan's Annual Inflation Rate Falls to 2.2% in January 2024

Consumer price inflation in the Eurozone dropped to 2.6% year-on-year in February 2024, down from 2.8% in the previous month. This decrease was driven by lower energy prices, moderated price rises for services, food, alcohol, tobacco, and non-energy industrial goods. However, the core inflation rate remained above forecasts at 3.1%.

In January 2024, the unemployment rate in the Eurozone decreased to 6.4%, reaching its lowest level on record, down from 6.5% in December, in line with market expectations. The number of unemployed individuals dropped by 34,000 to 11.009 million. Among the major Euro Area economies, Spain had the highest jobless rate at 11.6%, followed by France at 7.5% and Italy at 7.2%. Germany recorded the lowest unemployment rate at 3.1%.

Japan's annual inflation rate declined to 2.2% in January 2024, the lowest figure since March 2022. This decrease was attributed to lower food prices and easing costs for healthcare, culture, recreation, communication, and miscellaneous items. However, prices accelerated for transport and education, while the core inflation rate fell to a 22-month low of 2.0%.

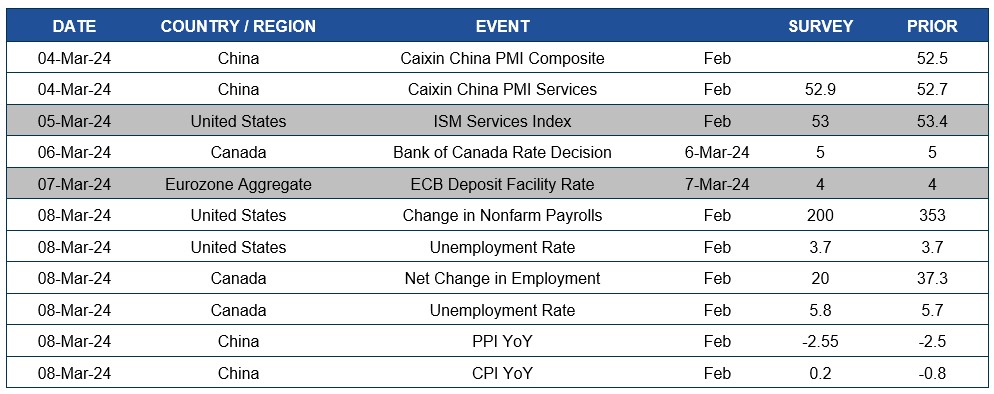

Quick look ahead

As of March 1, 2024