Weekly Market Pulse - Week ending March 15, 2024

Market developments

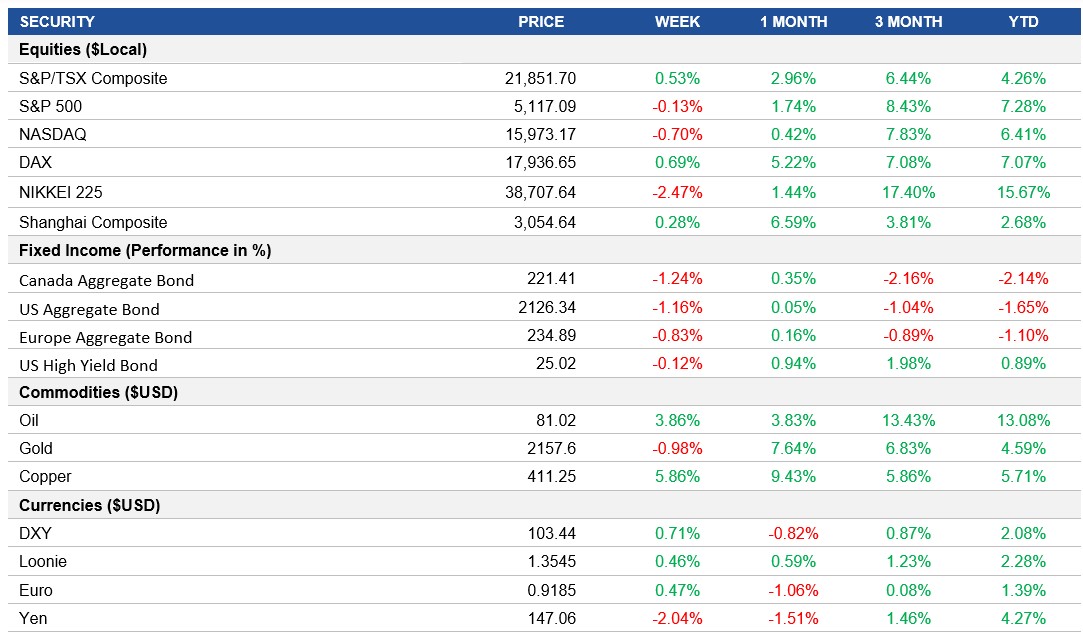

Equities: The S&P 500 ended the week slightly down, as tech stocks sold off, coinciding with a significant Friday options expiration with approximately $5.3 trillion in options set to expire, adding to the market's volatility. With earnings season effectively in the rear-view mirror, attention has pivoted away from corporates and onto the Fed. Canadian markets continued their climb with another positive week as materials and energy contributed, on the back of strong gains in oil and copper.

Fixed income: Despite concerns over inflation and the Federal Reserve's upcoming policy meeting, economists do not expect a shift in forecasts for interest rate cuts. The week was marked by confusion and debate surrounding inflation and economic slowdown, with expectations of three rate cuts in 2024. This narrative is somewhat consistent across Canada and Europe, with expectations for a June rate cut becoming increasingly more likely. The mixed data this week led to an increase in yields across most developed markets and a drop in bond prices.

Commodities: Oil prices remained near a four-month high, settling around $81, marking a 3.75% gain for the week. The rally was fueled by extended production cuts from OPEC and its allies, pushing the market towards a deficit. This surge followed a drop in U.S. stockpiles, the IEA's forecast of a supply deficit for the year, and geopolitical tensions heightened by Ukraine's attack on a Russian refinery.

Performance (price return)

Source: Bloomberg, as of March 15, 2024

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – U.S. Inflation Increases to 3.2%, U.S. PPI Rose Above Expectations and U.S. Retail Sales Increases Less Than Expected

In February 2024, the U.S. annual inflation rate increased to 3.2%, exceeding forecasts. Energy costs dropped less than expected, while prices for food, shelter, and medical care rose at a softer pace. Transportation prices continued to rise sharply.

The U.S. PPI for final demand rose by 0.6% in February 2024, driven by a surge in goods prices, primarily energy costs and food prices. Services prices also increased, with transportation and warehousing services leading the rise. Core inflation slightly exceeded expectations.

U.S. retail sales increased by 0.6% in February 2024, showing a potential slowdown in consumer spending compared to a larger decline in January. Sales rose in sectors like building materials, motor vehicles, and electronics, while furniture and clothing sales declined. Core retail sales remained flat.

International – China CPI Increases by 0.7%, China PPI Falls Again and Japan’s Economy Expands by 0.4%

China's CPI rose by 0.7% year-over-year in February 2024, marking the first increase in consumer inflation since August, driven by robust spending during the Lunar New Year holiday. Food prices declined less, while non-food inflation accelerated. Core CPI increased by 1.2%, the highest since January 2022.

China's PPI fell by 2.7% year-over-year in February 2024, the 17th consecutive month of contraction. Costs of means of production and consumer goods decreased, reflecting ongoing economic challenges despite government support measures.

The Japanese economy expanded by 0.4% in a turnaround from previous contractions, driven by business spending and net trade. However, private consumption remained weak due to price pressure and stagnant wage growth, while government spending decreased after a prior increase.

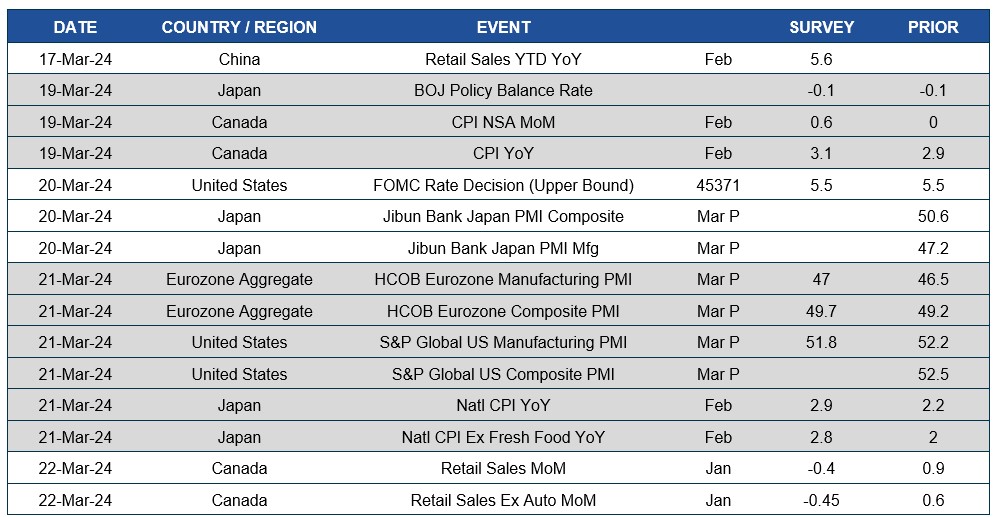

Quick look ahead

As of March 15, 2024