Weekly Market Pulse - Week ending March 22, 2024

Market developments

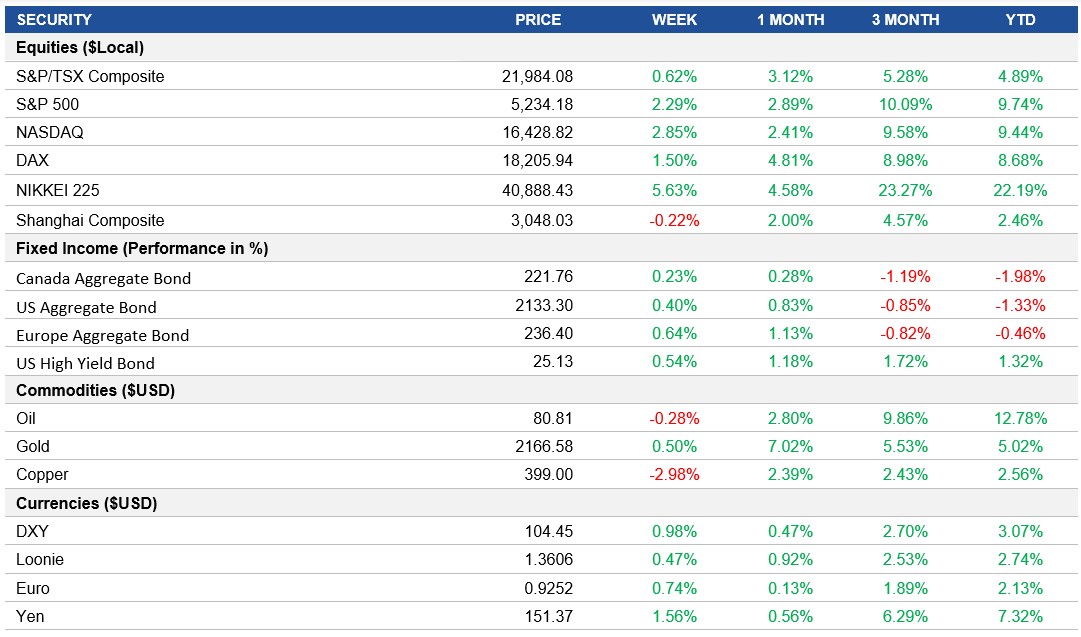

Equities: Stocks experienced a slight decline on Friday, halting the week's rally triggered by the Federal Reserve's commitment to potential interest rate cuts this year. Despite the day's decline, the S&P 500 is poised for its most significant weekly gain in 2024, reflecting optimism surrounding the Fed's intention to guide the economy towards a soft landing. Strategists raised their outlook on U.S. stocks, citing justifications for the recent rally and downplaying concerns of a market bubble. They noted that while inflation remains a risk, it is not yet a significant concern for central banks or markets.

Fixed income: Leading up to the Fed's meeting, there were concerns about a potential reduction in interest rate cut forecasts. However, the Fed maintained its previous projections, fueling optimism about continued economic and corporate growth which pushed U.S. treasury yields lower this week. The better-than-expected inflation print in Canada also helped move Canadian treasury yields lower, leading to a strong week for bonds across North America.

Commodities: Oil prices experienced fluctuations throughout the week, ultimately ending slightly lower on Friday but still managing to secure a small gain for the week. This was influenced by the failure of a United Nations Gaza ceasefire resolution and escalating conflicts between Russia and Ukraine.

Performance (price return)

Source: Bloomberg, as of March 22, 2024

Macro developments

Canada – Canadian Inflation Slows, Canadian Retail Sales Show Marginal Growth

The annual inflation rate in Canada dropped to 2.8% in February 2024, lower than expected, giving the Bank of Canada more room to consider looser monetary policy. Prices fell for cellular and internet services while food inflation cooled. Gasoline prices rose due to global oil costs, while mortgage rates and shelter prices increased.

Preliminary data suggests a slight 0.1% increase in Canadian retail sales for February 2024, following a 0.3% decline in January. Motor vehicle sales decreased, but core retail sales slightly rose, particularly in sporting goods and garden equipment stores.

U.S. – Fed Maintains Rates Amid Positive Economic Outlook, U.S. Business Activity Moderates

The Federal Reserve kept the fed funds rate steady in March 2024, planning for three interest rate cuts in the year. GDP growth forecasts were revised upwards, while inflation and unemployment rate projections showed mixed changes over the next few years.

The U.S. Composite PMI dipped slightly to 52.2 in March 2024, indicating continued business activity growth, albeit at a slower pace. Service sector growth slowed while manufacturing production expanded. Input and output price inflation increased, but business confidence surged.

International – Eurozone Business Activity Near Stabilization, Bank of Japan Raises Interest Rates Amid Economic Growth, Japanese Inflation Accelerates, Led by Energy Prices, Chinese Retail Sales Exceed Expectations

Eurozone Composite PMI rose to 49.9 in March 2024, signaling a near-stabilization of business activity, with service sector output increasing for the second consecutive month. Manufacturing continued to decline, albeit at a slower pace. Input cost and selling price inflation slowed, while business confidence improved.

The Bank of Japan increased its key short-term interest rate to around 0% to 0.1% in March 2024, halting eight years of negative rates. This decision follows sustained inflation and significant wage hikes, with the bank adjusting its asset purchasing programs.

Japan's annual inflation rate rose to 2.8% in February 2024, driven by base effects and increased energy prices. Culture and recreation prices accelerated, while inflation slowed for several other categories. Core inflation reached a four-month high, aligning with market forecasts.

China's retail sales grew by 5.5% year-on-year in January-February 2024, surpassing expectations and marking the 13th consecutive month of growth. Sales increased across various sectors, including grain, jewelry, and cars, indicating continued consumer spending growth.

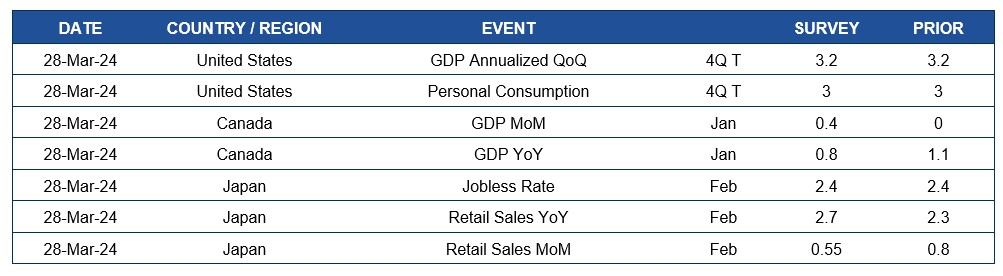

Quick look ahead

As of March 22, 2024