Weekly Market Pulse - Week ending March 29, 2024

Market developments

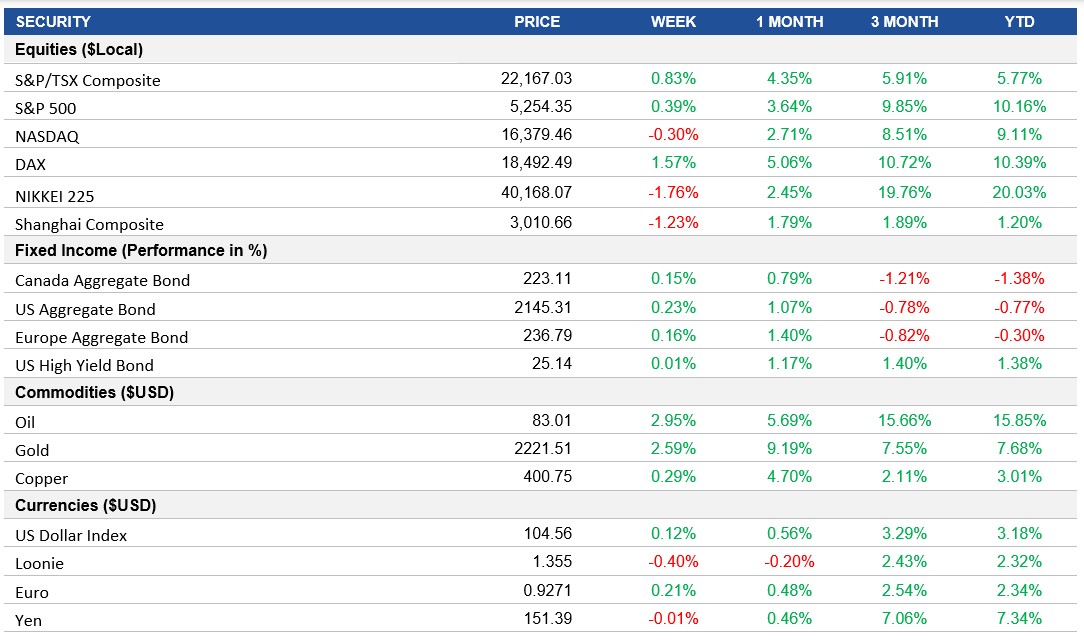

Equities: The S&P 500 Index saw modest weekly gains, propelling equities to their most impressive first-quarter performance since 2019, bolstered by the latest U.S. GDP figures. These numbers fueled speculation that the Federal Reserve might achieve a soft economic landing, contributing to a market environment that led to a 13% quarterly surge in the S&P500 (CAD), notably outshining the tech-heavy Nasdaq.

Fixed Income: The fixed income arena remained dynamic, with minor fluctuations reflecting the market's response to evolving economic indicators and central bank signals. Although the different Bond indexes experienced a slight increase, the bond market's reaction to the Federal Reserve's messages and the broader economic data was measured. This cautious approach in the bond market underscores the intricate balance between seeking yield and navigating the uncertainties tied to monetary policy and economic growth trajectories.

Commodities: In a volatile week, crude oil prices overcame initial setbacks from rising U.S. inventories, closing with a 2.95% gain. The increase in stockpiles momentarily dampened the tight supply outlook, but geopolitical tensions and OPEC+'s production cuts provided upward momentum

Performance (price return)

Source: Bloomberg, as of March 29, 2024

Macro developments

Canada – Economy Grows 0.6% in January

Canada experienced better-than-expected GDP growth of 0.6% in early 2024, driven by the resolution of public sector strikes in Quebec and broad-based gains across various sectors. This robust economic performance surpassed the Bank of Canada's projections, leading to speculation about the timing and necessity of future interest rate adjustments.

U.S. – Durable Goods Orders Rebound Signaling Investment Recovery

In February 2024, durable goods orders rebounded by 1.4%, driven by a significant increase in aircraft and motor vehicle orders, indicating a recovery in business equipment investment. The improvement reflects the positive effects of decreasing corporate borrowing costs and a more favorable investment environment. With core orders also rising and continued strength in IT equipment investment, signs point to a sustained recovery in the business investment sector.

International – UK Enters Technical Recession

The UK economy entered a technical recession in the latter half of 2023, as confirmed by the Office for National Statistics, with GDP falling 0.3% in the final quarter after a 0.1% decline previously. However, there are signs of economic resilience: January saw a 0.2% month-on-month GDP growth, and improvements in retail sales, business sentiment, and mortgage approvals indicate potential recovery.

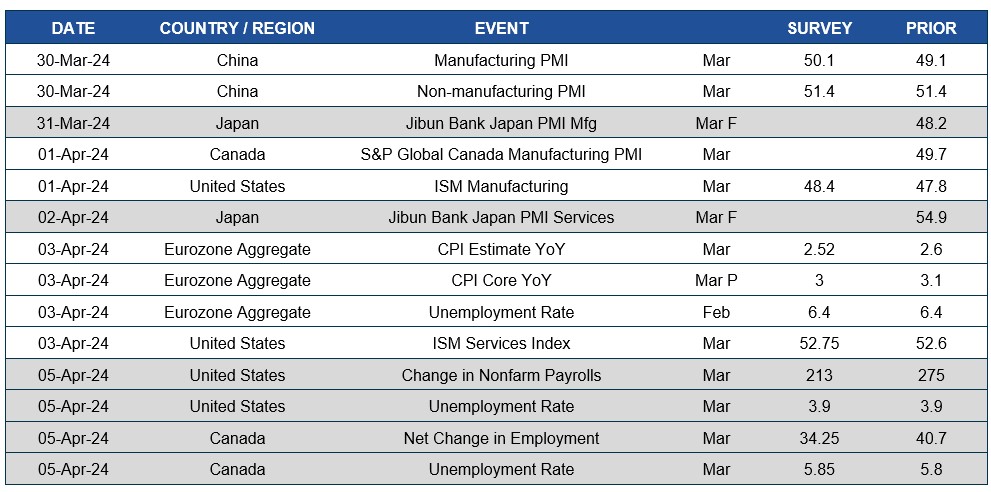

Quick look ahead

As of March 29, 2024