Weekly Market Pulse - Week ending November 18, 2022

Market developments

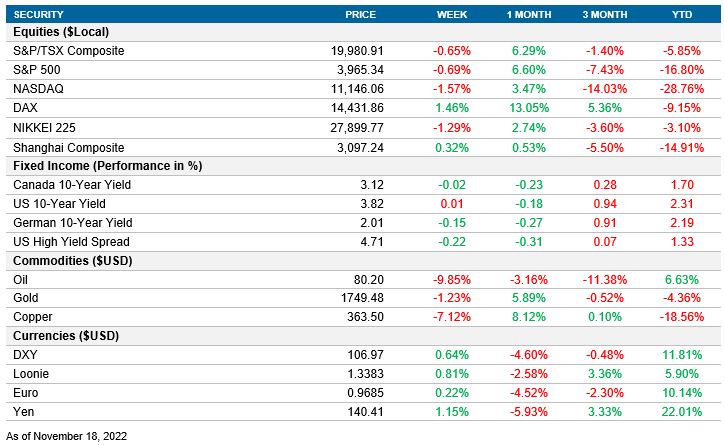

Equities: The lower-than-expected PPI data drove the S&P 500 above 4000, before James Bullard’s comments pushed rates higher and the U.S market lower. The S&P 500 ended the week down less than 1% and didn’t have more than 1% +/- move any day this week as volatility took a breather despite Fed comments and the turmoil in the crypto market.

Fixed income: We saw some volatility in rates following the better-than-expected CPI release last week. On Tuesday, the PPI data came in lower-than-expected driving 10yr US rates below 3.7% before Fed of St-Louis President, James Bullard, urged policy makers to raise rates further, stating the level will need to be higher and drove rates back above 3.8% to finish the week.

Commodities: Crude oil fell to a six-week low on Friday as the over 24,000 COVID cases in China raise concerns over their demand. Commodity markets remain under pressure as China’s zero-Covid restrictions have supressed economic growth. Some looser quarantine rules could suggest that end is in sight, however the country’s economy remains weak, pressuring the demand for oil.

Performance (price return)

As of Nov 18, 2022

Macro developments

Canada – CPI inline with market estimates and flat month over month

Canada’s annual inflation was at 6.9% for the month of October, remaining flat month over month and inline with market estimates. Price growth from fuel and housing offset the slower inflation in for food as continued rate hikes and higher interest rates lifted mortgage costs by 11.4%. Food came in at 10.1% vs 10.3% as grocery costs slowed.

U.S. – Retail sales surged by 1.3%

Retail sales in U.S. climbed by 1.3% month over month in October, the strongest increase in eight months and ahead of market estimates by 1%. Auto sales were up 1.3% as supply chain constraints continue to ease and rising gasoline costs pushed gas station sales up by 4.1%. Excluding autos and sales, retail sales were up 0.9% as data points like food services, drinking places and furniture all moved higher. On the other side, electronics, sporting goods, and general merchandise were down month over month. The data pointed to a more resilient consumer, despite high levels of inflation and rising borrowing costs.

International – Japan’s economy contracts by 1.2%, China’s retail sales decline by 0.5%, UK’s CPI jumps to 11.1%

Japan’s economy contracted by 1.2% during Q3, well below the market forecast of 1.2% growth. This was the first contraction in a year and pointed to weak private consumption amid rising cost pressures, a slowdown in business investment and growth in imports as the yen slid.

China retail sales declined by 0.5% year over year in October, compared to a 2.5% gain last month as COVID infections and restrictions weighed on consumption. Cosmetics, clothing, furniture, and home appliances were the largest detractors as well as softer gains in automobiles and oil products.

Inflation in the UK increased by 11.1%, a 1% increase compared to September and above market forecasts of 10.7%. This month’s reading was the highest level since 1981, with upward pressure coming from housing and household services (namely gas). Inflation would have risen to 13.8% had the government not stepped in to limit the price of household energy bills. Prices for food and beverages were also higher, while transportation cost slowed sharply to 8.9% vs 10.6% the month prior.

Quick look ahead

Canada – Retail Sales (November 22)

Statistics Canada will release new Retail Sales data on Tuesday. This early indicator will inform the market how the contractive monetary policy impacts private consumption. After higher-than-expected August growth of 0.7%, the market consensus is that Canadian Retail Sales declined 0.5% during September.

U.S. – Manufacturing PMI (November 23)

In the coming week, the release of a new Manufacturing PMI will serve as an early indicator to assess the economy’s expansion. Despite the last reading of 50.4 being in the expansion zone (above 50), the index is expected to continue downward, forecasting a value of 50 for November.

International – Euro Area’s PMI (Wednesday 23), U.K.’s PMI (November 23)

In addition to Canada and U.S., the S&P will also release Euro Area’s and U.K.’s Manufacturing PMI. The European Purchasing Managers’ Index is expected to continue with its downward trend, with an anticipated decline to 46 from 46.4. In line with the rest of the countries, the market consensus is that U.K.’s manufacturing PMI will decline to 45.8 from 46.2. This negative confidence from U.K.’s Purchasing Managers complements the idea from Chancellor Hunt, who believes that the U.K. is currently in a recession.