Weekly Market Pulse - Week ending October 7, 2022

Market developments

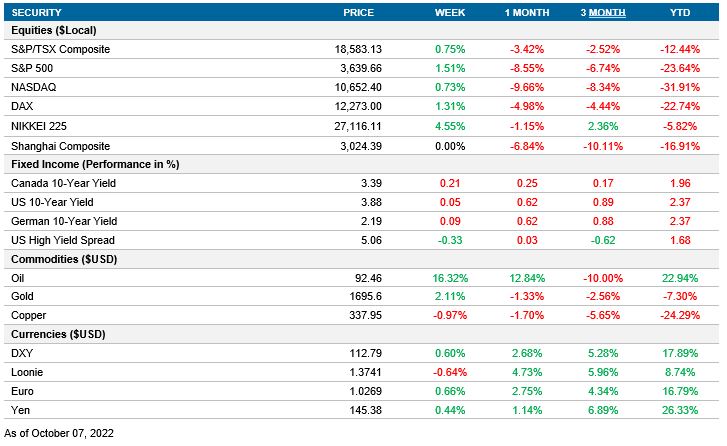

Equities: After ups and downs, the U.S markets still ended their week in the green, following three weeks of negative performance. Markets started the week in the positive, in reaction to declining ISM PMI data and a weak JOLTS report. However, the week ended o with a notable decline following a stronger than expected job market from the US labour report.

Fixed income: After many weeks where Equities and Bonds were correlated, this week they decoupled with a positive return for equities and a negative one for government bonds. In particular, the Canadian bond yield curve increased after the BoC Governor gave a hawkish speech.

Commodities: Crude Oil saw its biggest weekly gain since March 2022. This week's price movement was caused by OPEC+’s decision to cut oil production, increasing global supply concerns.

Performance (price return)

As of Oct 7, 2022

Macro developments

Canada – Manufacturing PMI Increases; Unemployment Rate decreases

S&P Global released Canada’s Manufacturing PMI index for the month of September. The index increased to 49.8, from 48.7. Despite the improvement, the index remains in the contraction zone (lower than 50), which indicates that the manufacturing sector deteriorated during September. The latest report reflected a fall in output and new orders for third month in a row.

Canada’s employment increased during the month of September, for the first time in four months. The net change in employment was 21.1K, above the 20K expected and a change in direction from the previous month’s decrease of 39.7k. The unemployment rate was 5.2% in September, down from 5.6% in August.

U.S. – ISM Manufacturing PMI decreases, Unemployment Rate Decreases

The Institute for Supply Management released September U.S. Manufacturing PMI. The index fell to 50.9 from 52.8 in August. This brings the index close to the neutral zone of 50 and is now at its lowest value since May 2020. New Orders, Employment, and New Export Orders are the PMI components that contracted during September. This fall contradicts the recently released S&P Manufacturing index. However, the size of the expansion in the later index was muted.

The Bureau of Labor Statistics’ employment data for September showed the unemployment rate decreased by 0.2% to 3.5%, but the participation rate declined to 62.3%. The change in Nonfarm Payrolls surprised to the upside, increasing by 263k compared to 315k in July. U.S. employment growth remains strong, and the data bolstered market expectation that the Fed will do a 75-bp hike in November.

International –Euro Area’s Retail Sales Decreases

Eurozone retail sales data for August contracted 0.3%, in line with expectations. However, the biggest surprise of the release was the revision of July’s data, that decreased from a MoM expansion of 0.3% to a contraction of -0.4%. Overall, the YoY Retail Sales contracted by 2.0%, confirming that the European economy is decelerating. Since the start of the war in Ukraine, consumer confidence has decreased in Europe, achieving close to record low levels in the four largest European economies.

Quick look ahead

Canada – No notable releases

No notable releases for the week.

U.S. – CPI (October 13); Retail Sales (October 14)

The Bureau of Labor Statistics (BLS) will release September’s CPI data. Economists are expecting inflation to decelerate. Forecasting a reading of 8.1% year over year and 0.2% month over month. Given that the Fed is data-dependent, September’s release will be critical for the interest rate decision at the next FOMC meeting on November 2.

The BLS will publish September’s PPI on September 12. After a decline in August, this new data will confirm if inflation pressures are moderating. The consensus expectation is MoM contraction of 0.2%.

The U.S. Census Bureau will release September’s monthly advance sales for Retail and Food Services. After a 0.3% increase last month, market consensus expects an increase of 0.2%

International –China’s CPI (October 14)

The National Bureau of Statistics (NBS) will release China’s CPI and PPI data for September. In August, the year-over-year CPI fell to 2.5%, after a 2-year high of 2.7%. The market consensus inflation rate for September is 2.8%, still below the 3% central bank target. In addition, the NBS will also publish September’s PPI.