Monthly Market Insights - Data and opinions as of June 30, 2020

Stocks post strong quarterly gains as global economy bottoms

Following the quickest bear market descent in history, stocks rebounded sharply in the second quarter fuelled by unprecedented stimulus measures, a rally in technology stocks, and general optimism among investors. June was highlighted by encouraging signs that the economic downturn was turning the corner, marked by improving global business activity and surprise gains in Canada and U.S. labour markets. But investor sentiment waned as a wave of anti-racism protests spread across the U.S. and around the world. In addition, a much dreaded but somewhat expected development: a resurgence of new coronavirus cases in certain U.S. states as they reopen, potentially further delaying the path to economic recovery.

The NEI perspective

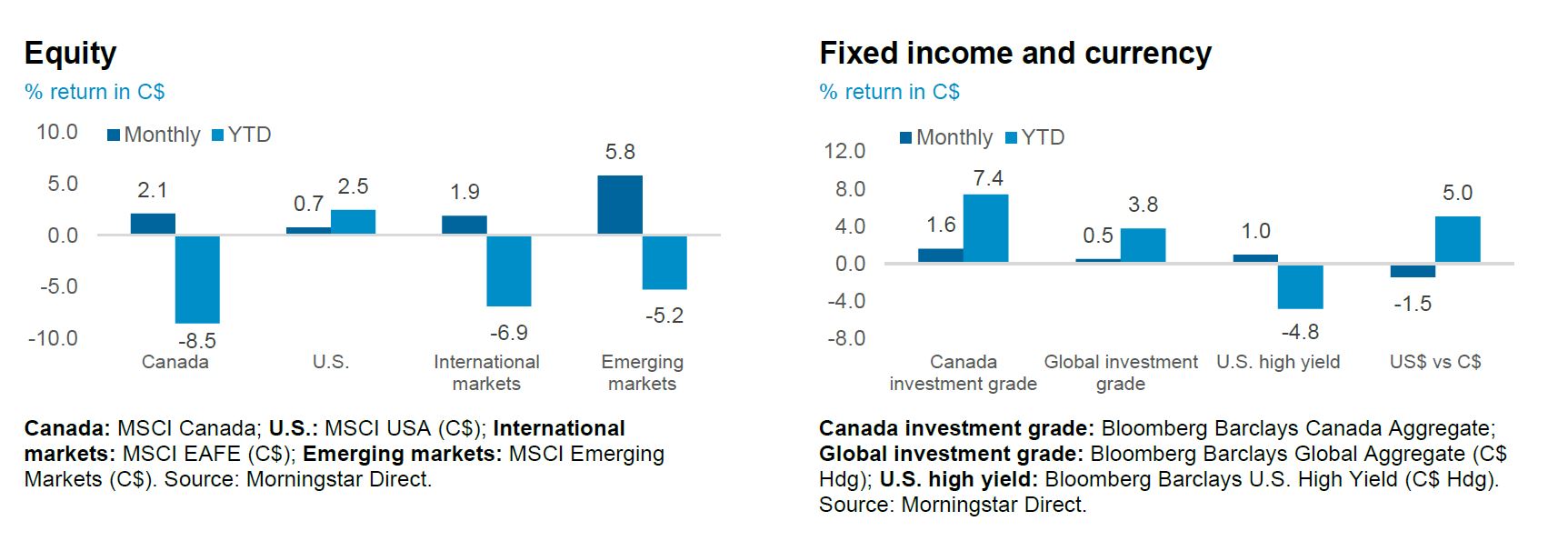

Strong quarter for stocks. U.S. stocks had their best quarterly return since 1998 and the S&P/TSX Composite return was the best in over a decade based on encouraging economic data. Both leading and lagging indicators point to a bottom where the worst of global economic data is likely behind us. The pace of recovery, however, remains uncertain.

Re-openings leading to surge in new cases. As feared, pockets of new infections are rising in some re-opened U.S. states. As healthcare systems have had time to ramp up capacity, this is not a huge concern for markets for the time being. Should the trend continue, we may see the economic recovery stretched out even longer.

Continued caution. Economic data seems to have finally started catching up to the equity market rally, but we wouldn’t be overly optimistic. Increases in new infections, weak fundamentals, and U.S.-China tensions are some of the reasons we continue to stay cautious in the near term.

As of July 2020

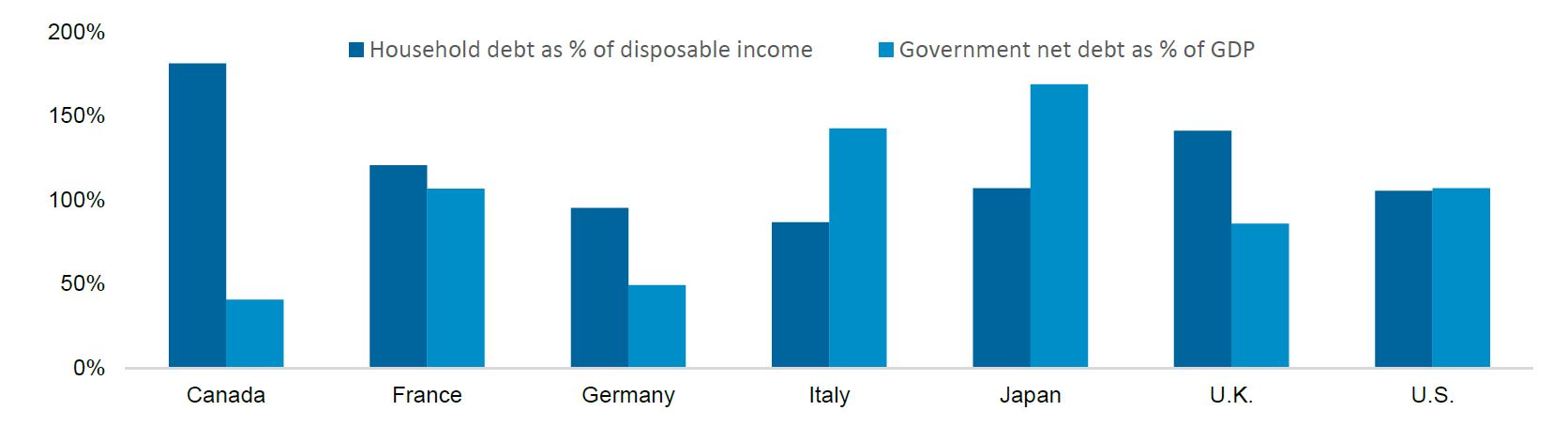

Global debt levels rise?

In an attempt to offset the economic impact of the pandemic, governments around the world have injected incredible amounts of stimulus into their economies. Central banks are running asset purchase programs, buying up the excess debt issued by their governments to fund their stimulus measures. Year-to-date, central bank balance sheets from England, Japan, the U.S., and Europe have grown by US$5.6 trillion, an increase of 37% from the end of 2019. The coordination of fiscal and monetary policy seems to be working so far, helping restore market confidence as well as aiding displaced individuals and small businesses.

Government and household debt across G7 countries

Source: IMF and OECD. Government debt figures are as of April 2020 (latest). Household debt figures are as of December 2019 (latest).

Canada is in somewhat of an odd position with the lowest level of net government debt and yet the highest level of household debt. Highly leveraged households are more vulnerable to economic shocks, although risks are somewhat mitigated for now by record low interest rates. Canada is experiencing one of the worst economic downturns in history, ravaged by both the pandemic and a weak energy sector. As of March 2020, private consumption accounted for 57% of Canada’s nominal GDP, and therefore it is critical that households receive the needed support.

To date, the federal government has announced more than $107 billion, totalling more than 3.5% of GDP, in direct support for individuals and businesses, as well tax deferrals. Despite a credit rating downgrade last month to AA+, the Government of Canada continues to have a strong balance sheet, which means there is ample room for additional fiscal programs to support individuals and businesses. A higher debt burden can create problems down the road, but for now, it is a necessary act to help bring the economy out of this slump.