Weekly Market Pulse - Week ending June 30, 2022

Market developments

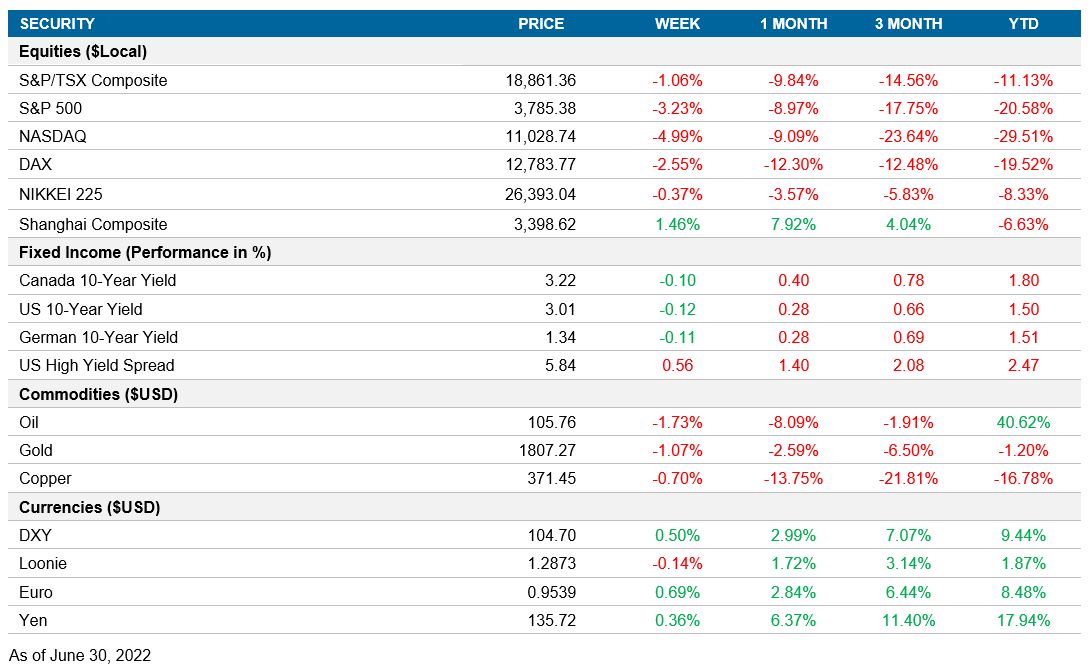

Equities:

U.S. equities resumed their negative trend this week. Areas of weakness included the information technology and consumer discretionary sectors. Canadian equities also suffered as oil prices continued their retracement. China stayed positive, alongside a slowly recovering economy.

Fixed income:

Bond yields continued falling for the second week in a row. The recession narrative, alongside developing expectations that inflation may have peaked, continues to gain traction among investors.

Commodities:

Oil prices continued dropping as economic growth concerns weighed on demand prospects. Gold remained weak. Copper has remained weak as well as it is considered a proxy for global growth expectations.

Performance (price return)

As of June 30, 2022

Macro developments

Canada – GDP growth for April in line with estimates

StatCan published Canada’s GDP data for April. GDP data was in line with consensus estimates, growing 0.3% month over month and 5.0% year over year. Mined goods (3.3%), food services (4.6%), and entertainment services (7.0%) were behind most of the month-over-month growth. The most significant detractors were real estate services (-0.8%), finance/insurance services (-0.7%), and public administration services (-0.4%). StatCan estimates through its preliminary analysis that GDP unexpectedly contracted by 0.2% in May.

U.S. – Durable goods orders rise; Consumer confidence falls

In the Census Bureau’s preliminary release of May’s durable goods orders, there was a major surprise on the upside with the actual figure coming in at 0.7%, compared to consensus forecasts of 0.1% growth. April’s figure was revised downward to 0.4%. Transportation new orders were up 0.8%, which can be attributed to the large 8.1% increase in new orders for defence aircraft. Defence capital goods saw a sizable growth in new orders of 2.6%, alongside shipments growth of 2.5% and an unfilled orders contraction of 0.1%. The shipments and unfilled orders metrics suggest defence supply chains are starting to see improvements. Core durable goods orders (which exclude transportation) also managed to come in at 0.7%, up from 0.2% the previous month.

The Conference Board released their consumer confidence survey findings for June. The index fell into contractionary territory with a reading of 98.7, down from 103.2 the prior month. Negative index performance is currently attributed to steadily decreasing optimism from rising rates and high inflation. The present situation index fell 0.3 points to 147.1 but the future expectations index fell 7.3 points to 66.4.

International – Japanese retail sales rise while industrial production falls; Chinese PMI expansionary; Eurozone unemployment decreases

The Ministry of Economy, Trade and Industry released May’s Japanese retail sales data. Retail sales continued to see growth, with surprises on the downside. Retail sales grew by 3.6% year over year, below consensus estimates of 4.0%, and 0.6% month over month, below forecasts of 1.0%. The demand for motor vehicles continues to stay low, with motor vehicle sales dropping by 7.4% month over month. Wholesale textile demand fell sharply, with sales contracting by 3.7% month over month. Growth in retail apparel sales is also starting to flatten, with a figure of 5.2% month over month, down from 13.0% the previous month. Demand for fuel is starting to increase, with sales growth of 2.5% month over month, while fuel sales experienced contractionary levels or no growth in the prior three months. Overall, much of the growth in retail sales can be attributed to the trickling in of pent-up demand from pandemic restrictions on business hours that were lifted in March.

The Ministry of Economy, Trade and Industry had its preliminary release of Japanese industrial production for May. Industrial production fell with a large surprise on the downside. Month-over-month production contracted by 7.2% and year-over-year production contracted by 2.8%. Supply chain issues stemming from China’s lockdown hit Japanese factories. Excess parts inventories held by many factories were depleted in April, causing most factories to slow down or pause production due to a lack of materials. Low production figures will likely continue until Chinese industrial production manages to expand further.

The National Bureau of Statistics released China’s June Purchasing Manager’s Index data. Chinese PMI figures have reached expansionary territory, with a composite index value of 54.1. The index was carried by the services industry after pandemic restrictions were rescinded on June 1. The manufacturing index was 50.2, whereas the non-manufacturing index was 54.7. Business expectations have reached optimistic levels for both sectors, alongside assumptions that new orders will have large increases. The backlog of orders was contractionary for both sectors. Employment improved within both sectors but remained contractionary. The employment situation will likely continue to improve as the Chinese economy rebounds.

Eurostat publicized the eurozone’s unemployment figures for May. April’s figures were revised downwards to 6.7%, and the unemployment rate continued to decrease during May—coming in at 6.6%. Spain (13.1%) and Italy (8.1%) continue to have the largest unemployment rates in the eurozone. France’s unemployment rate was above the eurozone figure, holding stable at 7.2%, and Germany’s unemployment rate remains low at 2.8%. Smaller European countries (aside from Sweden) were a primary contributor to the decrease in eurozone unemployment.

Quick look ahead

Canada – Employment data (July 8)

StatCan will release employment data for the month of June. During May, the unemployment rate decreased to 5.1%. Record low unemployment, alongside wage hikes, may put upwards pressure on inflation if this trend continues.

U.S. – Employment data (July 8)

The U.S. Department of Labor will release June’s employment data. Unemployment held stable at 3.6% for the last two months and economists are expecting this trend to continue. Similar concerns to Canada regarding the unemployment rate are prevalent in the U.S. as well.

International – Eurozone CPI (July 1); Eurozone retail sales (July 6); Germany’s industrial production (July 7); China’s PPI (July 8); China’s CPI (July 8)

Eurostat will release preliminary Consumer Price Index data for June. Consensus is projecting inflation to increase 0.7% month over month and 8.5% year over year. The aggregate eurozone region faced steadily increasing inflation throughout 2022, prompting European Central Bank President Christine Lagarde to reaffirm that the ECB will raise rates at the following two meetings.

Eurostat will release the eurozone’s retail sales figures for May. Economists are expecting month-over-month growth of 0.6% and a year-over-year contraction of 0.1%. During April, retail sales saw a month-over-month contraction of 1.3% and year-over-year growth of 3.9%. Fuel sales accounted for most of the year-over-year growth, with fuel sales growing by 14.6% year over year.

Destatis will publish Germany’s industrial production data for the month of May. During the previous month, industrial production increased by 0.7% month over month but fell by 2.2% year over year. Consensus is bearish on German industrial production, with forecasts expecting production to contract by 0.3% month over month and 2.6% year over year.

The National Bureau of Statistics will release China’s PPI data for the month of June. China’s Producer Price Index has had a downward bias throughout 2022, with the last release having a figure of 6.4%.

Chinese CPI data for the month of June will be released alongside the PPI release. Economists are expecting inflation figures of 2.5% year over year. Last month, Chinese inflation came in at 2.1% year over year. Chinese inflation remained low due to access to cheaper supplies of carbon-based fuels and due to reduced demand for goods and services during the lockdown. Economists are expecting inflation to increase alongside increasing demand for goods and services since measures were lifted on June 1.