Weekly Market Pulse - Week ending April 14, 2023

Market developments

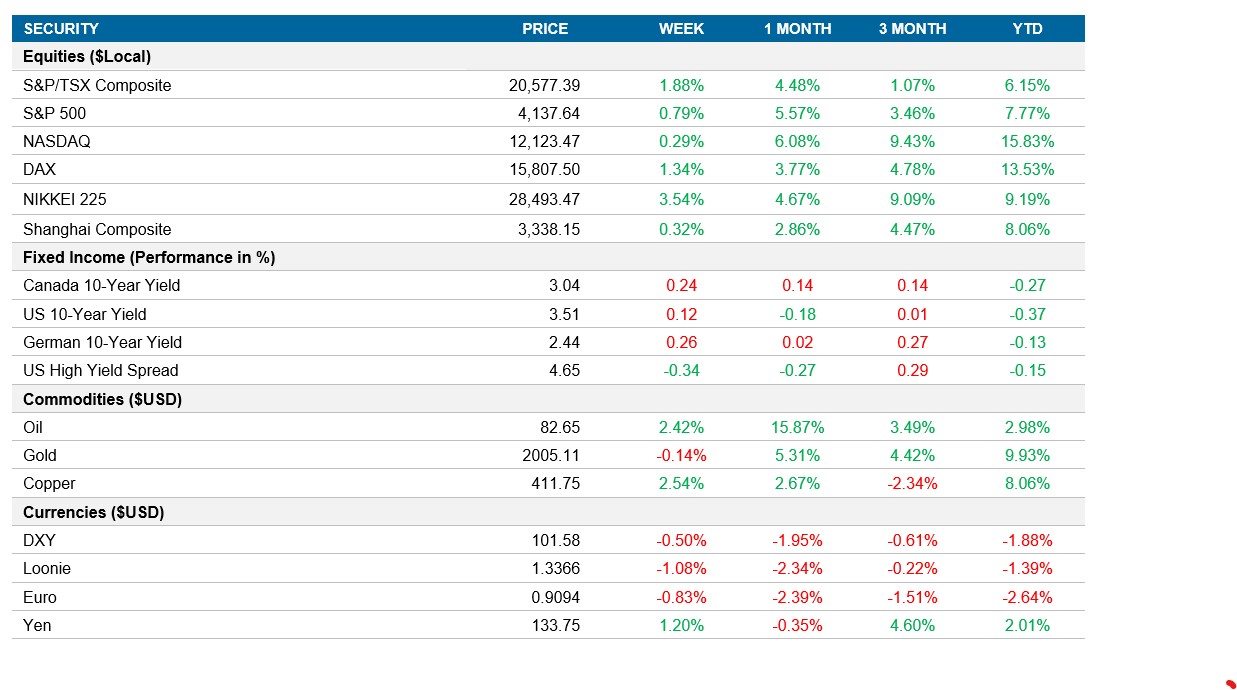

Equities: This week, the Nasdaq stocks were positive, but underperformed the broader U.S. market as traders increased bets that the Federal Reserve could raise interest rates at least once more this year. The Nasdaq fell by 0.3% and the S&P 500 also slid by 0.3%, trimming its weekly advance. On the other hand, financials outperformed Friday with JPMorgan Chase & Co. and Citigroup Inc. leading the charge after stronger than expected earnings. The assurance about the sector's health and an increase in deposits drove the big banks higher. The bank sector remains in focus next week with Charles Schwab and State Street Corp set to report on Monday. Investors will be looking for signs of health from Schwab, which has plunged roughly 40% this year as rising rates drove a spike in unrealized losses at the brokerage. Bank of America Corp., Goldman Sachs Group Inc, Netflix and Tesla also report next week.

Fixed income: Swap traders increased their bets for a rate increase by June causing treasury yields to rise on Friday., The 2yr rate jumped to a weekly high of 12 bps to trade around 4.1% and the 10yr went up to 3.5%. Inflation expectations also jumped in April with consumers expecting prices to climb 4.6% on an annual basis. This movement suggests that investors are becoming less optimistic about the economy in the short term while remaining positive in the long term.

Commodities: Oil futures finished higher on Friday, posting their fourth straight weekly gain, after the International Energy Agency warned that OPEC+ production cuts would lead to a larger and earlier crude oil deficit in 2023 than previously expected. The IEA report also highlighted the demand surge from China, and the gap between global oil supply and demand is projected to be two million barrels a day by the third quarter of this year. Although Saudi Arabia and other major oil producers announced plans to cut production, Goldman Sachs sees the report as roughly neutral for oil prices due to the bullish analysis of US supply constraints and the large fall in March preliminary commercial stocks offsetting the slight downgrade to demand and the slight upgrade to non-OPEC supply.

Performance (price return)

As of April 14, 2023

Macro developments

Canada – Bank of Canada Holds Interest Rate Steady at 4.5%

The Bank of Canada decided to keep its overnight target rate unchanged at 4.5% in its April 2023 meeting and reiterated its intention to monitor economic data for future decisions on the policy rate. The central bank expects inflation to decelerate from 5.2% in February to 3% by mid-2023 and to reach the target rate of 2% by the end of 2024. The bank has revised its GDP growth estimate to 1.4% for this year, 1.3% for 2024, and 2.5% for 2025.

U.S. – U.S. Annual Inflation Rate Falls to 5%, Retail Sales Drop in March by More Than Expected

According to the March 2023 CPI report, the annual inflation rate in the U.S. decreased to 5%, the lowest since May 2021, due to lower food prices and energy costs. Used car and truck prices declined, while shelter prices continued to increase. The CPI edged up 0.1%, below expectations of 0.2%, with higher shelter prices offsetting a fall in energy costs. Core CPI increased 5.6% on the year and 0.4% on the month. The Fed is likely to push ahead with a final 25bp interest rate hike at its next policy meeting in early May due to the lack of significant easing in core non-shelter services inflation and rebounding core goods prices. Despite the moderation in shelter cost pressures, core services prices were boosted by a resurgence in travel services prices.

Retail sales in the U.S. fell 1% month-over-month in March of 2023, which was worse than market forecasts of a 0.4% drop. The biggest declines were seen in sales at gasoline stations, general merchandise stores, building materials and garden equipment, electronics and appliances, clothing, motor vehicle dealers, and furniture. Sales at food and beverages stores edged 0.1% lower. On the other hand, sales rose 1.9% at non-store retailers and 0.1% at food services and drinking places. The core retail sales, which exclude automobiles, gasoline, building materials, and food services, went down 0.3%. This indicates cost pressures and rising interest rates are weighing on consumers' willingness to spend

International – China's March 2023 Inflation Rate Unexpectedly Drops to 0.7%, Eurozone Retail Sales Fall for Fifth Consecutive Month

China's inflation rate unexpectedly slowed to 0.7% in March 2023, compared to a market consensus of 1.0% based on February's reading. The drop was attributed to easing costs of both food and non-food, with food inflation falling to a 10-month low due to a steeper drop in the cost of fresh vegetables despite a faster rise in pork prices. Non-food prices also continued to ease, linked to further declines in the cost of transport and housing. However, inflation for health remained unchanged, while education costs accelerated. Core consumer prices, excluding food and energy, rose 0.7% year-over-year, and monthly consumer prices dropped 0.3%, below estimates of a flat reading

Eurozone retail trade fell by 0.8% month-on-month in February 2023, in line with market expectations and marking the fifth consecutive month of contraction on an annual basis. The decline was largely driven by a decrease in sales for food, drinks, tobacco, non-food products, and automotive fuel. Meanwhile, online trade rose by 2.6%, ending a four-month period of decline. The subdued domestic demand across the Eurozone has been attributed to factors such as high inflation, rising borrowing costs, and concerns over a potential recession.

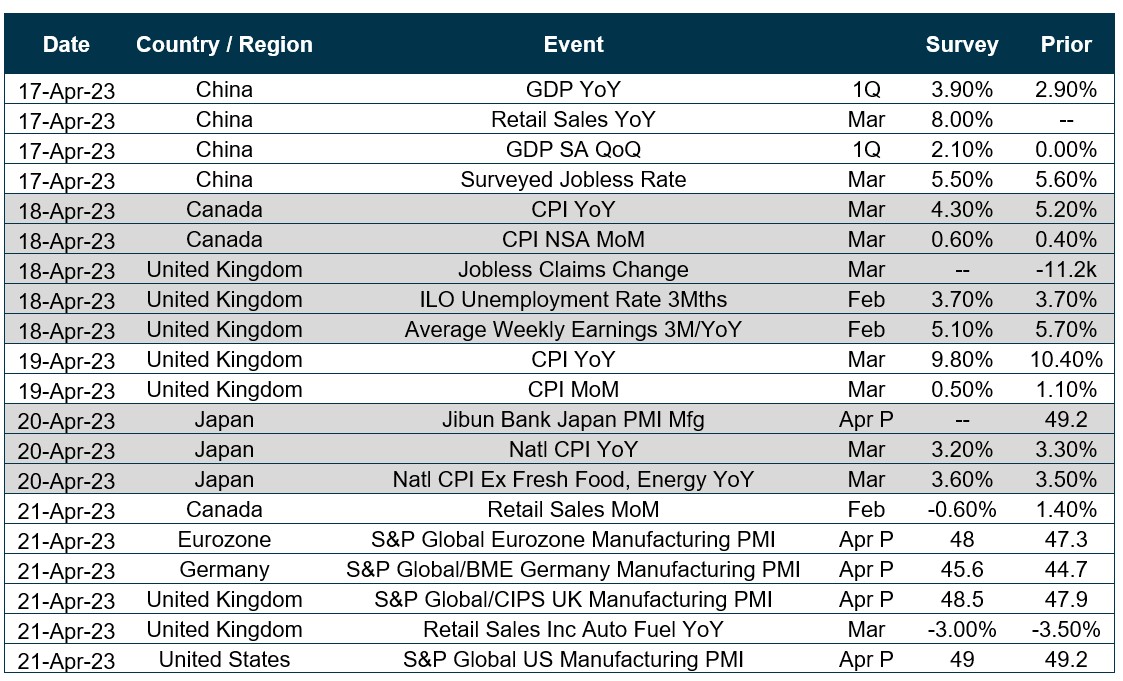

Quick look ahead

As of April 14, 2023