Weekly Market Pulse - Week ending April 28, 2023

Market developments

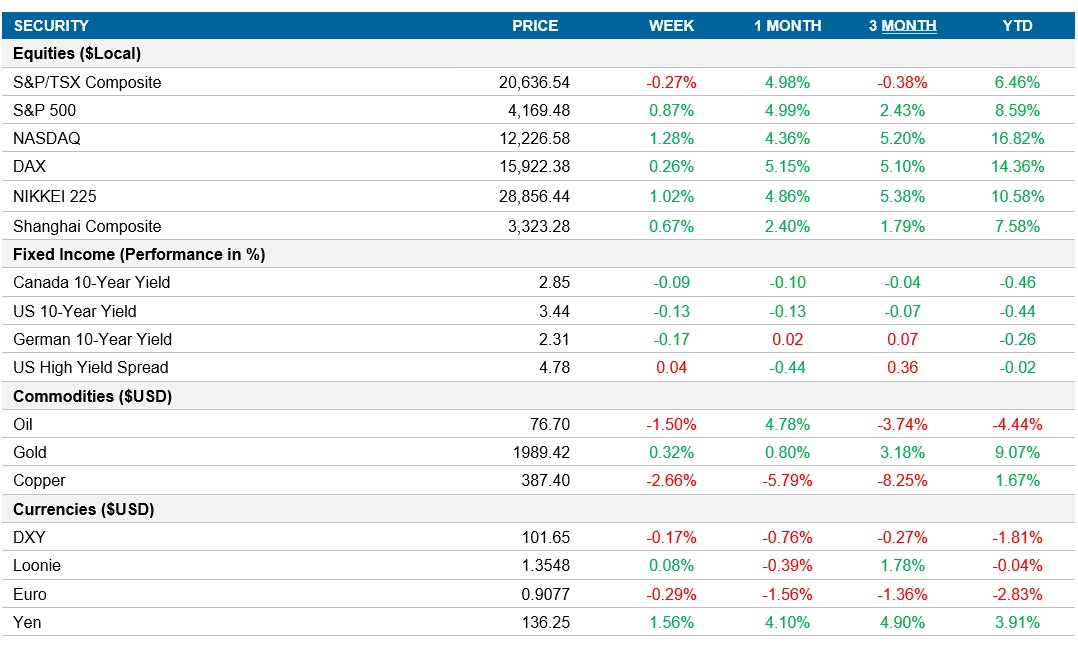

Equities: U.S. equities continued their rally on Friday with the S&P 500 gaining 0.8% (0.9% for the week) due to better-than-expected earnings from Exxon and Intel. Earlier gains were hampered after midday fluctuations on calls for broad changes to bank rules by Federal Reserve officials. The Nasdaq rose 0.7%, weighed down by Amazon’s 3.4% loss after a warning about growth in its key cloud computing business, and First Republic Bank fell ~40% after reports of FDIC receivership. Investors are concerned about the uncertainty of Federal Reserve interest-rate hikes after fresh inflation data showed a rise in the personal consumption expenditures price index. U.S. equities are on track to end the month 1.2% higher.

Fixed income: On Friday, Treasuries saw gains, driven by European rates. Intermediate and long-dated yields fell approximately 9 basis points, leading to a flattened curve. The German inflation rate slowed, easing the chances of a 50bps ECB rate hike at the next policy meeting, causing the European bond rally to accelerate. The U.S. 10-year yields ended at 3.44%, near the low end of the 3.37% - 3.57% weekly range. The Fed's policy expectations remained unchanged, with a quarter-point rate increase anticipated by mid-year.

Commodities: Oil futures finished strongly on Friday, causing a month-on-month increase in U.S. prices, based on expectations of tighter supplies. Supporting prices, speculation of a rescue for the struggling First Republic Bank helped counteract banking issues affecting the economic outlook and energy demand prospects. A monthly report showed that U.S. petroleum demand was at its highest since November 2022, while production was the lowest since December 2022. Analysts suggest that this week's crude futures gains filled a gap left in early April after Saudi Arabia and OPEC+ announced additional production cuts. However, Russia's export figures have raised doubts about whether it has truly reduced production as it announced.

Performance (price return)

As of April 28, 2023

Macro developments

Canada – Mixed Results for Canadian GDP in March

The Canadian economy saw a 0.1% month-over-month decline in March 2023, as gains in public sector, professional, scientific & technical services, and administrative & support, waste management & remediation services were offset by losses in retail & wholesale trade and mining & quarrying (except oil and gas). However, in February 2023, the GDP increased by 0.1%, following a 0.6% expansion in January. Both goods-producing and services-producing industries increased by 0.1%, with 12 of 20 industrial sectors reporting gains.

U.S. – U.S. Economic Growth Slows to 1.1% in Q1 2023

According to a preliminary estimate, the U.S. economy grew at an annualized rate of 1.1% in Q1 2023, slower than the 2.6% expansion in the previous quarter and lower than market expectations of 2%. This was the weakest expansion since Q2 2022, due to the slowdown of business investment growth, declining inventories, and rising interest rates that continued to impact the housing market. Residential fixed investment contracted for the 8th consecutive period, while private inventory investment subtracted 2.3 percentage points from GDP. Despite high inflation, consumer spending growth accelerated to 3.7%, while public spending increased at a faster rate of 4.7%. Net external demand also contributed positively to the GDP, with exports rising more than imports.

International – Eurozone Economy Grows by 0.1% in Q1 2023, Germany's inflation eases to 7.2% in April, Japan's inflation rate slightly drops in March 2023

A preliminary estimate showed that the Eurozone economy grew by 0.1% in Q1 2023, after being flat in the previous quarter, but missed market expectations of a 0.2% expansion. The economy was affected by the fastest policy tightening by the European Central Bank in over 20 years, rising energy and food prices, and weakening confidence. Germany did not register any growth in Q1, while the economies of France, Italy, and Spain did expand.

Germany's consumer price inflation decreased to 7.2% YoY in April 2023, down from 7.4% in the previous month and slightly below market expectations, due to smaller increases in food and services costs. However, energy inflation rose to 6.8%, up from 3.5% in the previous period. The EU-standard harmonized index of consumer prices also decreased slightly to 7.6% in April but remains well above the European Central Bank's target of 2.0%

Japan's inflation rate slightly decreased to 3.2% in March 2023, down from 3.3% in the previous month, but still above the Bank of Japan's target of 2%. The drop was mainly due to a slower increase in transportation costs and a faster drop in fuel, light, and water charges. Inflation remained unchanged for housing, clothes, education, and miscellaneous goods, while prices continued to rise for furniture, household utensils, and medical care. Additionally, food costs surged the most since September 1980. On a monthly basis, consumer prices rose by 0.3%.

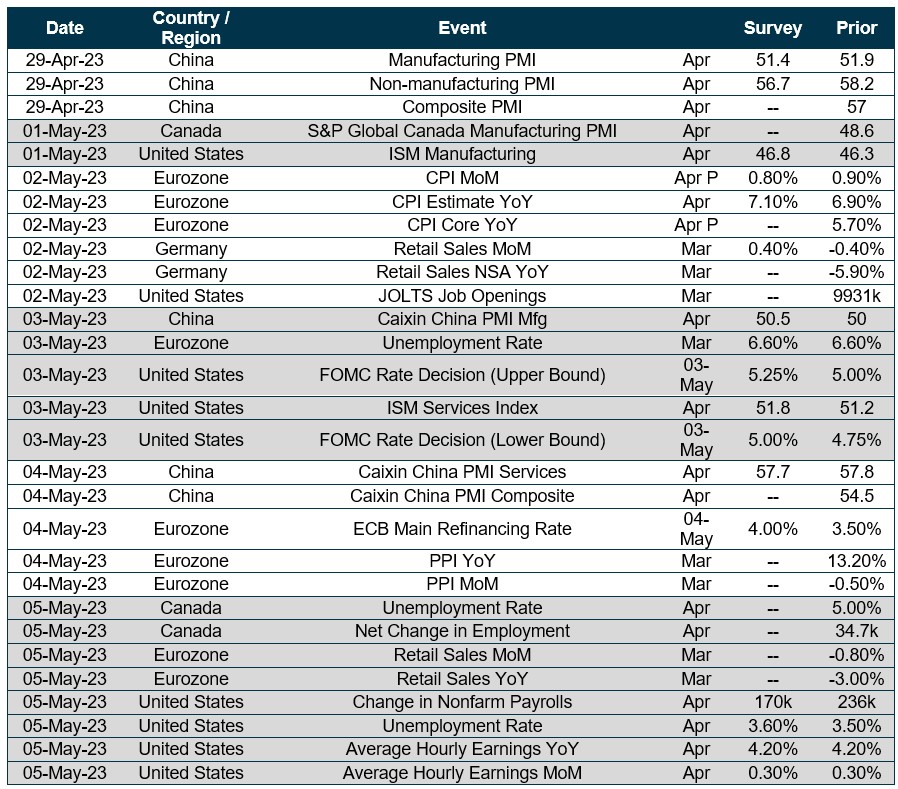

Quick look ahead

As of April 28, 2023