Weekly Market Pulse - Week ending February 17, 2023

Market developments

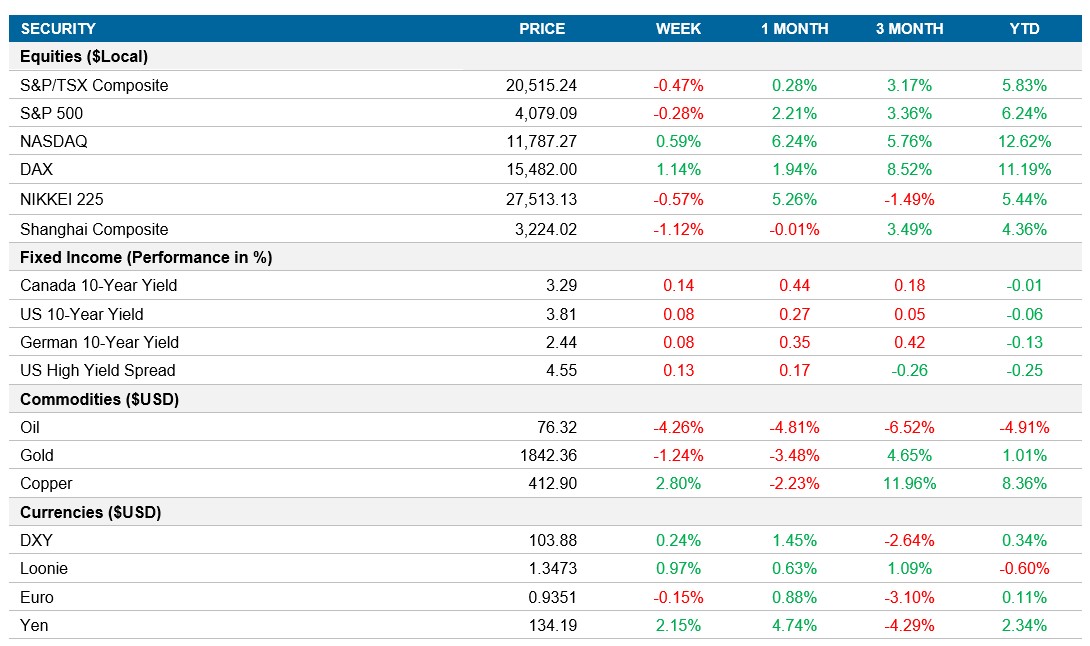

Equities: The U.S. market ended the week lower as higher than expected inflation data led to hawkish comments by Federal Reserve officials. The S&P 500 was down ~-0.3% after falling as much as 1% but was then lifted by consumer staples and utility stocks. The Nasdaq finished the week +0.4% as tech continues its strong year even as interest rates rise. Investors are closely watching the Fed comments on rates and are now estimating a ~5.3% peak rate later this year, compared to 4.9% two weeks ago.

Fixed income: The U.S.10yr finished the week up 8bps to 3.81% as investors now expect interest rates to have a higher peak and stay higher for longer. We heard from Fed Reserve Bank of Cleveland President Loretta Mester who said she saw a compelling case for another 50bps hike and James Bullard said he would not rule out supporting a 50bps hike in March. It’s been a difficult couple of weeks for Fixed Income investors as high inflation and a strong labour market are forcing a more hawkish view from the Fed.

Commodities: Oil fell this week, down -4.3% to $76.32 as hawkish signals from the Feb added to concerns of supply chain build up. Crude has had a volatile start to the year as the positive tailwind of China’s reopening is battling against the US economy that may potentially enter a recession.

Performance (price return)

As of February 17, 2023

Macro developments

Canada – No notable releases

No notable releases this week

U.S. – CPI came in above market expectations at 6.5%, PPI increased more than expected and retail sales jumped 3% MoM

U.S. CPI slowed to 6.4% in January, down from 6.5% in December but ahead of market expectations of 6.2%. This was the lowest reading since October 2021, with food cost up 10.1% and energy up 8.7%. Although we are seeing signs of inflation slowing, we’re still well above the Fed’s target of 2%. PPI for final demand increased 0.7% MoM in January, the most in seven months and above market forecasts of 0.4%.

Retail sales jumped 3% MoM in January, the largest increase since March 2021 and well above the market forecasts of 1.8%. The biggest increases were seen in sales at department stores, food services & drinking places and motor vehicles and parts. The data shows that the U.S. consumer has been resilient as a strong labour market and wage growth have helped consumers overcome higher prices..

International – Eurozone GDP expanded by 0.1%, U.K inflation fell to 10.1% in January, Japan’s economy expanded by 0.2% in Q4

Eurozone quarterly GDP expanded by a 0.1% in the fourth quarter of 2022, down from the 0.3% expansion in Q3. They did avoid a contraction at the end of the year, even as inflation and rising borrowing costs impacted domestic demand. On an annual basis, growth slowed to 1.9% during the fourth quarter, the lowest level of expansion since 2020/2021.

U.K inflation fell to 10.1% in January, down from 10.5% a month ago and below market expectations of 10.3%. this the third consecutive month where inflation fell, and January was the lowest number since September 2022. On an annual basis CPI fell 0.6%, the first decline in a year and the biggest since January 2019.

Japan grew by 0.2% QoQ in the fourth quarter of 2022, reversing from the -0.3% we saw in the third quarter, but fell short of market expectations of +0.5%. Private consumption picked up, even as headwinds from higher living costs persisted. For the full year, the economy grew by 1.1% in 2022, slowing from 2.1% in 2021.

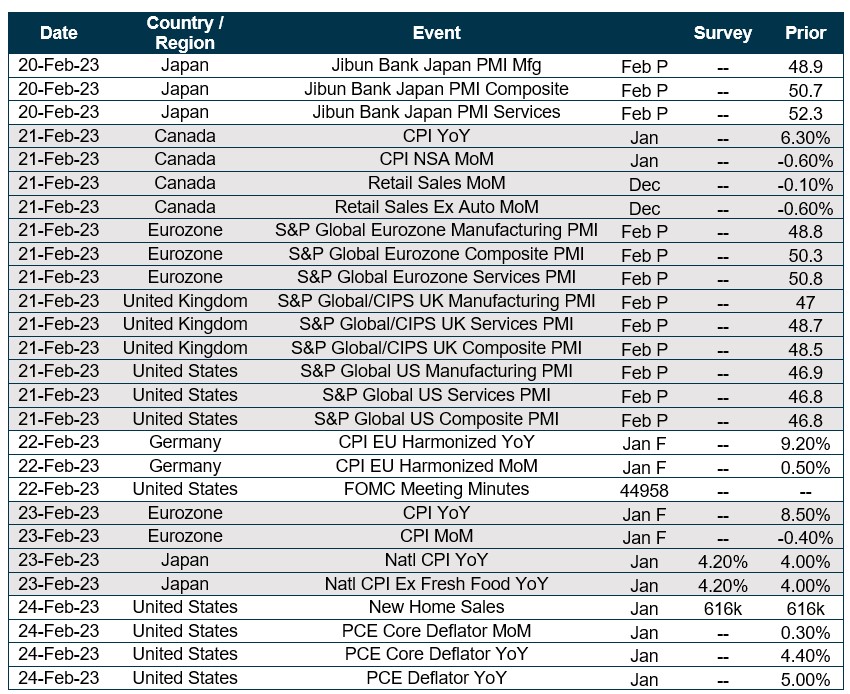

Quick look ahead

As of February 17, 2023